What Is Venture Growth

Venture capital financing involves venture capitalists who are often part of a venture capital firm investing in a startup company. 1 as an asset class which covers strategies such as venture capital growth equity buyouts mezzanine financings and distressed debt.

Private Equity Defined Venture Growth And Buyouts Private Equity Equity Reading Online

The growth of any new business venture is a product of both the opportunity selection and management factors.

What is venture growth. The business venture definition is a new business that is formed with a plan and expectation that financial gain will follow. They will likely have some revenue and may be expanding from their initial product range or branch. And unlike in larger leveraged buyouts debt is not used extensively.

Such type of debt financing is typically used as a complementary method to equity venture financing. The true mark of a good venture is how it manages growth and whether it can sustain it. Growth equity also known as growth capital or expansion capital is a type of investment opportunity in relatively mature companies that are going through some transformational event in their lifecycle with potential for some dramatic growth.

Venture debt can be provided by both banks specializing in venture lending and non-bank lenders. Innovation-4pptx - VENTURE GROWTH What is Venture Growth u2022Venture growth can be described as a strategy of expanding firmu2019s products and services Innovation-4pptx - VENTURE GROWTH What is Venture Growth. Uses of Growth Equity.

With a commercially available product a startup at this stage should be taking in ample revenue if not profit. Venture economies require a robust and comprehensive capital continuum to fuel the development of innovations into companies. Please note this is not an entry-level job.

Accordingly VC funding serves as more fuel for the fire enabling expansion to additional markets eg other cities or countries and diversification and differentiation of product lines. Often this kind of business is referred to as a small business as it typically begins with a small amount of financial resources. Growth Stage Startup Funding Life Cycle The growth stage of a new business generally begins late in the Early Stage and proceeds well into the mezzanine VC financing stages.

However most new ventures fail. And even when they do. And 2 as a transaction type where it really means buyouts.

Venture capital is a common way for promising startup companies to gain the finances they need to grow. Centralized decision making and informal controls characterize entrepreneurial management. Growth equity or growth capital is designed to facilitate the target companys accelerated growth through expanding operations entering new markets or consummating strategic acquisitions.

Private Equity is a term that has two common meanings. Venture debt is a type of debt financing obtained by early-stage companies and startups. We are looking for someone specifically with 1-3 full-time not internship years of experience in marketing project management or consulting.

Growth is often exponential by this stage. TriplePoint Venture Growth TPVG operates in the very hot sector of advanced venture capital-backed tech companies. There is a high level of.

Growth equity resides in between venture capital and buyout strategies on the continuum of private equity investing. To meet ambitious plans for growth and diversification corporations are turning in increasing numbers to new venture strategies. The life of high-growth ventures can be broken into four stages of investments along the venture capital continuum.

SeedInvest is seeking an Analyst to join our Venture Growth team in Manhattan New York. Growth-focused Private Equity sits at the intersection of Venture Capital and traditional PE Working together with the management team growth equity PE firms help create value through accelerated operational improvements and revenue growth whether organic or acquisitive. A venture-stage company has established its business model and technology over some years and has secured funding and a valuation into the millions.

See why the attractive dividend yield may be your total return. Late in the early stage aspects of the company begin to become more complete and there is clear evidence of progress in the companys development. Joint venture is a growth strategy in which two or more companies establish a new enterprise or organisation by participating in the equity capital of the new organisation and by agreeing to participate in its management in an agreed manner.

A Venture Capital Trust Fund Is A Highly Tax Efficient Closed End Collective Investment Scheme Designed To Provide Equity Capital Venture Capital Investors

The Company Financing Life Cycle As Risk Lowers Over Time Funding From Investment And Sales Venture Capi Venture Capital Startup Funding Startup Infographic

Bell Mason Framework For Corporate Venture Development Corporate Venture Innovation Integration Testing

Funding Options For Life Science Companies Life Science Investing Venture Capital

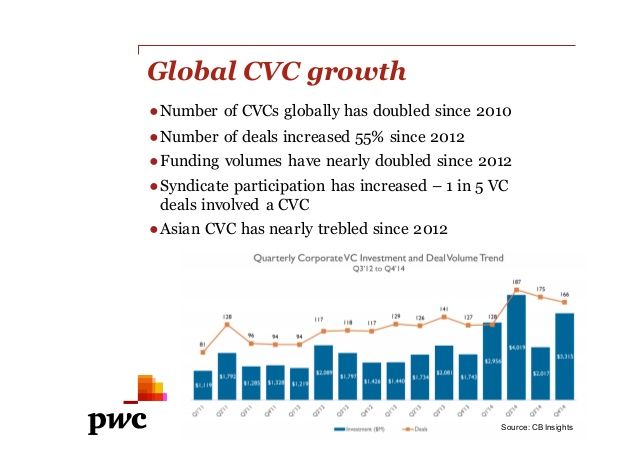

Future Of Venture Capital 2016 Pwc Presentation Venture Capital Financial Management Venture

Future Of Venture Capital 2016 Pwc Presentation Venture Capital Corporate Venture Investing

Stages Of Startup Funding And Venture Capital Funding Startup Funding Venture Capital Start Up

Venture Capital Is The Funding Investors Provide To The High Growth Potential Startups In Exchange For Equity In The Venture Capital Venture Capitalist Venture

Engineer Mba To Venture Capital What Worked Venture Capital Mba Venture

7 Strategies For Explosive Business Growth Valerievshow Everyedge Homecaremarketing Nursing Business Growth New Product Development Business Development

Venture Art Your Partner In Growth And Development Start Up Solutions Development

Venture Capital Ecosystem Venture Capital Startup Funding Angel Investors

Your Guide To Startup Growth In 10 Business Philosophies Infographic Openview Labs Startup Growth Start Up Growth Hacking Startups

Major Legal Factors Affecting Business Entrepreneurship Articles Business Factors

Stages Of A Business Small Business Organization Business Management Infographic

How To Find The Right Investors To Fund Your Startup Venture Capital Stages Investing Startup Funding Venture Capital

Help Your Business Achieve Explosive Growth Business Strategy Management Business Growth Strategies Growth Marketing

Post a Comment for "What Is Venture Growth"