Business Valuation Revenue Multiplier

Bizbuysell says nationally the average business sells for around 06 times its annual revenue. Note that there will always be a discrepancy between the business value based on sales and the business value based on profits.

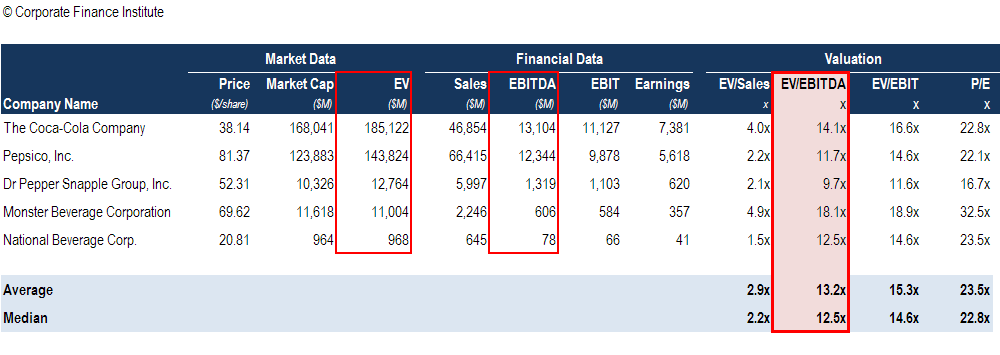

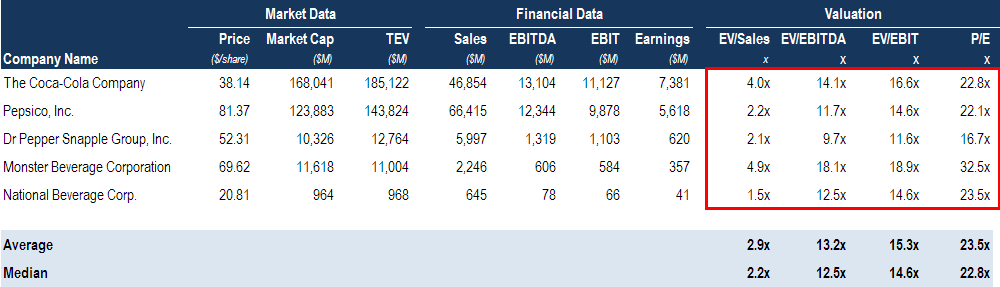

Ebitda Multiples By Industry Chart

This multiplier is applied or multiplied against what is known as Owners Discretionary Earnings.

Business valuation revenue multiplier. Recurring revenue sets a baseline. With a subscription model tracking and reporting sales customer lifetime value CLV churn monthly recurring revenue MRR and more is simplified. The multiplier for a small to midsized business will generally fall between 1 and 3 meaning that you will multiply your earnings before interest and taxes EBIT by either 1X 2X or 3X.

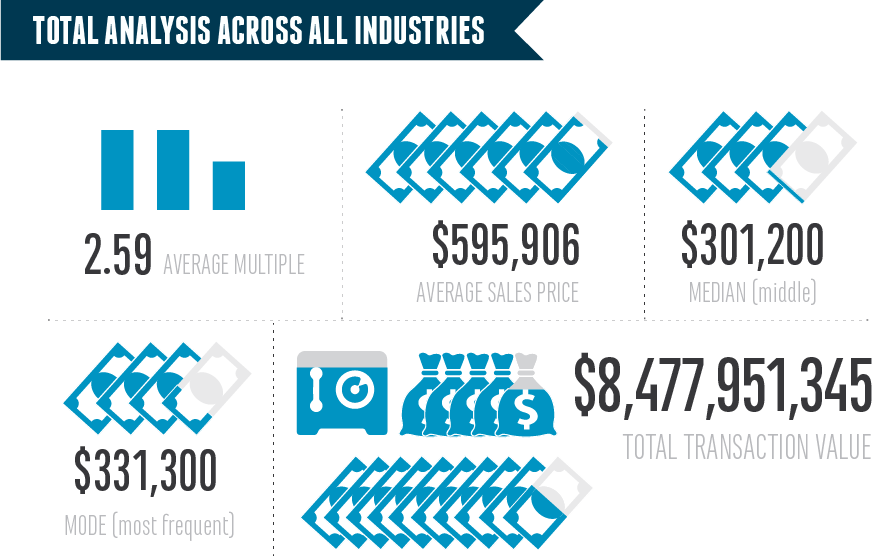

To estimate the value of a subject start-up IT company called CD Corporation that has an annual revenue of 2000000 multiply the revenue by the average revenue multiple of 225x. The industry profit multiplier is 199 so the approximate value is 40000 x 199 79600. The average multiplier for all businesses with a value below one million dollars is between 23 and 27 depending on the database source.

