Schedule C Business Use Of Home Simplified Method

Form 1040-NR line 13 and on. When you get to the home office section in TurboTax well ask if you had more than one home office during the tax year answer Yes and if these offices were in the same home answer No.

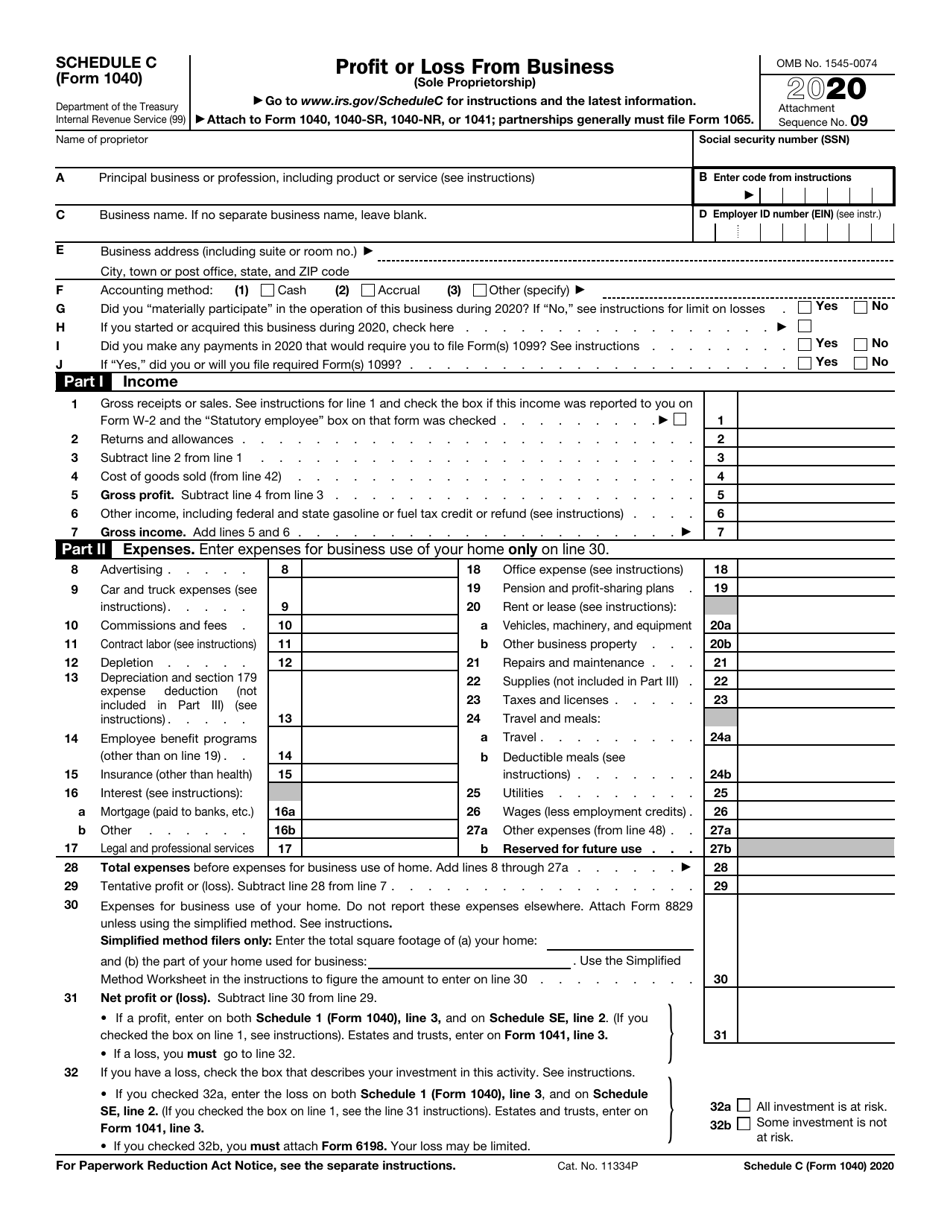

Irs Schedule C Form 1040 Fill Out Printable Pdf Forms Online

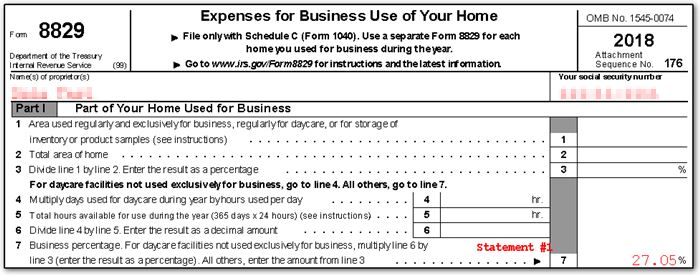

Deduction for home office use of a portion of a residence allowed only if that portion is exclusively used on a regular basis for business purposes.

