Business Expenses Greater Than Income

Greater than A group of private wealthy investors called ______________ help entrepreneurs finance a new business by investing anywhere from 50000 to 2 million. Yes and legally you should claim all eligible business expenses along with all income.

Understanding Profitability Ag Decision Maker

Yes g etting a business off the ground takes time and the IRS recognizes this.

:max_bytes(150000):strip_icc()/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg)

Business expenses greater than income. If your business expense deductions for a year are more than your income for that you you may have a net operating loss NOL. Business losses come about when expenses are greater than income. The amount of money paid for raw materials and products sold is called.

In such situation you will have to earn and save more money and you will need to cut back your expenses and scrutinize and re do your budget. For instance if you have a small baking business that usually earns 75000 per year and you decide to put 100000 down on a 500000 building the down payment and the purchase price wouldnt count as. The money spent to run a business is called.

To run this NOL calculation you. Some expenses paid during the tax year may be partly personal and partly business. A business would have a positive cash flow if revenue is _____ operating expenses.

In business terms income is the money. This calculation involves the removal of any non-business work or trade-allowable. If your deductible expenses are greater than the income you have a loss and you can start the process of calculating a net operating loss NOL.

Your business loss can offset other income on your tax return and lower your overall tax bill. Your expenses are 80. Ordinary and necessary business expenses include traveling expenses including amounts expended for meals and lodging other than amounts which are lavish or extravagant under the circumstances while away from home in the pursuit of a trade or business.

If your expenses are more than your income you have a hobby loss but you cant deduct that from your income. In general this does not cause problems. In contrast if you have a business loss you usually can deduct that from income in another year.

If you want to dive deeper into the law IRC 183 explains the IRS hobby loss rules in detail. Your profit margin is 20. A profit margin is the amount of money your business makes after you have deducted your business expenses.

21 rows If expenses are greater than income theres no. You must use a form 1045 to calculate the allowable net operating loss. Simply deduct your profit margin percentage from 100 to get your expense percentage and vice versa.

The way you determine and deal with an NOL depends on your business type. How Are Business Expenses. As it says this is a loss on your business operations not investments.

Your business has 100000 in annual sales. In business terms income is the. If the loss is from a personally owned corporation you must use form 1139.

There is no doubt that it is wonderful when your business is profitable but because of unexpected situations it. However if you consistently have losses 3 years or more for example then the IRS could come back and consider this a hobby instead of a business. When your expenses are higher than your income this creates a lot of problems like - if this thing happens without any check then soon your savings are gone and you are in debt.

Your business expenses and profit margins have a direct relationship. Is it OK to have business expenses more than business income ie negative business income. In your first few months or year of operation you may not bring in any income.

If the amount on line 41--your adjusted gross income--on IRS form 1040 is negative you have a net operating loss. Farmers must allocate these expenses between their business. How Do You Deduct Expenses for a Hobby.

When you make major purchases of items that last more than one year for your business such as buildings equipment or furniture the IRS usually doesnt let you claim the entire cost as an expense. Your total combined expenses add up to 80000. Even without income you may be able to deduct your expenses as long as you meet certain IRS guidelines.

If expenses are greater than income theres no. Examples include gasoline oil fuel water rent electricity telephone automobile upkeep repairs insurance interest and taxes.

/dotdash_Final_Gross_Profit_Operating_Profit_and_Net_Income_Oct_2020-01-55044f612e0649c481ff92a5ffff1b1b.jpg)

