Business Definition Net Current Assets

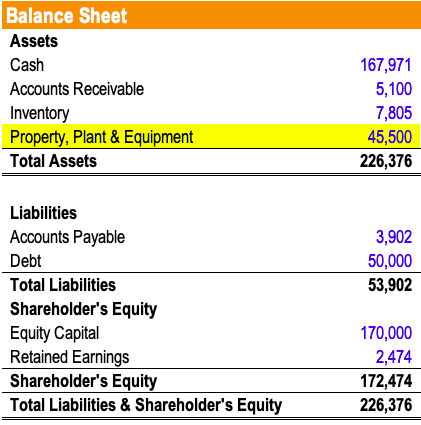

It is commonly known as net worth NW. The net asset on the balance sheet is defined as the amount by which your total assets exceed your total liabilities and is calculated by simply adding what you own assets and subtract it from whatever you owe liabilities.

Current Assets Formula Calculator Excel Template

Of course the balance sheet is just a snapshot of the working capital position at a point in time the balance sheet date.

/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)

Business definition net current assets. Net current assets definition. Noun plural ACCOUNTING FINANCE uk. Net assets are virtually the same as shareholders equity because its the companys monetary worth.

There should be a positive amount of net current assets on hand since this implies that there are sufficient current assets to pay for all current obligations. In other words the retained earnings or profits made by the company are not distributed to the owners. The assets of a business that can be applied to its operation.

A companys assets after its current liabilities debts that must be paid within 12 months have been subtracted from its current assets assets that will be used or sold within 12 months. Net corporate surplus comprises reserve funds of various kinds excluding depreciation reserves while companies net current assets represent the excess of their liquid and other current assets viz cash deposits securities and stocks over their current liabilities of various kinds. Put another way net assets equal the company assets economic resources minus liabilities what is owed to someone else.

In contrast non-current also called long-term assets or capitalized assets refer to anything that brings value to a company for longer than one year. Refers to fixed assets such as land buildings motor vehicles etc whereas intangible assets are the items that lack a physical form. Shareholder funds and net current assets were.

This is the amount of retained earnings that are left in the business. Current assets refer to anything that a company could sell to create revenue by the end of the year. Current assets include cash cash equivalents.

Net current assets is the aggregate amount of all current assets minus the aggregate amount of all current liabilities. Non-current assets are capitalized rather than expensed and their value is drawn down and allocated over the number of years that the asset will be in use. Current assets minus current liabilities.

If the net amount is negative it could be an indicator that a business is having financial difficulties. Current assets are the assets a business owns which are either cash cash equivalents or are expected to be turned into cash during the next twelve months. Current assets are all the assets of a company that are expected to be sold or used as a result of standard business operations over the next year.

The amount of current assets that exceeds current liabilities. Your browser doesnt support HTML5 audio. Current assets show the cash and other assets that are available to settle those current liabilities.

Current assets are therefore very important to cash flow management and forecasting because they are the assets that a business uses to pay its bills repay borrowings pay dividends and so on. Want to learn more. Current assets are considered short-term assets because they generally are convertible to cash within a firms fiscal year and are the resources that a company needs to run its day-to-day.

Also see working capital. The profits are left in the business to help it grow. A companys assets after its current liabilities debts that must be paid within 12 months have been subtracted from its current assets assets that will be used or sold within 12 months.

Net assets are what a company owns outright minus what it owes. Net assets are more commonly referred to as equity. Shareholder funds and net current assets were in the negative at the end of 2009.

Your browser doesnt support HTML5 audio. This is because the value of these assets typically diminishes after one year. For individuals the concept is the same as net worth.

In reality a business is constantly settling liabilities taking money from customers buying inventories and so on.

