Are 1st Quarter 2020 Payroll Taxes Extended

2020 business returns normally due on April 15 and March 15. 4th Quarter 2021 Estimated Tax Payment Due.

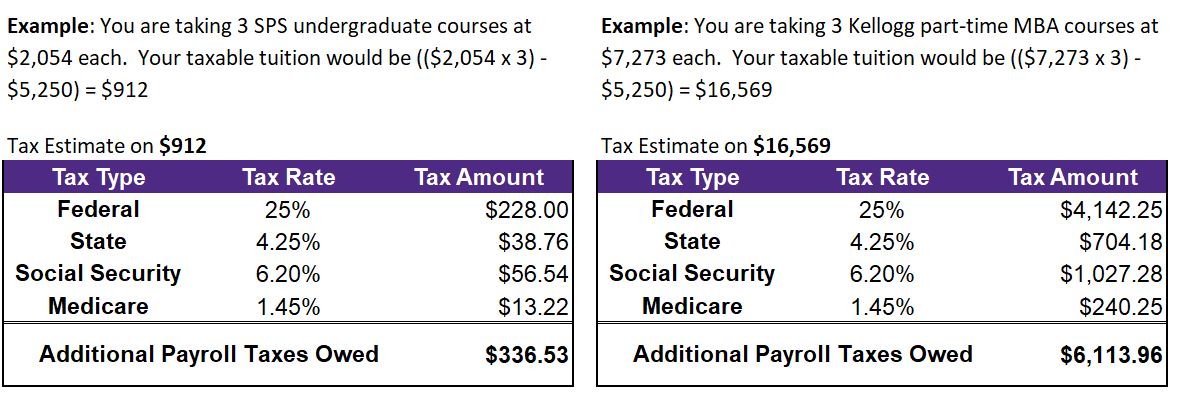

Tuition Taxation Human Resources Northwestern University

Employers use Form 941 to.

:max_bytes(150000):strip_icc()/how-and-when-to-file-form-941-for-payroll-taxes-398365_FINAL-3e897153189040e99df9b89437493b7b.png)

Are 1st quarter 2020 payroll taxes extended. Business taxpayers must still file Form 941 for the first quarter of 2020 and pay any payroll taxes due by April 30 2020. Form 941 is used to report federal income tax withheld from employees as well as Social Security tax and Medicare tax for the quarter. 2021 quarterly payroll and excise tax returns normally due on April 30.

The EDD offers a no-fee option for employers and payroll agents to manage your account online. Your 1st quarter federal forms have a due date of April 30 2020. These deadlines include for example making a contribution to an IRA 401k HSA or Archer MSA for 2019.

The FUTA tax rate is 6 of the first 7000 paid to each employee as wages during the year. Quarterly tax deadlines. All employers must file Quarterly Employers Contribution and Payroll Report electronically by midnight on April 30th to avoid late report filing penalty.

Notice 2021-31 provides guidance on temporary premium assistance for COBRA continuation coverage under the American Rescue Plan Act of 2021 PDF. See more about Form 941. While it would seem intuitive to also move the second quarter due date of June 15th this currently has not been done - Q2 income tax estimated payments are still due June 15th 2020.

2021 quarterly estimated income tax payments due April 15. The Extension applies to both payments of tax on self-employment income and estimated income tax payments for the first quarter of tax year 2020 that are due on April 15 2020. For businesses that have made their FUTA deposits on time the.

How do I change my tax payment or filing date in payroll. November 1st for the third quarter. Monthly payrollFICA tax payments are due by the 15th day of the following month.

August 2nd for the second quarter. The Consolidated Appropriations Act 2021 does not retroactively expand ERC eligibility or increase the credit amount for wages paid in 2020. 2020 tax-exempt organization returns normally due May 17 2.

If you got a filing extension on your 2020 tax return you need to get it completed and postmarked by October 15 2021. However estimated income tax payments for the second quarter of tax year 2020 are still due on June 15 2020. No dollar limit applies to the Extension.

To qualify for the extension the employer must be current on all quarterly tax payments before the 1st quarter of 2020 regardless of whether or not they are seeking an extension of tax payment. The first quarter estimated tax payment due date of April 15th 2020 has also been extended to July 15th 2020. Extended Individual Tax Returns Due.

