Venmo Business Account Transaction Limit

A Venmo Business Profile allows you to send and receive business and personal transactions from within the same account while keeping those two categories separate for record-keeping purposes. Or The Bancorp Bank and the funds in your Venmo balance will be eligible to be insured by the FDIC.

Which Mobile Payment App Is Best Paypal Or Venmo

There are a few additional restrictions to keep in mind however.

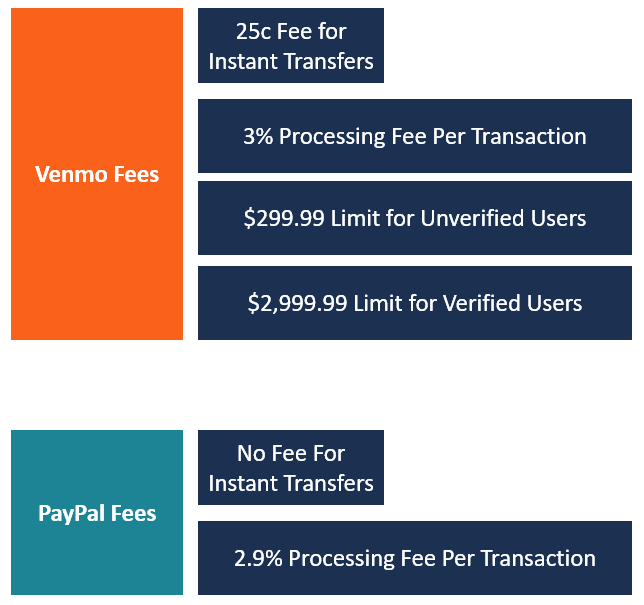

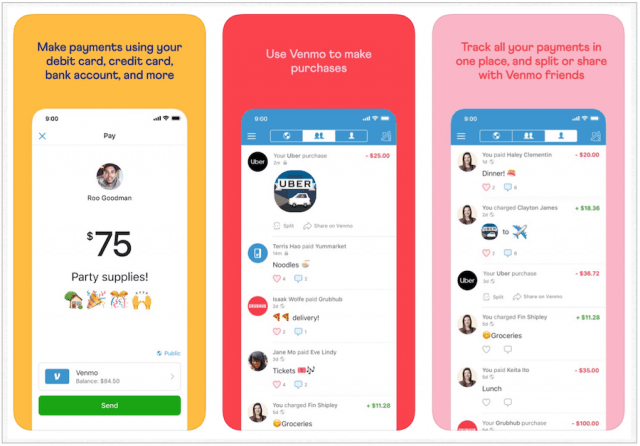

Venmo business account transaction limit. For registered users without identity verification the company imposes a 29999 rolling limit on the total payments and purchases per week. Whether youre selling homemade planters at a craft fair serving up one-of-a-kind haircuts or mowing lawns a business profile makes it easy for your customers to find and pay you on Venmo. When you add money to your Venmo balance using Direct Deposit or remote check capture Venmo will deposit all funds held in your Venmo balance into one or more custodial accounts we maintain for the benefit of Venmo account holders at one or more FDIC member banks currently Wells Fargo Bank NA.

The person-to-person sending limit is capped at 499999. This limit includes person-to-person payments in-app and online purchases and purchases with your Venmo Mastercard Debit Card and purchases using your in-store QR code. Setup is simple and transactions are too.

Customers can share where theyve shopped in their Venmo feeds putting you in the spotlight. Easy to send and receive money from Venmo personal or business users. It means that for every seven days unverified users cannot transact more than 29999.

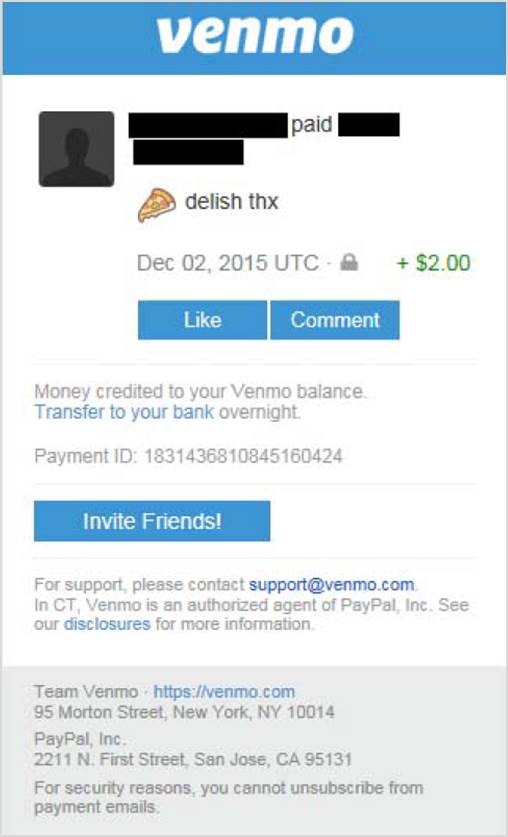

Some businesses dont accept Venmo because they see the transaction. Earnings to the individual receiving payment through Venmo are taxable to that individual and must be reported in compliance with tax law. Using Venmo for business transactions incurs processing fees that follow your Discover processing fees.