Gross Profit Operating Profit And Net Income

Overhead Expense Role In Cost Accounting And Business Strategy

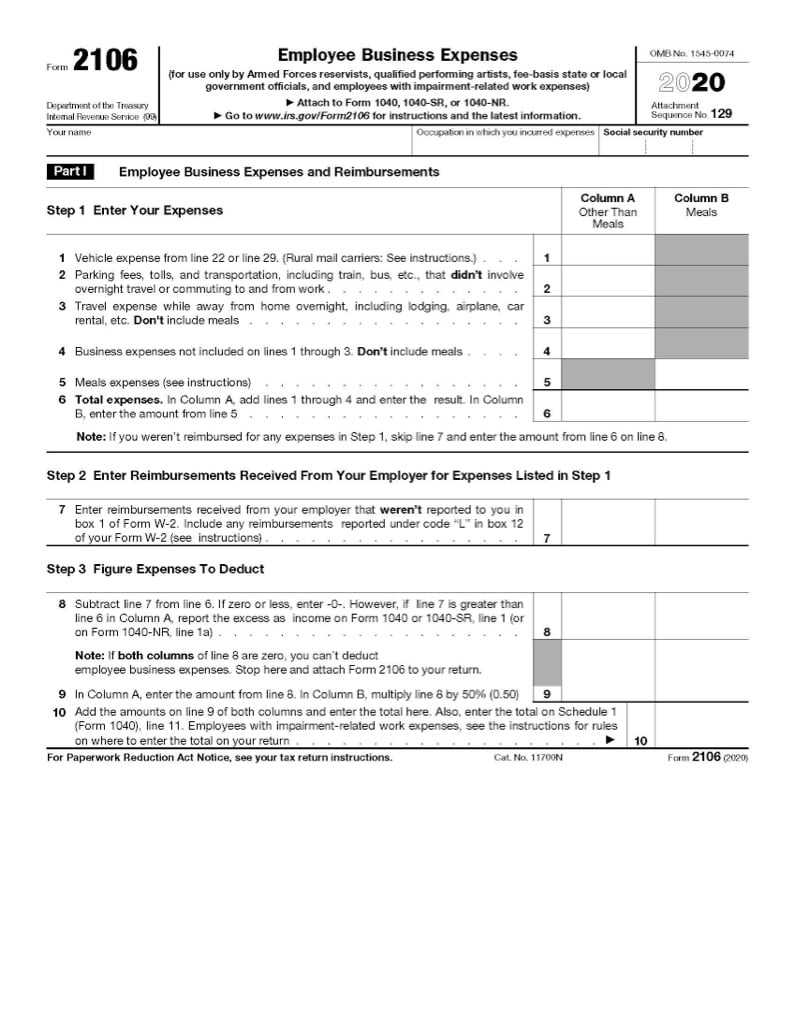

Form 2106 Claiming Employee Business Expenses

:max_bytes(150000):strip_icc()/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg)

