How To Find My Business State Tax Id Number

The IRS requires this number to identify taxpayers who must file various business tax returns. The company requires another state tax ID number if it relocates to another state.

4 Form Deductions 4 Benefits Of 4 Form Deductions That May Change Your Perspective 1099 Form Deductions Handy Printabl Tax Prep Checklist Business Tax Tax Prep

Enter one ID and primary customer zip code to retrieve your Case ID.

How to find my business state tax id number. What file formats can you use for importing in OPRS. If you are from one of these states and you also want to get a federal Employer Identification Number EIN you may obtain both your state. What if my FEIN or Company name are missing incorrect or show Not Available Can I make tax payments in OPRS.

It is better to ask for this information while you still have a working relationship with the business. Press 1 for English then 2 for general information on taxes then 2 for any other taxes. How to find your business tax ID number.

Get a Federal and State Tax Id Number. State Taxpayer ID - TID Located on Liability Notice Social Security Number - SSN. Works with certain types of organizations.

On the other hand the IRS is the agency that issues EINs to businesses and the company retains the number for. State and Federal Online Business Registration. However the Business Registry.

A Minnesota Tax ID Number is a seven-digit number used to report and pay Minnesota business taxes. Minnesota Department of Revenue. Check your EIN confirmation letter Check other places your EIN could be recorded Call the IRS.

What happened to OTTER and SETRON when OPRS was launched in March 2019. Zip Code or 6 digit Canadian Postal code. Is not the same as your Business Registry Number obtained through the Secretary of States Business Registry.

Sales and Use Tax. The Minnesota Department of Revenue manages the state. This is a free service offered by the Internal Revenue Service and you can get your EIN immediately.

An Employer Identification Number EIN is also known as a Federal Tax Identification Number and is used to identify a business entity. What Transit Taxes can be Reported in OPRS. Apply for an FEIN online or contact the IRS at 1-800-829-1040.

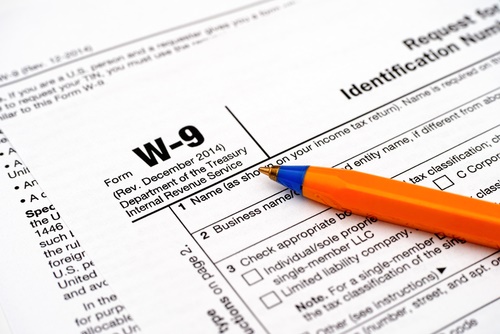

The form and instructions can also be printed directly from the IRS website at Forms and Publications go to Forms Instructions Publications. If not you can send a W-9 form to a company if you have a valid reason and a legal right to obtain tax identification numbers. Businesses obtain state tax ID numbers from the department of revenue of the state where it is located.

You may apply for an EIN in various ways and now you may apply online. 2 All owners of New Mexico businesses registered as a Partnership Limited Liability Company or CORPORATION must obtain a New Mexico CRS Tax ID number. A Tax Id number is also called an Employer Identification Number or EIN.

Withholding unemployment tax Workers Benefit Fund Assessment and transit taxes TriMet and Lane Transit. Apply for an EIN with the IRS assistance tool. According to the IRS a federal tax ID number is used to identify a businessThere are many reasons why a business may need one including paying employees.

It is a nine-digit number assigned by the Internal Revenue Service IRS. 1 Select the FEDERAL ID NUMBER HOME link to obtain a Federal Employer Identification Number EIN tax identification number. Choose and enter only one form of ID verification.

What is a Business Identification Number BIN. If you receive federal or state tax reporting from a business each form will contain the companys tax numbers. You can also try pressing 0 after pressing 1 for English.

2 The state can also do a lookup of this number of you give them a call at 850-488-6800. You will leave the IRS website and enter the state website. Revenue Minnesota Department of.

AutoFile enrollment also requires only the first 13 digits. Enter Primary Zip Code. Is used for all payroll tax programs.

Getting a federal tax identification ID number is an important first step when you start your business. Sometimes referred to as FEIN. If you need a business registration number from one of the states listed on this page all you need to do is click on one of the links below.

Form SS-4 may be obtained from the Internal Revenue Service by calling the IRS at the telephone number listed in the Resource Directory section of this Guide. Generally businesses need an EIN. It will guide you through questions and ask for your name social security number address and your Doing Business As DBA name.

Your nine-digit federal tax ID becomes available immediately upon verification.

W 2 User Interface W 2 Wage And Tax Statement Data Is Entered Onto Windows That Resemble The Actual Forms Imports Employee Inform Irs Forms Irs Tax Forms

What To Bring To Your Tax Appointment Tax Appointment Business Tax Tax Organization

Letter Ein Confirmation Confirmation Letter Employer Identification Number Doctors Note Template

Where Do I Find My Employer Id Number Ein Turbotax Support Video Youtube

How Do I Obtain A Federal Tax Id When Forming An Llc Legalzoom Com

Pin By Lance Burton On Unlock Payroll Template Tax Refund Money Template

Tax Forms Directory Comprehensive Irs Tax Forms Guide Irs Taxes Irs Tax Forms Business Tax Deductions

Business Registration Application For Income Tax Withholding Sales And Use Tax And Machinery Equipment And Manufacturing Income Tax Registration Tax Forms

The Guide To A Painless Tax Season Nurse Ceo Tax Season Tax Prep Business Tax

Individual Tax Preparation Checklist Tax Preparation Tax Preparation Services Tax Checklist

Pin On Difference Betweem Single And Multi Member Llc

Fake Bank Statement 2 2 Unconventional Knowledge About Fake Bank Statement 2 That You Can T Confirmation Letter Doctors Note Template Letter Of Employment

Tax Return Fake Tax Return Income Tax Return Income Statement

Pin By Investopedia Blog On Finance Terms Employer Identification Number Business Irs

Is My Tax Id The Same As My Social

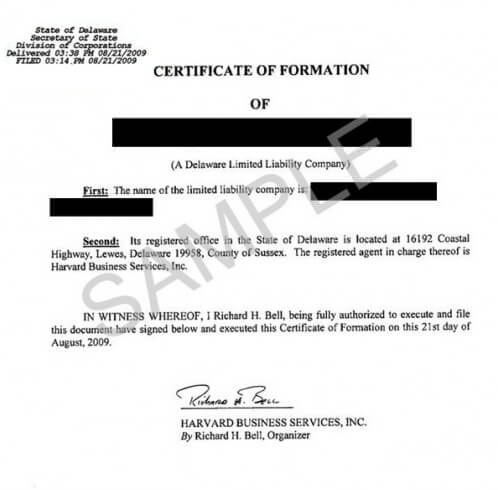

Delaware State File Number What It Is How It S Used Harvard Business Services

W4 Form Explained 4 Important Life Lessons W4 Form Explained Taught Us Tax Forms W2 Forms Income Tax

Post a Comment for "How To Find My Business State Tax Id Number"