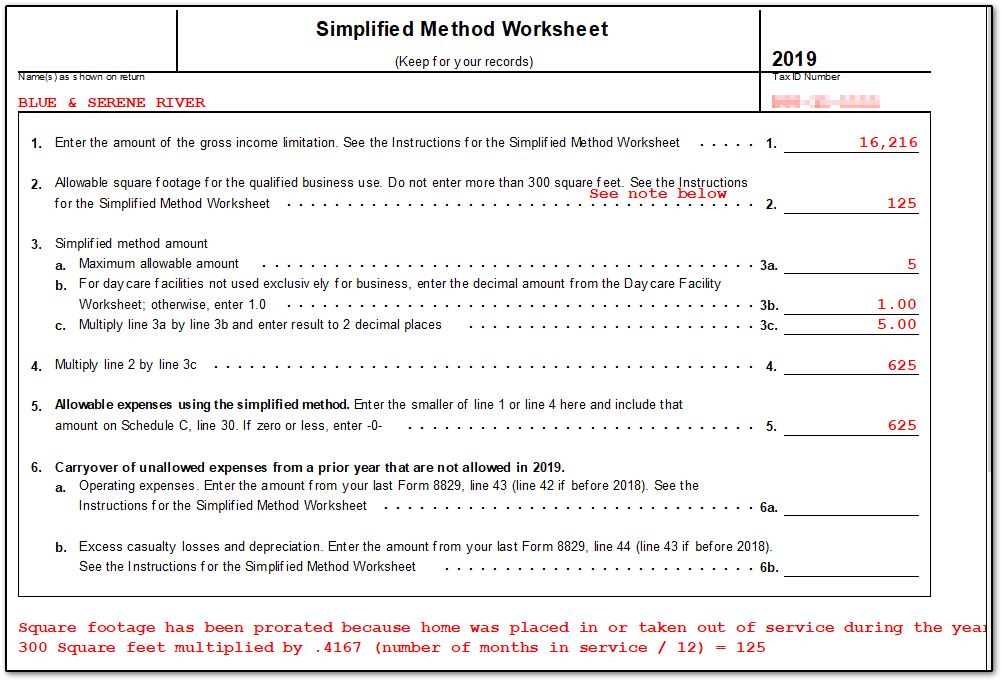

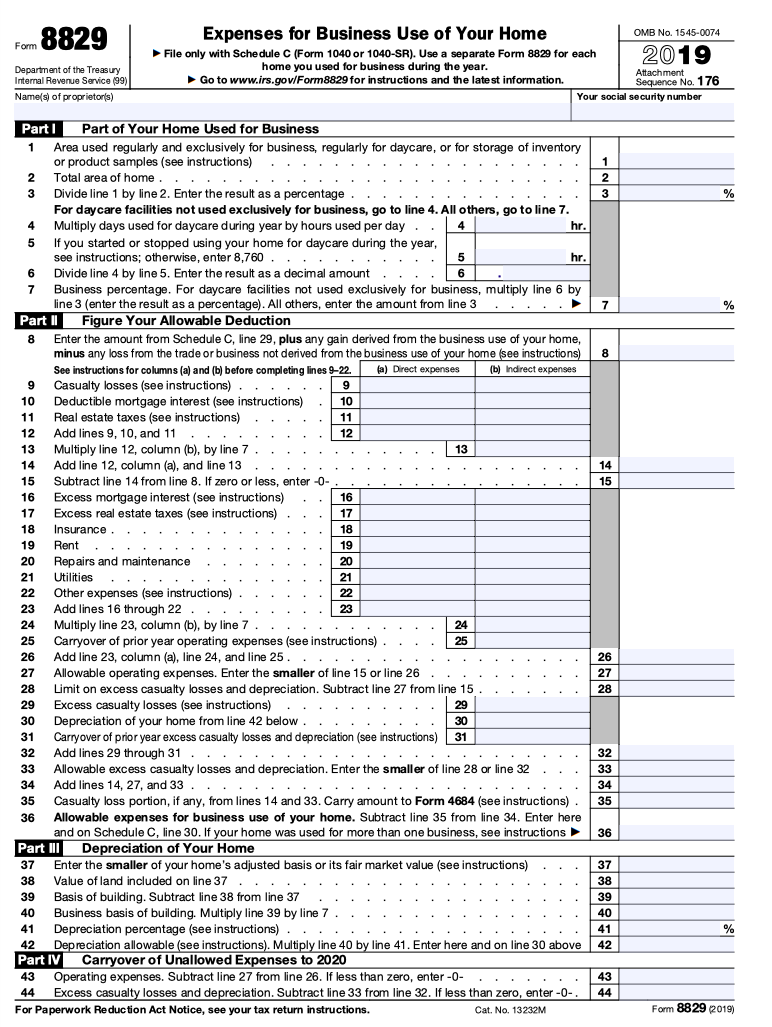

Schedule c business use of home simplified method. To elect the simplified method open the 8829 screen and select the applicable form or schedule in the For drop list. The simplified calculation just multiplies the amount of space by a specific square foot amount up to a maximum. To calculate the deduction with the simplified method you will multiply your clients total home office space by the rate per square foot for the current tax year.

Starting in the 2013 tax year taxpayers now have a simplified option for figuring their business use of home deduction. Using this method doesnt require a complicated calculation. You cannot use the simplified method for a taxable year and deduct actual expenses related to the qualified business use of the home.