That has not changed in the least. Employers unable to pay all of their 1st quarter 2020 UI payroll taxes by the statutory deadline because of COVID-19 related factors would not have any penalties or interest imposed as long as they paid the amount in full within 30 days of the end of Governor Browns. For the period beginning January 1 through March 31 April 15.

Enroll in e-Services for Business to file reports make deposits view rates update business information and manage. Can I file. Many deadlines tied to an April 15 2020 filing date have been extended to July 15 2020 as well.

April 30th for the first quarter. See the IRS website Filing and Payment Deadlines Questions and Answers. More Time to Withhold and Pay the Employee Share of Social Security Tax Deferred in 2020-- 28-JAN-2021.

CHANGE New FAQs make clear that the deadline to make a contribution to a traditional IRA Roth IRA and Health Savings Account for the 2019 tax year is extended until July 15 2020. If you are a reimbursable employer your payment due date is extended to June 30 2020. Same time and place as usual.

The delay also applies to estimated tax payments for the first quarter of 2020 which are ordinarily due in April as well. Due to covid-19 when are 1st qtr payroll tax forms and taxes due Fed Form 941 NYS-45. The only forms and full payments postponed until July 15 are any with an actual due at of April 15.

Filings and payments for the first quarter have been extended to June 1 2020. January 31st of next year for the fourth quarter. And this is an automatic extension -- you dont need to do anything to.

All employers are required to electronically submit employment tax returns wage reports and payroll tax deposits to the EDD or you will be charged a penalty. Clarification of the Definition of Qualified Sick Leave Wages and Qualified Family Leave Wages-- 29-JAN-2021. The Consolidated Appropriations Act of 2021 extends and expands eligibility for the refundable employee retention tax credit for qualified wages paid between December 31 2020 and July 1 2021.

:max_bytes(150000):strip_icc()/how-and-when-to-file-form-941-for-payroll-taxes-398365_FINAL-3e897153189040e99df9b89437493b7b.png)

