Business Use Of Home Square Footage Calculation

You determine the amount of deductible expenses by multiplying the allowable square footage by the prescribed rate. 10 rows Allowable square footage of home use for business not to exceed 300.

Measuring Your Square Footage Of Your Floor Tile And Grout Or Carpet Can Be Difficult If You Don T Know How To Calc Square Feet Living Room Kitchen How To Plan

Day care providers can use time method.

Business use of home square footage calculation. For example continuing with our example if the total square footage of your home is 3100 divide the 510 square feet used for business purposes by 3100 which will give you 0164. Using the Simplified Option qualifying taxpayers use a prescribed rate of 5 per square foot of the portion of the home used for business up to a maximum of 300 square feet to figure the business use of home deduction. B is the area calculated by c divided by the total floor area of your home c is the total area in square metres of your home that is separately identifiable and used primarily for the business d is the square metre rate that is published by Inland Revenue.

The percentage of office use is 120 square feet 1200 square feet x 100 10. Area used for business divided by the total area of the home multiplied by total expenses. Refer instruction for form 8829 What is Regular Method.

The prescribed rate is 500. To do this you divide the square footage of your office space by the total square footage of the home. Form 8829 has on line 1.

Total area of home. For tax year the prescribed rate is 5 per sq ft area of the office and maximum area of home office allowable is 300 sqft. In this case you will have a larger deduction if you use the number of rooms calculation.

First list all direct expenses such as paint wallpaper and other expenses directly related to and used in the business space. Alternately if your home office was 168 square feet and your home was a total of 2000 square feet your business use percentage will be 1682000 or 84 percent. Thus square footage usage 100 x time usage 30 gives you 30 business use of home percentage for last year.

Under this safe harbor method depreciation is treated as zero and the taxpayer claims the deduction directly on Schedule C Form 1040 or 1040-SR. The square footage and the entry in percentage of indirect expenses to apply to this business if not 100 are used to calculate the business use. Home business owners were previously required to complete Form 8829 to calculate the home business space deduction.

Use lines 17 of Form 8829 or lines 13 on the Worksheet To Figure the Deduction for Business Use of Your Homenear the end of this publication to figure your business percentage. Your business percentage is 10. Your home business space deduction includes two parts.

Your office is 10 1 10 of the total area of your home. Revenue Procedure 2013-13 PDF allows qualifying taxpayers to use a prescribed rate of 5 per square foot of the portion of the home used for business up to a maximum of 300 square feet to compute the business use of home deduction. If the office measures 150 square feet for example and the total area of the house is.

The calculation is as follows. As an example assume your home has 1200 square feet and the part of your home used for business activity is a room thats 10 x 12 feet 120 square feet. And on line 2.

20 120 metres 6000 in household expenses 1000 Sonia can deduct 1000 of her household expenses as business-use-of-home expenses. These expenses may be deducted at 100. The allowable square footage is the smaller of the portion of a home used in a qualified business use of the home or 300 square feet.

The most exact way to calculate the business percentage of your house is to measure the square footage devoted to your home office as a percentage of the total area of your home. Self-employed taxpayers filing IRS Schedule C Profit or Loss from Business Sole Proprietorship first figure this deduction on Form 8829 Expenses for Business Use of Your Home. So unless you are open 247 365 days per year your business usage of home can never be 100.

Area used regularly and exclusively for business regularly for daycare or for the storage of inventory or product samples. If your square footage usage was only 75 you would then take 75 x 30 and you would have 225 business use of home allocation. This form has you calculate the percentage of the home used for the home office.

Under this simplified option you multiply a prescribed rate by the allowable square footage of the office in lieu of determining actual expenses. Square metre rates for each tax year.

7 Tips How To Measure Square Footage Of A House

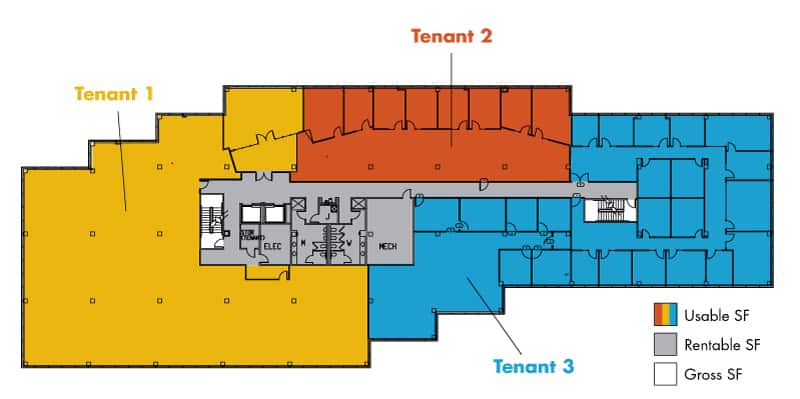

Let Me Clarify Things When You Search The Records For A Property You Will Likely Find 3 Types Of Square Footage Listed Li Square Feet Square Footage Square

Rentable Vs Usable Square Footage What S The Difference

3 Ways To Calculate Price Per Square Foot For House Painting

Stainless Steel Backsplash How To Kitchen Renovation Metallic Backsplash Kitchen Design

How Do I Calculate Carpet Square Footage Carpet Measurement How To Lay Carpet Carpet Squares

Average Room Dimensions Building A House Checklist Architectural House Plans How To Plan

How To Measure For Back Splash Area Length Width Inches 144 Areas Square Footage Tile Backsplash Backsplash House Search