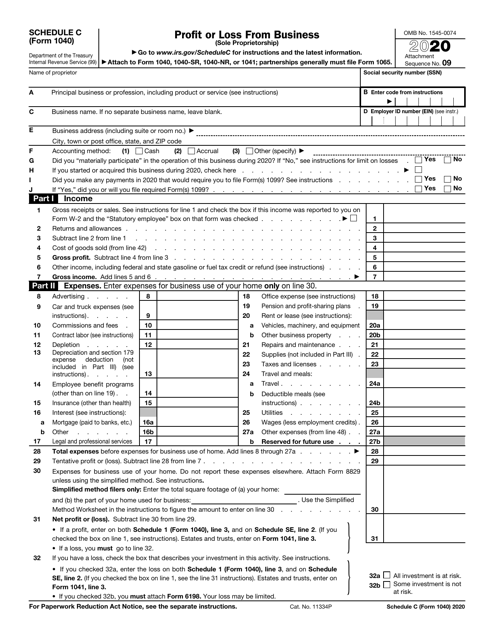

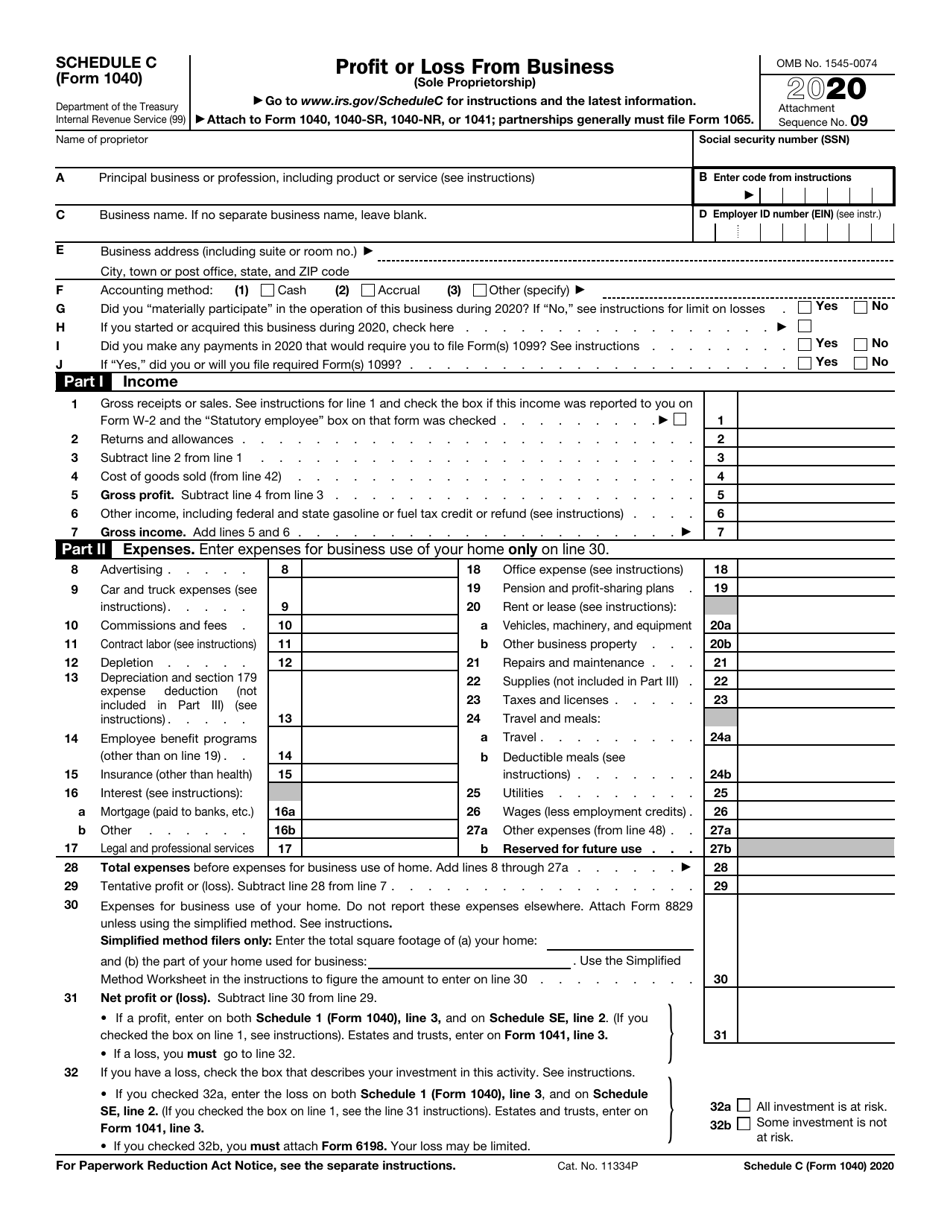

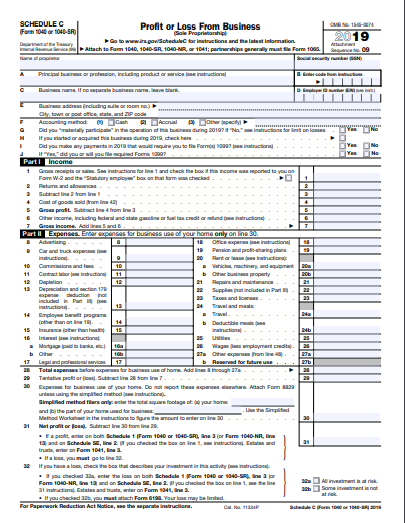

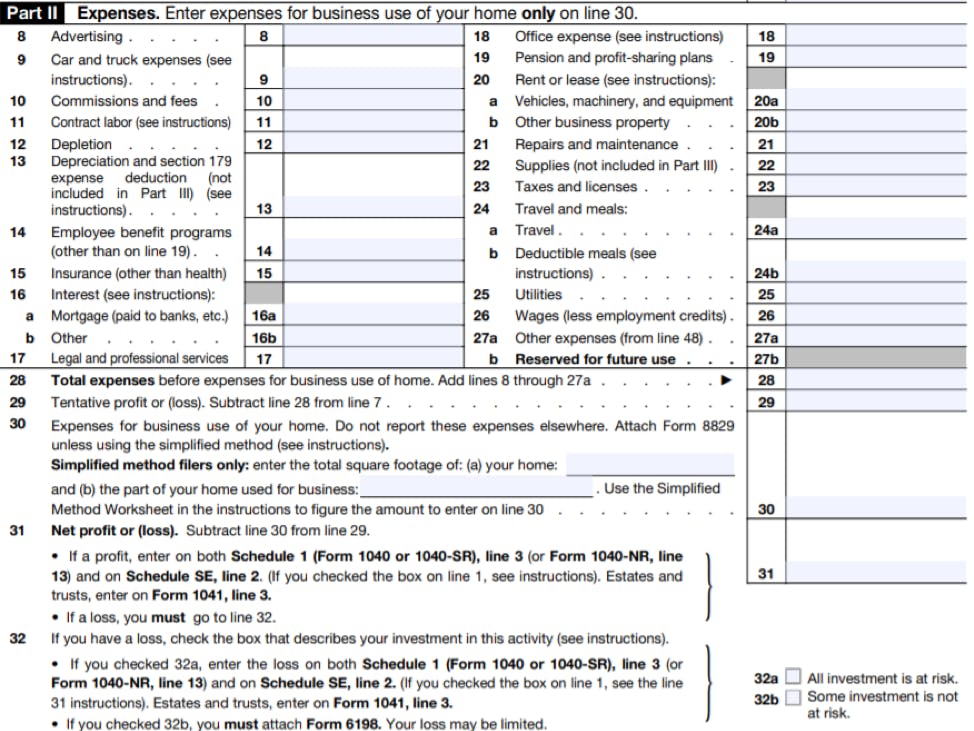

For the real scoop refer to the IRS publications. 31 Net profit or loss. If youre using the simplified method for the