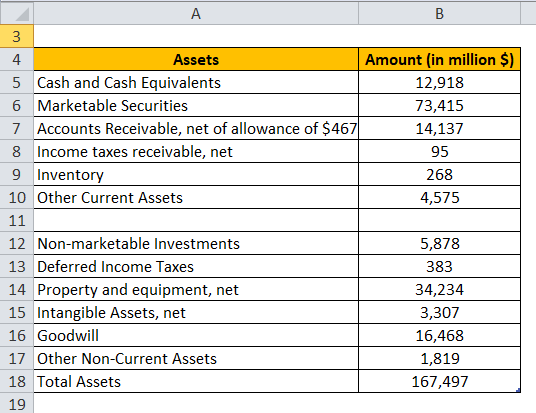

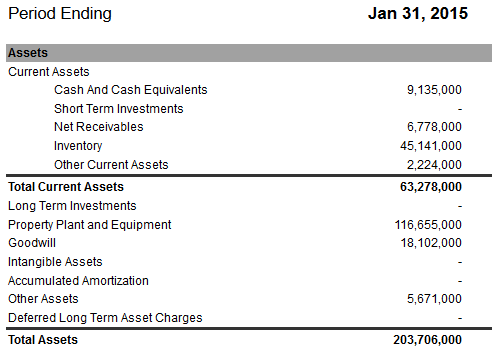

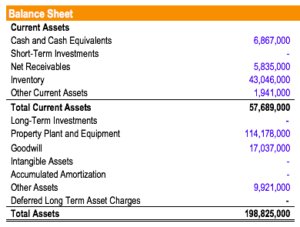

How To Find Total Current Assets The Motley Fool

Changes In Net Working Capital All You Need To Know

Working Capital Formula Examples More Wall Street Prep

/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)

Current And Noncurrent Assets The Difference

Current Ratio Formula Examples How To Calculate Current Ratio

What Are Current Assets Definition Meaning List Examples Formula Types

Fixed Assets Definition Characteristics Examples

What Are Tangible Assets Definition And Examples Ig Uk

Understanding Net Worth Ag Decision Maker

/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)

Current And Noncurrent Assets The Difference

Current Assets Know The Financial Ratios That Use Current Assets

How To Find Total Current Assets The Motley Fool

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Liabilities_Sep_2020-01-6515e265cfd34787ae2b0a30e9f1ccc8.jpg)

Current Liabilities Definition

Working Capital Net Current Assets Tutor2u

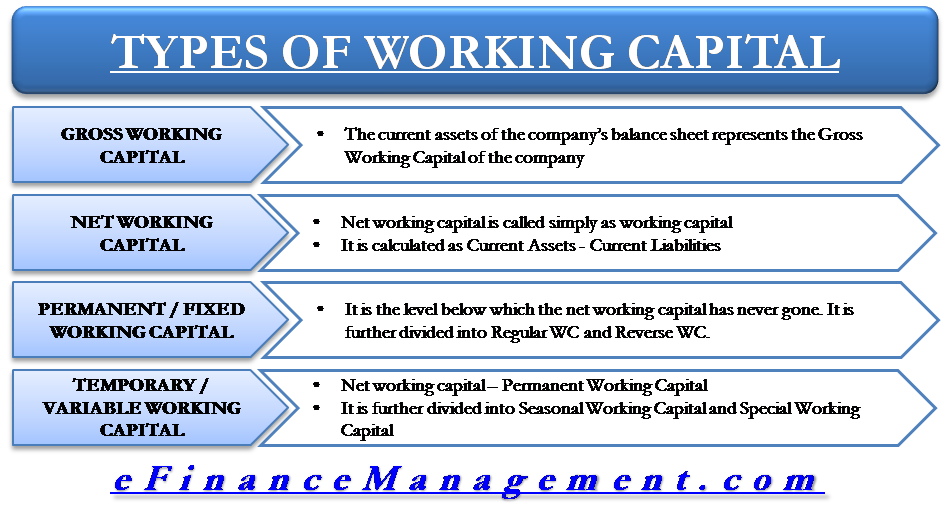

Types Of Working Capital Gross Net Temporary Permanent Efm

/dotdash_Final_Other_Current_Assets_OCA_Dec_2020-01-1ef8bd75eff345e7ac48ba70fb718619.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Other_Current_Assets_OCA_Dec_2020-01-1ef8bd75eff345e7ac48ba70fb718619.jpg)

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

Post a Comment for "Business Definition Net Current Assets"