The Trump Payroll Tax Cut What It Means For Your Small Business

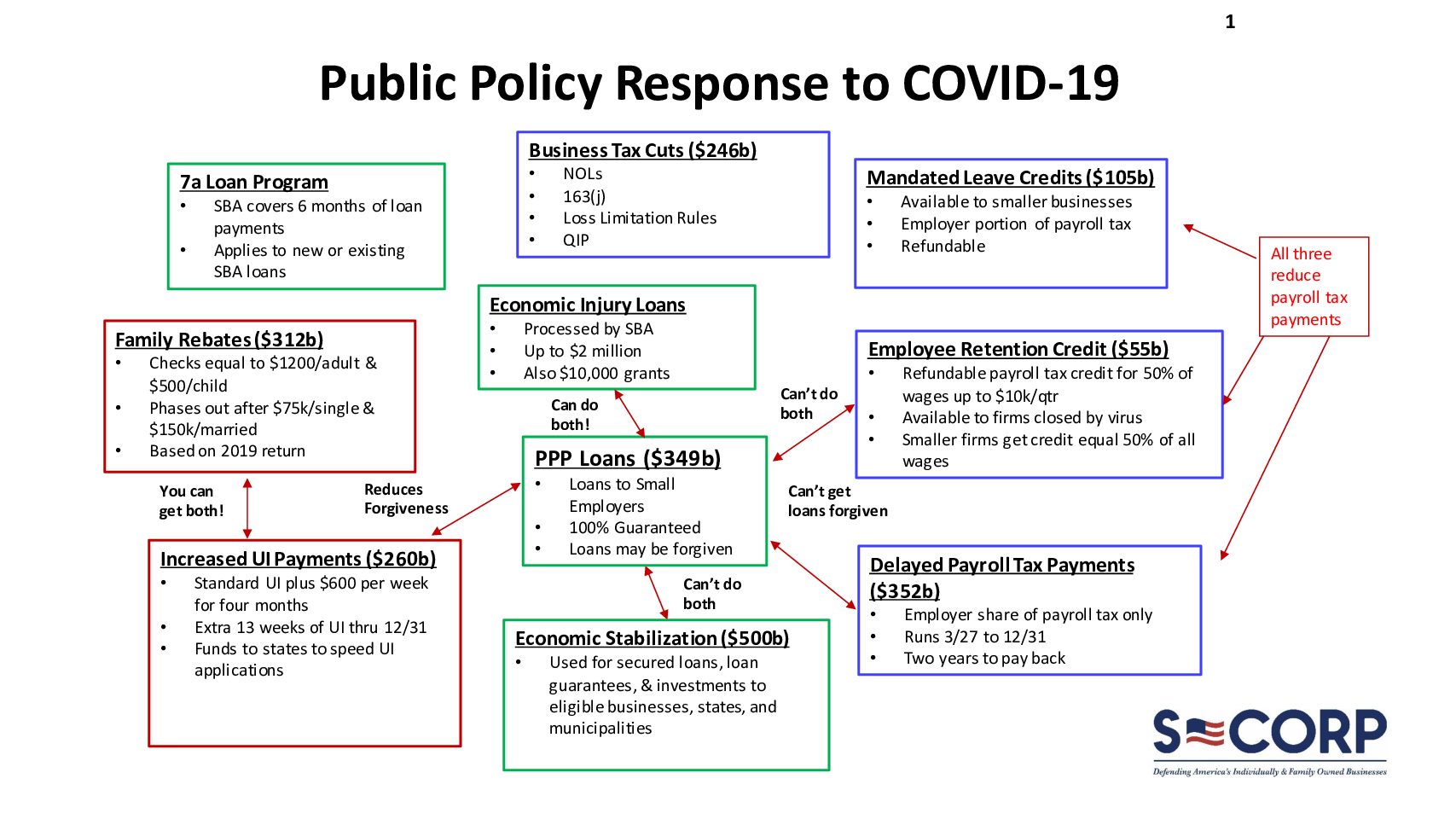

Cares Act Payroll Tax Deferrals And R D Credits

Draft Of Revised Form 941 Released By Irs Includes Ffcra And Cares Provisions Current Federal Tax Developments

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-699095069-378b27663c104c6aa8cdfc18b5f943c8.jpg)

The Trump Payroll Tax Cut What It Means For Your Small Business

Three New Payroll Tax Provisions For Eligible Employers

Irs Form 941 Employer S Quarterly Federal Tax Return Plianced Inc

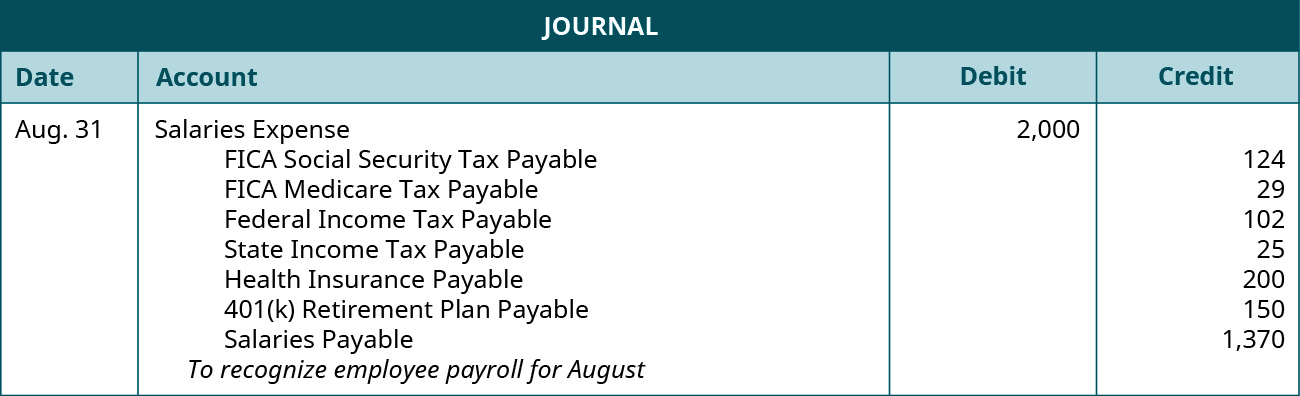

Record Transactions Incurred In Preparing Payroll Principles Of Accounting Volume 1 Financial Accounting

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Payroll Tax Deferral Starts Today

Payroll Taxes 2021 Filing Deadlines Rates And Employer Responsibilities

Form 944 To Simplify Tax Filing For Small Business Owners Https Www Irstaxapp Com Form 944 To Simplify Tax Filing Taxes Small Business Owner Payroll Taxes