home office deduction which allows you to take a standard deduction of 5 per square foot of your home office up to 300 square feet you dont need to fill out Form 8829.

Go to Screen 29 Business use of Home. Use the SimplifiedMethod Worksheet in the instructions to figure the amount to enter on line 30. If a married couple files 1120S how to get the home office deduction.

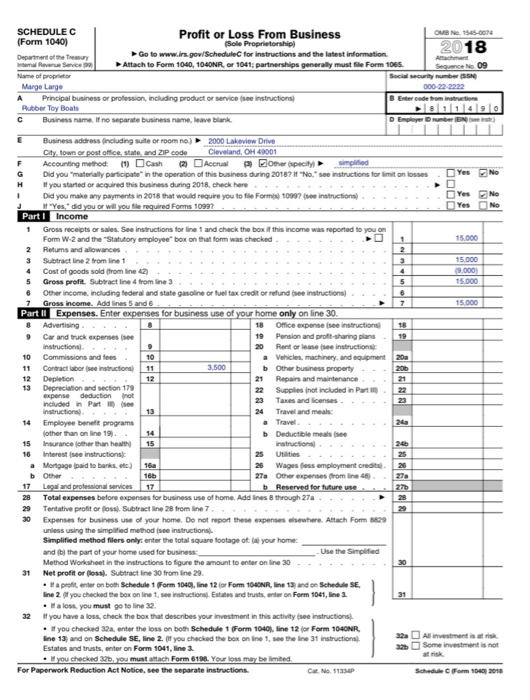

Highlights of the simplified option. And b the part of your home used for business. Standard 5 per square foot used to determine home business deduction.

