Percent Of Gross Income From Business Use Of Home

100 divided by 1800 5. Check your homebuying eligibility now.

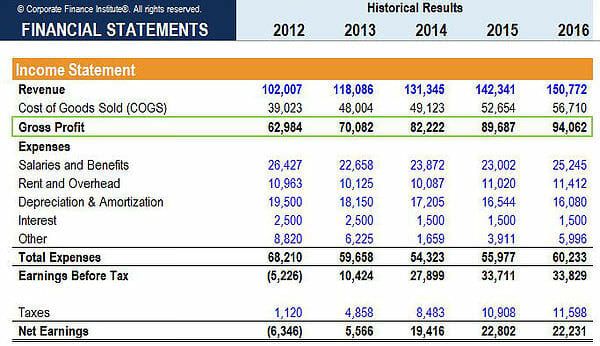

How Income Statement Structure Content Reveal Earning Performance

However your deduction is limited to the percentage of your home that is dedicated exclusively to your business.

Percent of gross income from business use of home. If you use your car as a part of your business you are allowed to deduct certain car expenses. This primarily includes those who work on commission or bonus. There are two ways that you can calculate the business percentage of your home eligible for a tax deduction.

Multiply 5 by the area of your home used for business purposes up to 300 square feet. You can only use this method if your home office is 300 square feet or less. Allowable square footage of home use for business not to exceed 300 square feet Percentage of home used for business.

When it comes to your budget its important to know which number to use. Revenue Procedure 2013-13 PDF allows qualifying taxpayers to use a prescribed rate of 5 per square foot of the portion of the home used for business up to a maximum of 300 square feet to compute the business use of home deduction. Your business percentage is 10.

Use lines 17 of Form 8829 or lines 13 on the Worksheet To Figure the Deduction for Business Use of Your Homenear the end of this publication to figure your business percentage. Your office is 10 1 10 of the total area of your home. Remember your deduction cant exceed the gross income from the business use of your home.

Deduction for home office use of a portion of a residence allowed only if that portion is exclusively used on a regular basis for business purposes. For example if only 10 of the square footage of your house is reserved exclusively for business use you can only use 10 of your home expenses as a business deduction. How Gross Income and Net Income Can Affect Your Budget.

If all your work is done in your home office enter 100 for 100. Since your net income is your take-home pay or the money that youll actually earn on pay day it may be best to focus on that number when creating a budget. Understand the Benefits of 5 Down Payments.

If your gross business income is less than the total amount of your business deductions your deduction for certain expenses for the business use of your home is limited. The question is asking what percentage of your business gross income is attributed to work done in your home office. Business use of your car.

When divided by 12 that comes out to 322475 per month. But if you figure that one-fourth of your income is made on the road or in another location and three-fourths of your income is made from your home office enter 75 for 75. Compare the size of the business designated portion of your home to your whole house.

Then the allowable portion of business-use-of-home expenses would be. The next step in calculating the home business tax deduction is to apply this percentage to your allowable household expenses. If you have 5 to put down on a property some lenders will give you mortgages with no closing costs.

Gross income or net income. Keep Monthly Costs Below 42 of Your Income. That is 2 hundred and forty divided by 12 hundred.

Generally you can deduct the cost of. Using IRS Form 8829. The lenders definition of self-employed excludes those who own less than 25 percent of a business.

In order to get the largest home office deduction youll likely have to use both methods to find which deduction is larger. Keep all credit cards loans home insurance costs bank obligations mortgage principal and interest lower than 42 of your gross income. For example if your office is 2 hundred and 40 square feet and your home is 12 hundred square feet your business percentage would be 20 percent.

A common example might be a partnership or LLC where the individual owns say 10 percent. According to that post in California someone with a 50000 salary would net 38697. To use the area method divide the area used for business by the total area of your home.

The amount of the deduction computed using the simplified method cannot exceed the gross income derived from the qualified business use of the home for the taxable year reduced by the business deductions that are unrelated to the qualified business use of the home. GoBankingRates has published a list of how much the average resident in all 50 states would take home as net income based on a 50000 salary gross income. The optional deduction is capped at 1500 per year.

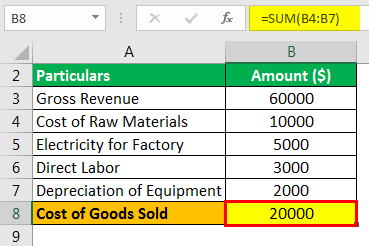

Your deduction of otherwise nondeductible expenses such as insurance utilities and depreciation with depreciation taken last is limited to the gross income from the. Under this safe harbor method depreciation is treated as zero and the taxpayer claims the deduction directly on. Gross Business Income10000 Minus Home Expenses Real estate taxes etc 106000 Minus Business Activity Expenses Second phone line etc 1002000 Equals.