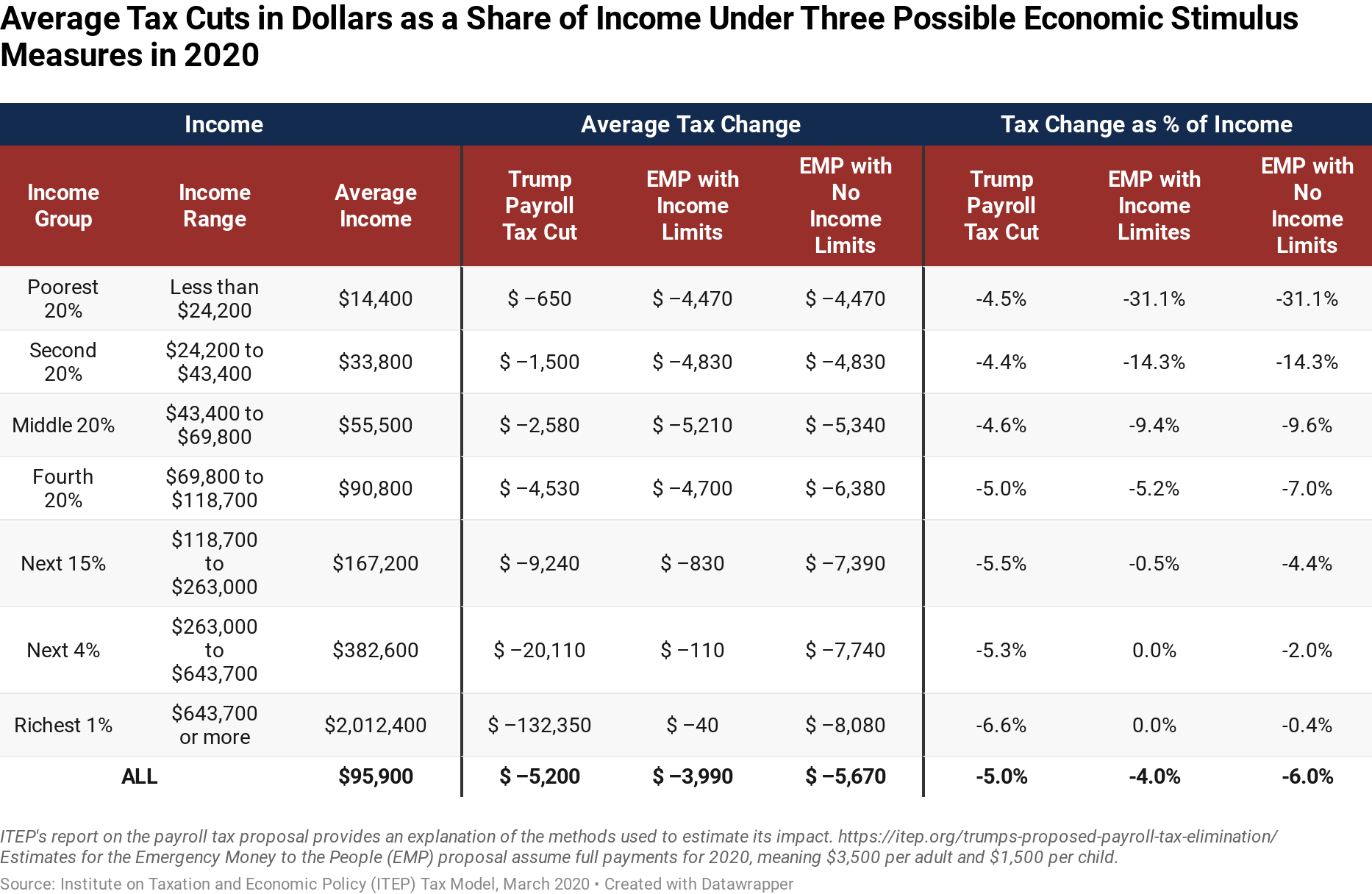

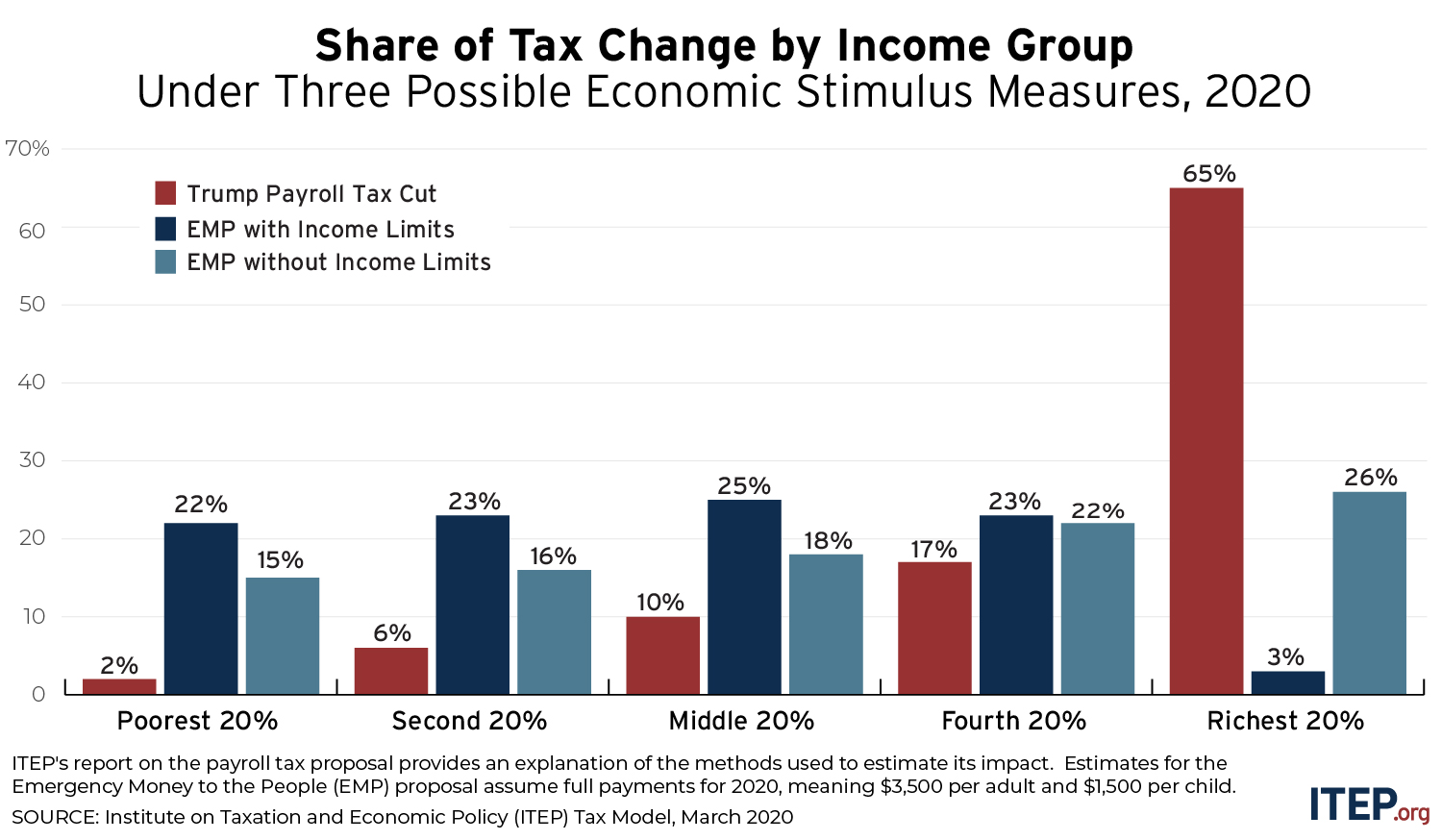

Checks To All Vs Trump S Payroll Tax Cut Itep

Payroll Tax Deferral How Will It Affect You Experian