The result is an estimated valuation of 4500000. Buyers guided by appraisers and business valuation experts use rules of thumb to value businesses based on multiples of business earnings. A 1 million sale price divided by 25 million in annual revenue equals a 040x revenue multiple.

For businesses valued over 2 million you can expect a 60x to 100x multiple. For example if your companys adjusted net profit is 100000 per year and you use a multiple like 4 then the value of the business will be calculated as 4 x 100000 400000. 98 rows Industry specific multiples are the techniques that demonstrate what business is worth.

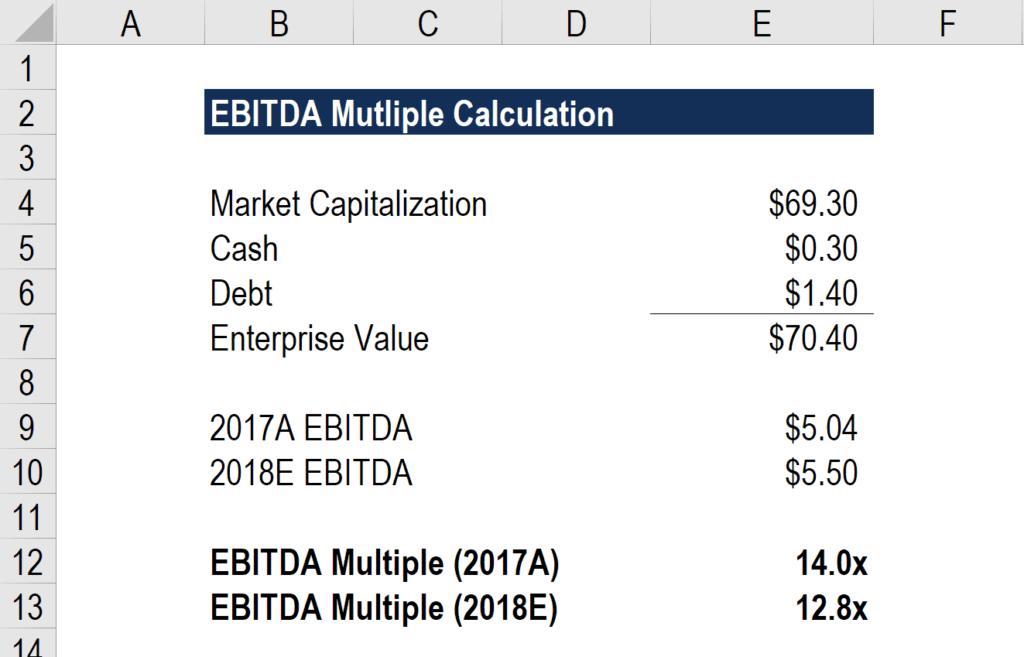

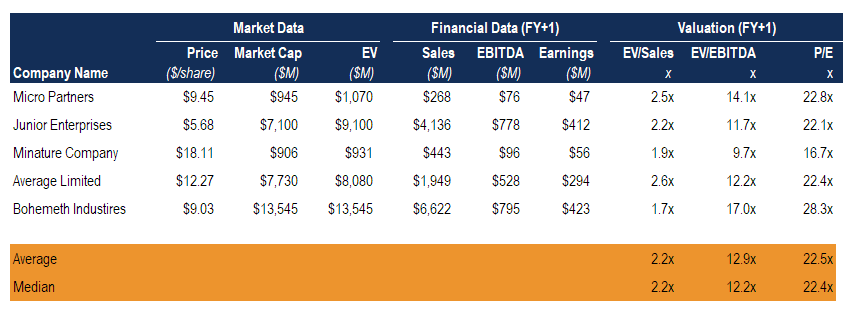

It can also be viewed as a rating that scores a companys long-term business prospects and popularity. Valuation a business valuation and equipment appraisal firm specialized in SBA related valuations nationwide. Take a simple measurement such as revenue or EBITDA earnings before interest tax depreciation and amortization.