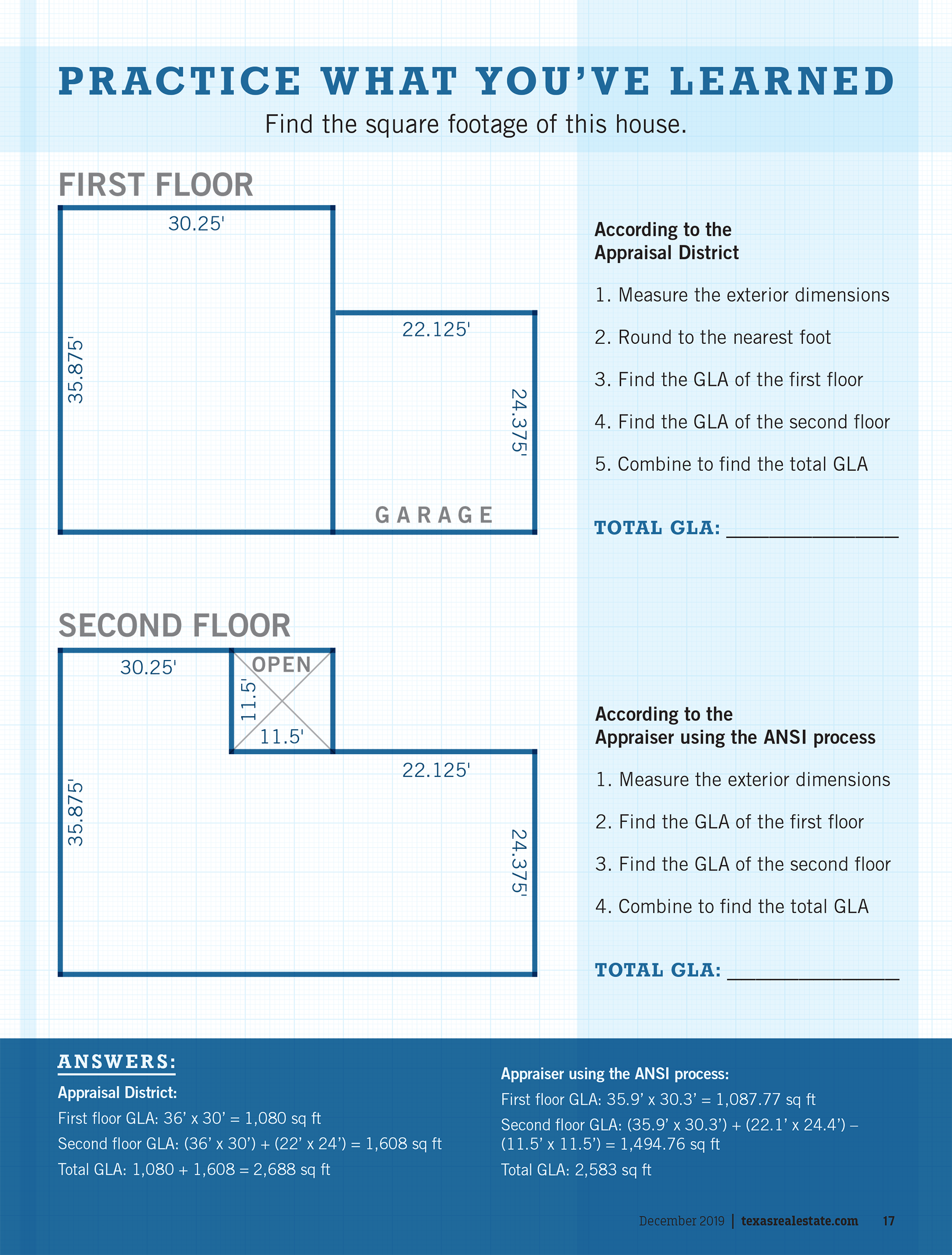

There S More Than One Way To Measure A House Texas Realtors

How To Calculate Square Footage For A Backsplash Easy Measuring Tips Backsplash Kitchen Redesign Kitchen Backsplash

Square Footage Calculator Soooo Helpful For Calculating Paint Materials Everything You Can I Square Footage Calculator Square Footage Wall Stickers Bedroom

How To Calculate An Actual Business Use Percent Tom Copeland 39 S Taking Care Of Business Business Care Calculator

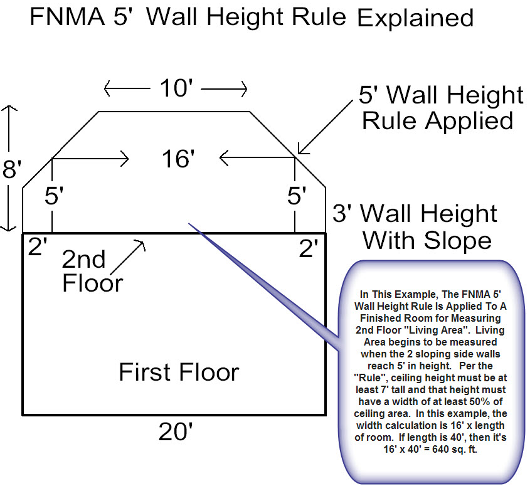

The 5 Foot Rule For Calculating Square Footage

How To Calculate Square Footage The Home Depot Youtube

Home Business Worksheet Template Business Worksheet Business Tax Deductions Home Business

Square Foot Calculator Square Footage Calculator Square Footage Calculator Square Foot Calculator Square Feet Calculation

10 Reasons Why Public Records And The Appraiser S Square Footage Can Differ

Pin On Real Estate Info Group Board

Post a Comment for "Business Use Of Home Square Footage Calculation"