Irs Defers Employee Payroll Taxes Jones Day

Checks To All Vs Trump S Payroll Tax Cut Itep

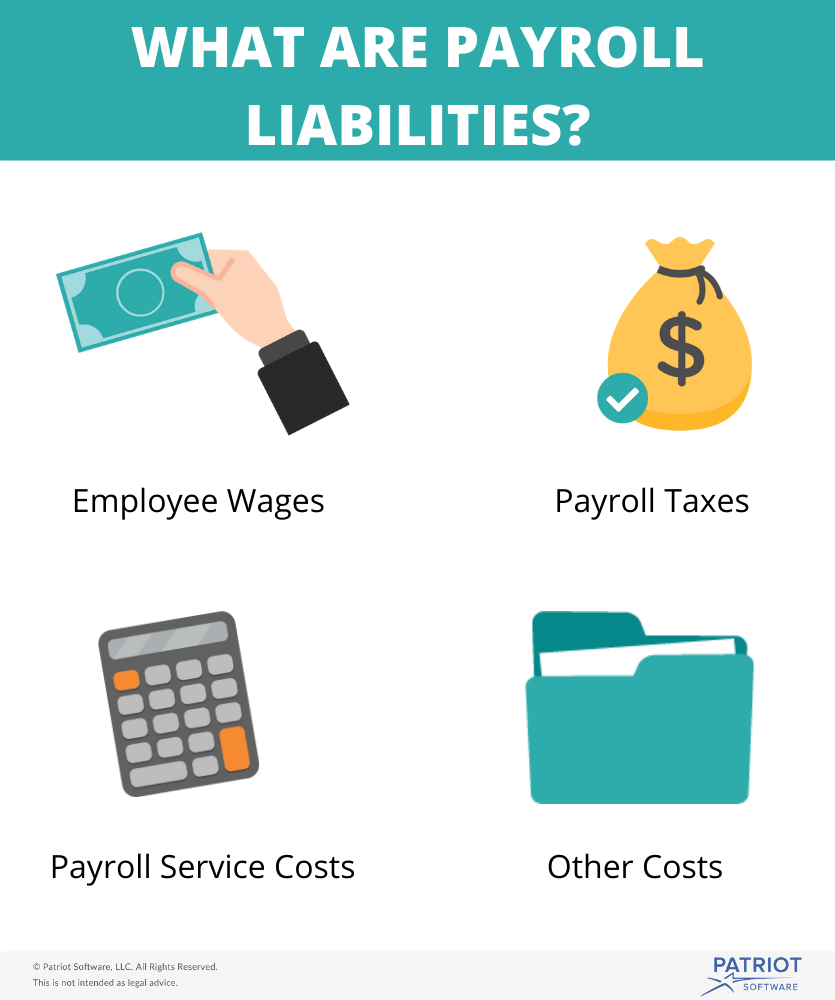

What Are Payroll Liabilities Definition How To Track Them More