How Do Capital And Revenue Expenditures Differ

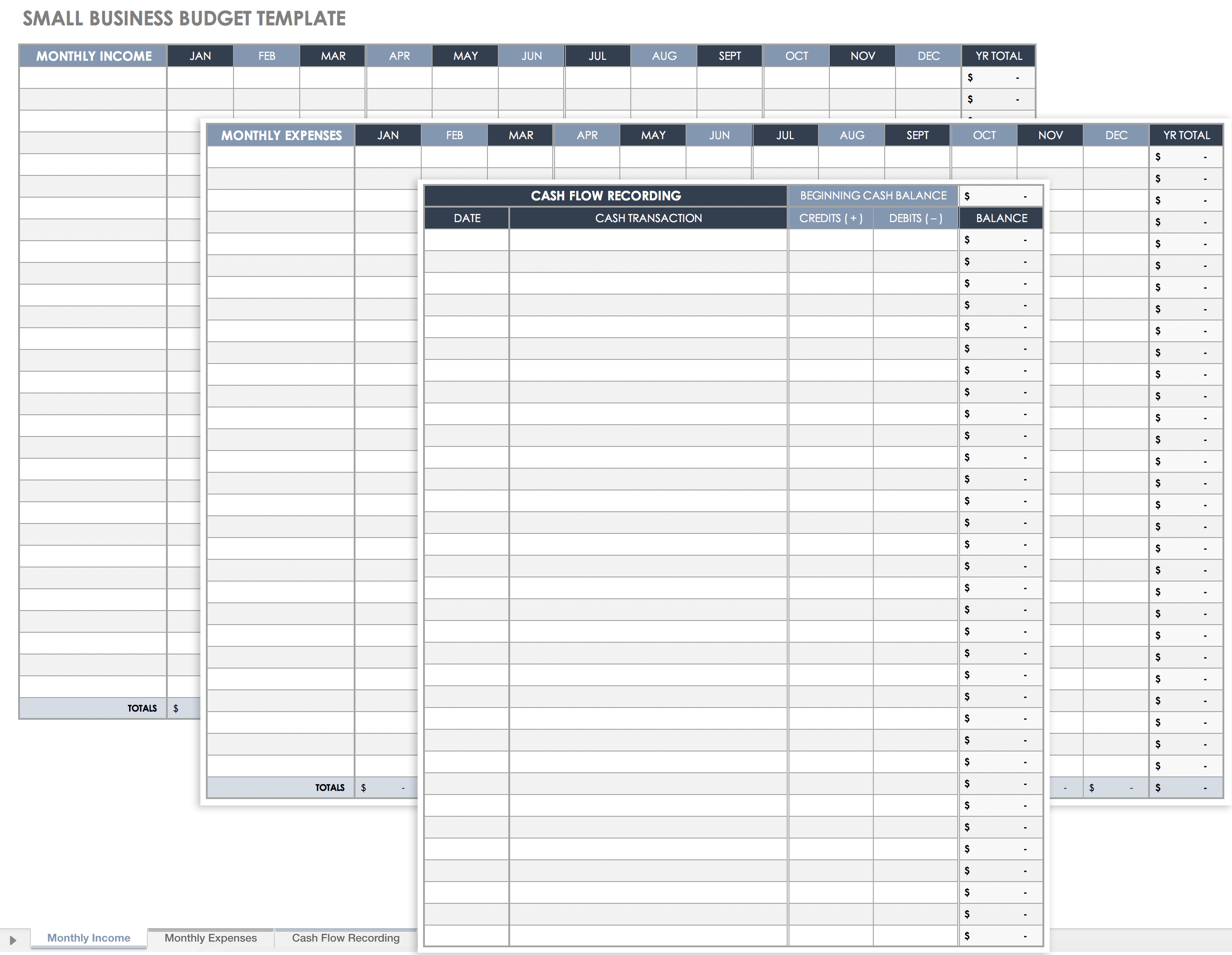

Free Small Business Budget Templates Smartsheet

Full Time Job And Side Business Taxes Top 10 Tax Deductions Wealthfit

What Is Net Operating Profit After Tax Nopat Formula Definition Quickbooks

How To Pay Little To No Taxes For The Rest Of Your Life

Free Small Business Budget Templates Smartsheet

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

How To Pay Little To No Taxes For The Rest Of Your Life

/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

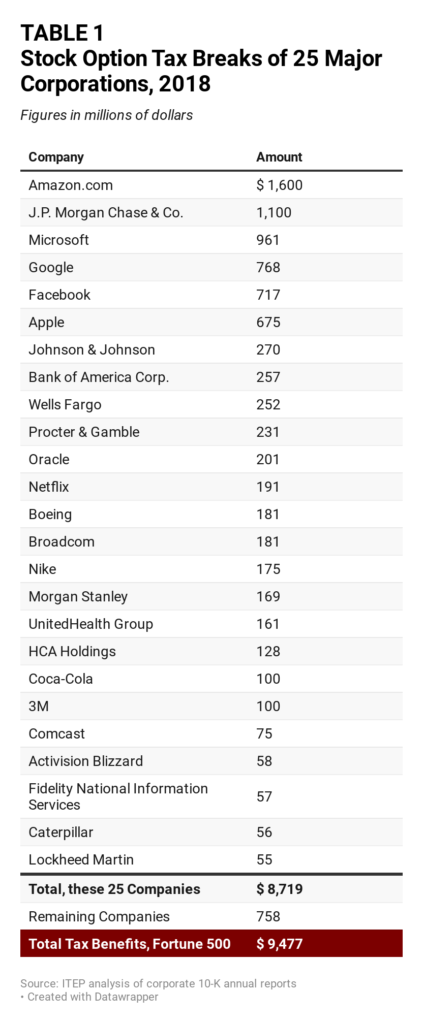

How Congress Can Stop Corporations From Using Stock Options To Dodge Taxes Itep

13 Hidden Online Startup Business Expenses Due

Gross Vs Net Income Financial Infographic From Accc Learn More About Personal Finances To Better Manage Your Net Income Debt Relief Programs Personal Finance

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

Post a Comment for "Business Expenses Greater Than Income"