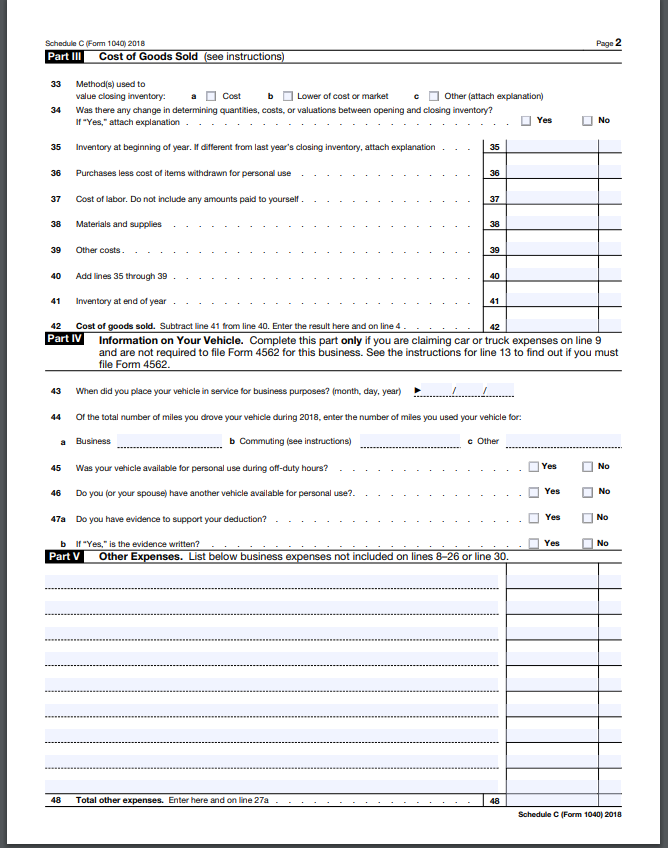

Then enter the square footage of office on line 1 the total square footage of the home on line 2 and select the checkbox Use the simplified method. Dont give more square feet to. You file it with your annual tax return and information from this form appears on Line 30 of your Schedule C.

The simplified method allows a standard deduction of 5 per square foot of home used for business with a maximum of 300 square. Per the IRS website Simplified Option for Home Office Deduction. IRS Pub 587 says If you elect to use the simplified method you cannot deduct any actual expenses for the business except for business expenses that are not related to the use of the home View solution in original post 0.

The Simplified Deduction allows sole proprietor Real Estate Agents to deduct 500 per square foot of. Enter a Multi-Form code if applicable. For more information press F1 on this field.

Subtract line 30 from line 29. 10 rows Simplified Option Regular Method. You can also use the simplified method for your home office deduction.

Standard deduction of 5 per square foot of home used for business. The amount allowed as a deduction when using the simplified method is in lieu of a deduction for your actual expenses. Self-employed taxpayers filing Schedule C Form 1040 Profit or Loss From Business Sole Proprietorship first compute this deduction on Form 8829 Expenses for Business Use of Your Home.