Payroll Tax Deferral Retention Credit S Corps Molen Associates

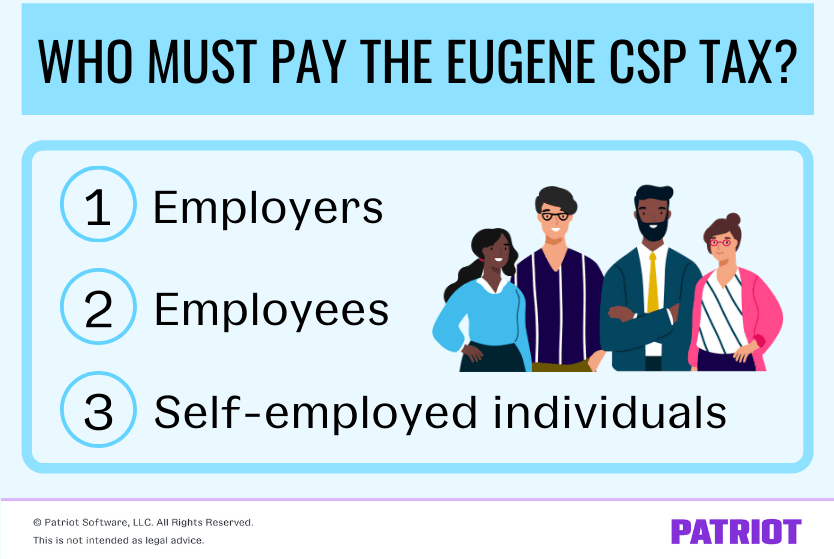

Eugene Community Safety Payroll Tax Rates Example More

Post a Comment for "Are 1st Quarter 2020 Payroll Taxes Extended"