Oregon Small Business Administration Loans

More than 521 Million in PPP Loans Approved by SBA in Oregon in Current Round of Funding That Re-Opened This Month January 27 2021 Shopping Small for 2020 Holiday Season Needed More Than Ever. Information about these loans is available at httpsdisasterloansbagovelaInformationIndex.

Sou S Small Business Development Center Small Business Dev Center Providing Free Guidance To For Profit Businesses

Service-Disabled Veteran-Owned Small Business Concern program.

Oregon small business administration loans. The Citizens Bank first made their services available to the public in 1929 in Carthage Tennessee. Whatever your situation may be SBA-backed loans are extremely useful for any small business in Oregon and SBAExpressLoans Inc. The program focuses on companies with under 100 employees in the manufacturing processing and distribution industries and offers grants of up to 2500 per job created or trained.

For our purposes small business is defined as a for-profit or nonprofit organization with zero to 100 employees. The loan can be used to repair or replace items damaged or destroyed in a declared disaster. SBA - Loans and Grants Identify Federal government financing programs available to help you start or expand your business.

Buy an existing business or franchise. Provides consultingcounseling financial services. Write your business plan.

Craft3 is a certified non-profit Community. Kate Browns request to declare the state an economic disaster paving. Business Oregon is the states economic development agency and operates several direct loan and loan guarantee programs for.

11 rows 14. Get federal and state tax ID numbers. The Small Business Administration reports that Oregon received more than 62000 loans worth just under 7 billion as of June 30 2020.

8a Business Development program. Small Business Administration the Oregon Business Development Department and other private and public partners with Lane Community College serving as the Networks lead host institution. Apply for licenses and permits.

A note about these Oregon SBA lenders People. SBA loans Oregon. Governing Rules and responsibilities.

The SBA will forgive loans if all employee retention criteria are met and the funds are used for eligible expenses. We Help Small Business Navigate Government. Oregon also offers small businesses access to financing.

State Financial AssistanceBusiness Oregon. SBAs Debt Relief Program pays the principal interest and fees for six months for 7 a 504 and Microloans disbursed before September 27 2020. Here are the six best banks to apply for a small business loan.

The US Small Business Administration offers disaster assistance in the form of SBA loans to designated states. Additional financial resources for businesses can be found at Business Oregon which is Oregons economic development agency. General Small Business Loan 7A This loan is for small businesses which operate for profit engaged in business within the United States have reasonable invested equity demonstrate a need for the loan proceeds and are not delinquent on any existing debt obligations to the US.

Choose your business name. Is standing by to provide you with all the help you need to get the financing your small business needs. For instance the Building Opportunities for Oregon Small Business Today BOOST Fund offers loans and grants to promising small businesses in the state.

Open a business bank account. Women-Owned Small Business Federal Contracting program. WASHINGTON KTVZ -- Oregons congressional delegation announced Friday the Small Business Administration has approved Gov.

Beginning in February 2021 that relief was extended for certain businesses. Our office helps small businesses that have a question or concern about state or local government. The Oregon Business Development Fund OBDF is a revolving loan fund that provides term fixed-rate financing for land buildings equipment machinery and permanent working capital.

How to win contracts. For the 2021 round of funding Oregon small businesses have received more than 25000 loans worth more than 2 billion since the end of February. The Oregon SBDC Network is funded in part through a Cooperative Agreement with the US.

We are an independent voice for small business that speaks from an objective point of view. Small business loans in Oregon can take anywhere from a matter of weeks to a couple months for an approval to come through. Banks in Oregon That Offer Small Business Loans.

Choose a business structure. Pick your business location. Specialty Crop Block Grant Program.

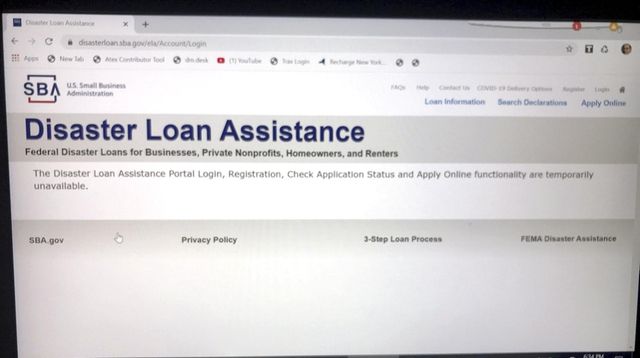

Details Emerge On Sba Security Breach Of Disaster Loan Portal Newsday

Sba Paycheck Protection Ppp Loans For Construction How To Apply

Top Oregon Sba Lenders Sba Loans In Oregon

Sba Loans Available For Small Businesses Facing Hardship During Pandemic Kmtr

How To Apply For The Sba Payroll Protection Program Loan Simple Guide

Sba Paycheck Protection Ppp Loans For Construction How To Apply

Oregon Small Business Loans Sba Express Loans

Sba Stands Ready To Assist Oregon Businesses And Residents Affected By Wildfires

Fast Small Business Startup Loans Grants In Oregon

Fast Small Business Startup Loans Grants In Oregon

Small Business Administration Sba Contact Information 2017 Smallbusiness Com

The 5 Best Small Business Loans Of 2021 Money

Sba Provided 20 Billion To Small Businesses And Non Profits Through The Economic Injury Disaster Loan Advance Program Pointofsale Com

Nevada One Of First States To Get Approval For Sba Disaster Loans

Sou S Small Business Development Center Small Business Dev Center Providing Free Guidance To For Profit Businesses

A Master List Of States And Counties Eligible For Sba Coronavirus Relief Loans Workest

Few Qualify For The New Targeted Eidl Advance Tom Copeland S Taking Care Of Business

Oregon Sba Loans Small Business Loans

The Sba Loan Book Book By Charles H Green Official Publisher Page Simon Schuster

Post a Comment for "Oregon Small Business Administration Loans"