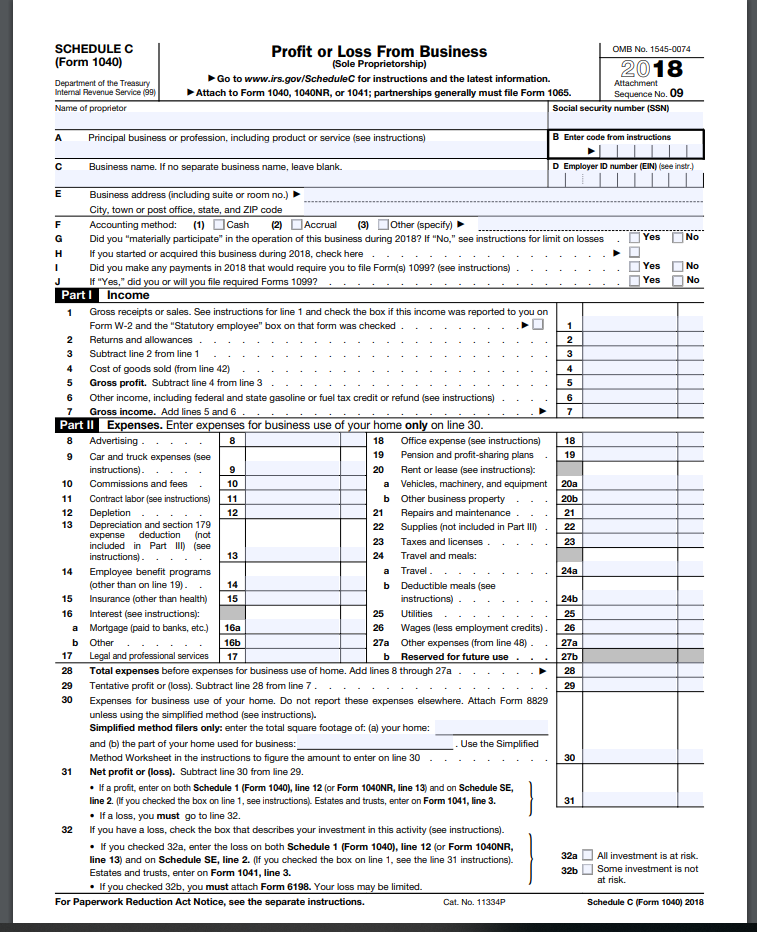

Divide the 300 square feet among your businesses in a logical way. Both include a calculation of the amount of home space used for your business. The Simplified Methods calculation occurs on Line 30 of Schedule C 2018 Expenses for Business Use of Your Home and does not require a separate form.

Allowable square footage of home use for business not to exceed 300 square feet Percentage of home used for business. The regular calculation method includes making a detailed list of home expenses. TurboTax supports up to 2 different home offices per Schedule C business but only one office is allowed to use the simplified method per IRS rules.

If a profit enter on both. As this article is published the rate is 5 per square foot for up to 300 square feet of home office space. If you are filing Schedule C Form 1040 to report a business use of your home in your trade or business and you are using the simplified method to figure the deduction use the Simplified Method Worksheet and the Daycare Facility Worksheet in your Instructions for Schedule C for that business use.

If so youre limited to a maximum of 300 square feet for all your businesses combined. Schedule SE line 2. How the simplified method works.

Use the simplified method 5 sq foot on 1120S or Schedule C. I submitted the 1120S but when completing Turbotax Business states the home deduction would be addressed when completing personal taxes and not within 1120S. Simplified Option - While taxpayers can still figure the deduction using the regular method many taxpayers may find the optional safe harbor method less burdensome.

Locate the Business Use of Home 8829 section. Limitations to the home office deduction simplified method. Schedule 1 Form 1040 or 1040-SR line 3 or.

Enter a 2 in 1use actual expenses default 2elect to use simplified method. Deduction go on personal return. Enter the total square footage of.

Checklist For Irs Schedule C Profit Or Loss From Business 2014 Tom Copeland S Taking Care Of Business

8829 Simplified Method Schedulec Schedulef

8829 Simplified Method Schedulec Schedulef

Irs Form 1040 Schedule C Download Fillable Pdf Or Fill Online Profit Or Loss From Business Sole Proprietorship 2020 Templateroller

Schedule C Self Employment Covered Ca Subsidies Home Office Hobby

Preparation Calculating Correct Entries For Self E Chegg Com

Irs Form 1040 Schedule C Download Fillable Pdf Or Fill Online Profit Or Loss From Business Sole Proprietorship 2020 Templateroller

How To Fill Out Form 8829 Bench Accounting

Schedule C Self Employment Covered Ca Subsidies Home Office Hobby

Using The Iformation Fill Out Schedule C Form Line Chegg Com

Https Www Irs Gov Pub Irs Utl 2015 Ntf Employee Business Expense Eng Pdf

Checklist For Irs Schedule C Profit Or Loss From Business 2015 Tom Copeland S Taking Care Of Business

Solved 1 The Image Shows A Completed Schedule C Using Th Chegg Com

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Preparation Calculating Correct Entries For Self E Chegg Com

Solved 1 The Image Shows A Completed Schedule C Using Th Chegg Com

Working For Yourself What To Know About Irs Schedule C Credit Karma Tax

Form 8829 Instructions Your Complete Guide To Expense Your Home Office Zipbooks

Post a Comment for "Schedule C Business Use Of Home Simplified Method"