Find Business Tax Id Online

The Finder - This handy tool allows business owners to look up local income tax and sales tax rates for any address in the state of Ohio. You can ask the IRS to search for your EIN by calling the Business and Specialty Tax Line at 800-829-4933.

How To Find Your Lost Misplaced Ein Make Your Ein Application Online Finding Yourself Confirmation Letter Online Application

It will be in either your.

Find business tax id online. Search by an Individual Name. Naturally this is the preferred and most common way to apply for a federal tax ID these days. Ohio Business Gateway - Use the Ohio Business Gateway to register file and pay many types of taxes and other transactions including sales and use tax.

Apply for EIN Online. Search for a business entity FAQ or Help. Business Name- The current name of the business as it appears on our records.

This is the original document the IRS issued when you first applied for your EIN. If you open the return and discover that the number has been replaced with asterisks for. It is a License Number for Foreign Corporations.

It is also used by estates and trusts which have income which is required to be reported on Form 1041 US. The letter will show your business tax. Your previously filed return should be notated with your EIN.

We have a database of over 73M entities which can be searched to find the ein number of business entities. You may apply for an EIN in various ways and now you may apply online. This department is open from 7 am.

First check to see if you received an email or physical letter from the IRS confirming your EIN when you first applied. If you need a business registration number from one of the states listed on this page all you need to do is click on one of the links below. Each option is explained below.

Looking up your EIN or tax ID should be simple since theoretically it should be stamped all over your documents. The person applying online must have a valid Taxpayer Identification Number SSN ITIN EIN. You can find the number on the top right corner of your business tax return.

Local time Monday through Friday. You can apply for an EIN right at the IRS website on their EIN online application. Apply for EIN by Fax.

Ohio Business Gateway - Use the Ohio Business Gateway to register file and pay many types of taxes and other transactions including sales and use tax employer withholding commercial activity tax unclaimed funds and unemployment compensation tax. Only the authorized person for your business can get this information. If you are from one of these states and you also want to get a federal Employer Identification Number EIN you may obtain both your state.

Find tax information and tools for businesses including Employer ID Number EIN Employment Tax Estimated Tax and the Foreign Account Tax Compliance Act FATCA. Generally businesses need an EIN. It is a Charter Number for Domestic Corporations.

An Employer Identification Number EIN is also known as a federal tax identification number and is used to identify a business entity. This search allows vendors to determine permit status of purchasers before accepting a resale certificate. The hours of operation are 700 am.

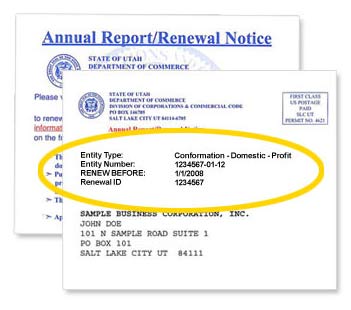

You must enter a individual name. This is a free service offered by the Internal Revenue Service and you can get your EIN immediately. Entity Number The entity number is a unique identifier assigned to a business by the Ohio Secretary of State.

The easiest way to find your EIN is to dig up your EIN confirmation letter. State and Federal Online Business Registration. Businesses can fax in their application to the appropriate.

You will leave the IRS website and enter the state website. Search by Entity Name. The department offers two methods to accomplish this - through the Ohio Business Gateway or by paper application.

Search by Filing. Sales Taxpayer Search Taxpayers may search by taxpayer number employer identification number EIN legal name business name city and zip code to verify the status active or inactive of a sales and use tax permit. Find a previously filed tax return for your existing entity if you have filed a return for which you have your lost or misplaced EIN.

The ID number must be 6 or 9 digits in length. You must enter an entity name. Refer to Employer ID Numbers for more information.

Income Tax Return for Estates and Trusts. Local time Monday through Friday. Ask the IRS to search for your EIN by calling the Business Specialty Tax Line at 800-829-4933.

An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity. You are limited to one EIN per responsible party per day. Search by Identification Number.

Business Name Search Glossary of Terms. You may apply for an EIN online if your principal business is located in the United States or US.

Online No Tax Due System Information

What Is An Employer Identification Number Blogger S Beat Employer Identification Number Business Management Bookkeeping Business

What Is A W 9 Tax Form H R Block

Free Online Receipt Maker Fake Business License Fake Receipt Us Receipt Maker Receipt Bill Template

4 Form Deductions 4 Benefits Of 4 Form Deductions That May Change Your Perspective 1099 Form Deductions Handy Printabl Tax Prep Checklist Business Tax Tax Prep

How To Contact The Irs If You Haven T Received Your Refund

How To Apply For An Ein Employer Identification Number For Your Business Taxes Wahm Business Tax Small Business Finance Employer Identification Number

What S A Tax Id Number Employer Identification Number How To Apply Tax

How To Find My State Id Number Online If I Lost My Id Quora

Learn How To Fill Out A W 9 Form Correctly And Completely

Online No Tax Due System Information

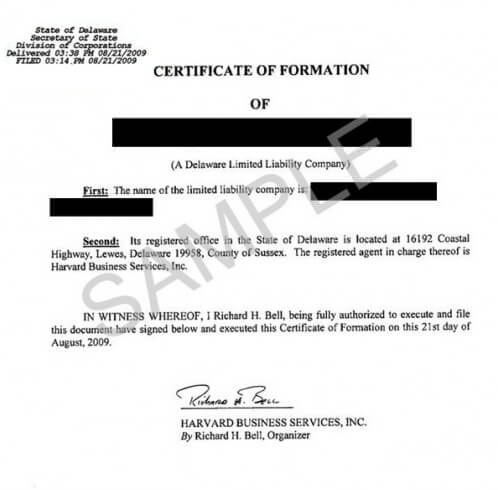

Delaware State File Number What It Is How It S Used Harvard Business Services

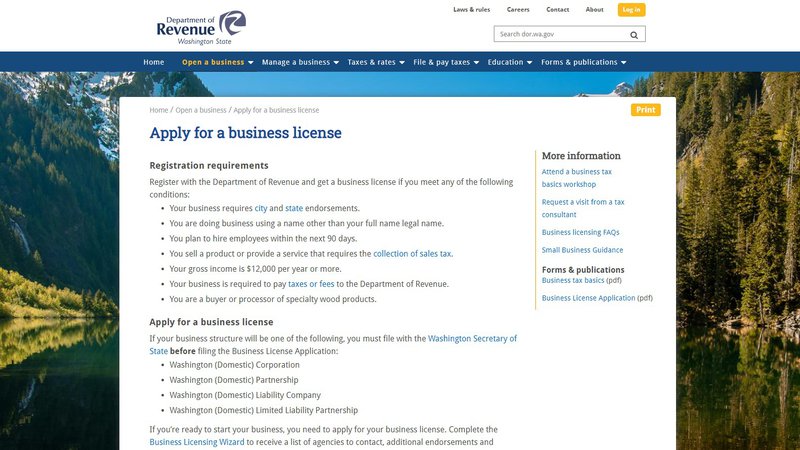

Do I Need A Business License To Sell Online Updated 2021 The Blueprint

Form 1099 Nec For Nonemployee Compensation H R Block

Letter Ein Confirmation Confirmation Letter Employer Identification Number Doctors Note Template

Is My Tax Id The Same As My Social

Post a Comment for "Find Business Tax Id Online"