The personal use portion would be 95. Standard 5 per square foot used to determine home business deduction. As with home expenses the vehicle use for business deduction must be calculated based on the percentage of miles driven for business purposes versus personal trips.

Get the biggest tax write off for your home office.

:max_bytes(150000):strip_icc()/Howdogrossprofitandnetincomediffer2-962e065a0ae84e52b083fff305afaa96.png)

Gross Profit Vs Net Income What S The Difference

Operating Income Vs Gross Profit

What Is Gross Income For A Business

Operating Income Vs Gross Profit

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza Adobe Commerce

What Are Itemized Deductions And Who Claims Them Tax Policy Center

What Are Itemized Deductions And Who Claims Them Tax Policy Center

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza Adobe Commerce

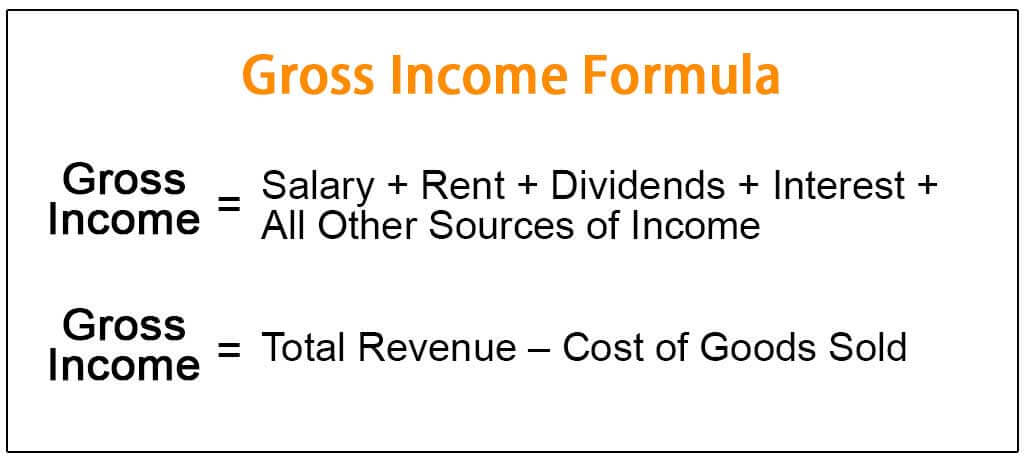

Gross Income Formula Step By Step Calculations

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Profit Essentials You Need To Know About Gross Profit

Gross Income Formula Step By Step Calculations

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza Adobe Commerce

Sales Cost Of Goods Sold And Gross Profit

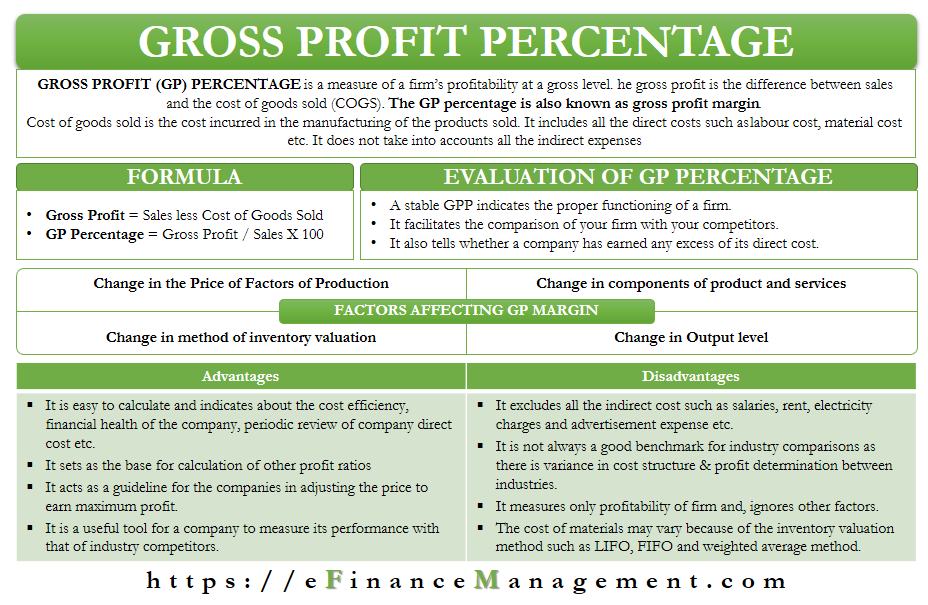

Gross Profit Percentage Meaning Example Advantages More

Taxable Income Formula Calculator Examples With Excel Template

Gross Income Formula Step By Step Calculations

What Are Itemized Deductions And Who Claims Them Tax Policy Center

Post a Comment for "Percent Of Gross Income From Business Use Of Home"