Statista reports that Venmos net payment volume was a whopping 37. Business profiles allow Venmo users to accept payments for the sale of goods and services from customers on Venmo. Accepting Venmo gives your customers an easy familiar way to pay.

Venmo debit card transactions. If you have a Venmo Mastercard debit card there are other transaction limits you should be aware of. If you have completed identity verification your combined weekly spending limit is 699999.

In our Contactless Payment 101 series were breaking down the basics of processing transactions hands-freeToday were talking Venmo payments. Vendor payments over 600 in a calendar year must be reported on IRS Form 1099-MISC regardless of the mechanism by which the payment is made. Venmo now accepts cryptocurrencies such as Bitcoin.

Money can be moved instantly with a 1 transfer fee between bank accounts. If your identity has not been confirmed yet the limit on the funds that you can send to your bank account is 99999 per week depending on security checks at Venmo. Now its starting to look like Venmo for business is the next big thing for SMBs.

A Venmo business profile simplifies checkout and gets you noticed by our community of over 60 million people. When Braintree is selected as. When a business sets up Venmo payments through PayPal standard fees of 29 percent plus.

These limits may change from time to time at our discretion. Once weve confirmed your identity your weekly rolling limit is 499999. Tap into a community of more than 60 million people who can pay with Venmo.

You can raise this limit by confirming your identity see instructions below. Typically faster than credit card processing. Venmo Transaction Limits Venmo limits the amount of money that customers can transact through the platform.

Venmo took the world of peer-to-peer transactions by storm. Accepting payments as a small business owner can get a little murky. That means that the rates you pay may be different than the rates.

When you sign up for Venmo your person-to-person sending limit is 29999. Please remember that for person-to-person payments both the per-transaction and maximum weekly limit stand at 499999 USD. Venmo debit card purchases and payments to authorized merchants each have a per-transaction limit.

Disadvantages of Accepting Venmo Payments for Businesses. To learn more about limits or how to verify your identity please visit this article. For example you cant make any individual purchase above.

There is no fee to the user for sending money from a Venmo balance bank account or debit card In 2016 Venmo began allowing some businesses to accept Venmo for payment. Digital wallets are booming in light of the coronavirus outbreak but Venmo in particular has risen to the top. Sole proprietors will share the same card limit as your personal profile while registered business es will have a separate card limit.

There are the various fees for different cards Square here Stripe there and if youre in the know Schedulicity Pay too and the one 70-something client. Once you do you can transfer up to 1999999 per week. Balance Transfers If youve verified your identity on Venmo youll have the option to request a balance transfer between your personal and business accounts.

How To Use Venmo To Send And Receive Money Payments The Handbook Of Prosperity Success And Happiness

Venmo Settlement Addresses Availability Of Funds Privacy Practices And Glb Federal Trade Commission

Venmo Overview How It Works Fees And Transaction Limits

Venmo Vs Paypal Which Payment Service Is Better

What Is Venmo And How Do I Use It

Venmo Announces Debit Card In Latest Bid To Monetize The Service Marketwatch

What You Need To Know About The Venmo Debit Card Creditcards Com

Pnc Customers Can T Access Venmo Third Party Payment Apps Whyy

:max_bytes(150000):strip_icc()/how-safe-venmo-and-why-it-free_FINAL-5c7d732a46e0fb00018bd86c.png)

What Is Venmo Are There Any Fees And Is It Safe

How Pay Someone Compares To Venmo Texas Citizens Bank

Venmo Vs Zelle Which Is Better

As Payments Go Social With Venmo They Re Changing Personal Relationships All Things Considered

/Venmo-ItsBusinessModelandCompetition2-7a04c392fba04909b3d5dd560a9782e3.png)

Venmo Its Business Model And Competition

How To Use The Venmo Mobile App To Make Or Receive Payments Business Insider India

Venmo 1099 Taxes For Freelancers And Small Business Owners

Brave Parenting Guide To Venmo Brave Parenting

Venmo Is More Like A Check Than Cash Which Helps Scammers Money

The Real Story Behind The Pnc Venmo Clash

Post a Comment for "Venmo Business Account Transaction Limit"