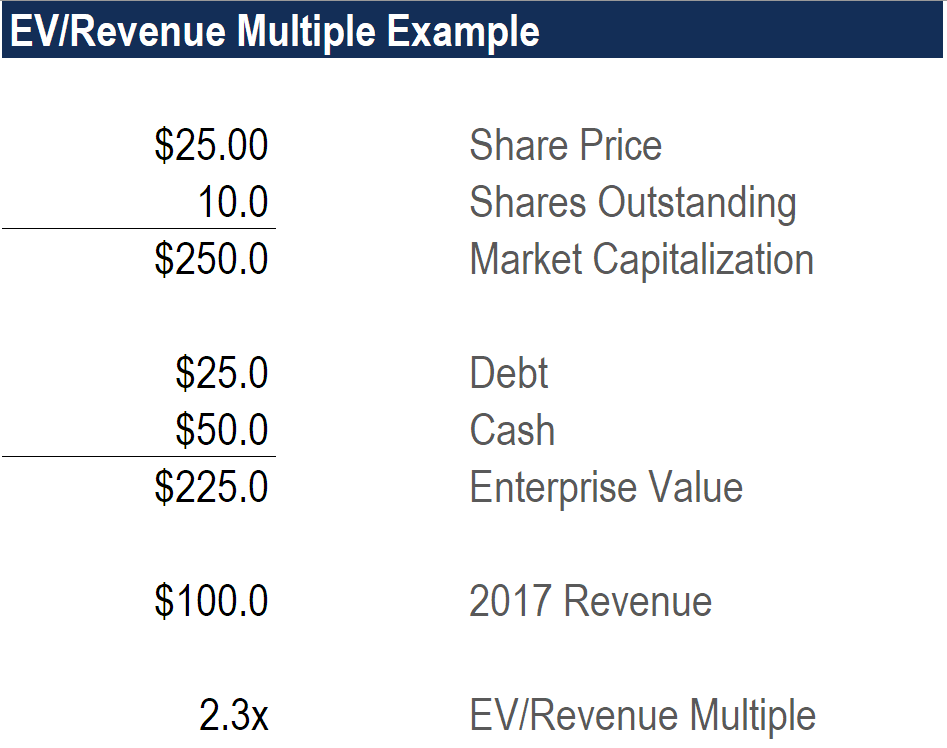

He is a Certified Business Appraiser through the Institute of Business Appraisers IBA where he is the Chair of the Board of Governors and a Certified Valuation Analyst through the. 1 applying a multiple to the discretionary earnings of the business and 2 applying a percentage to the annual gross revenue of the business. You can take any price and divide it by the annual revenue of a business and obtain a revenue multiple or fraction thereof.

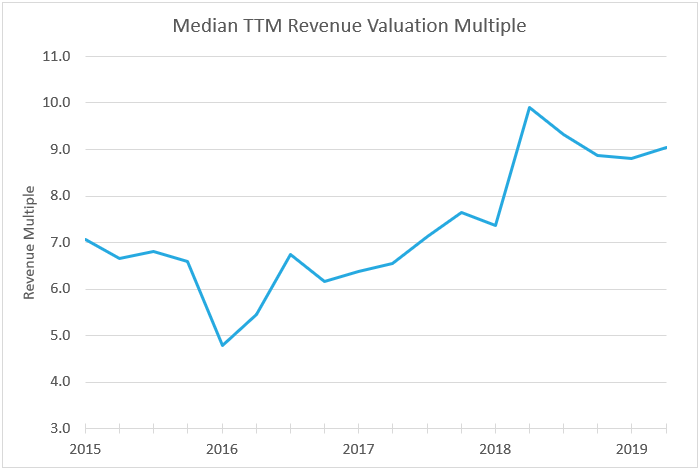

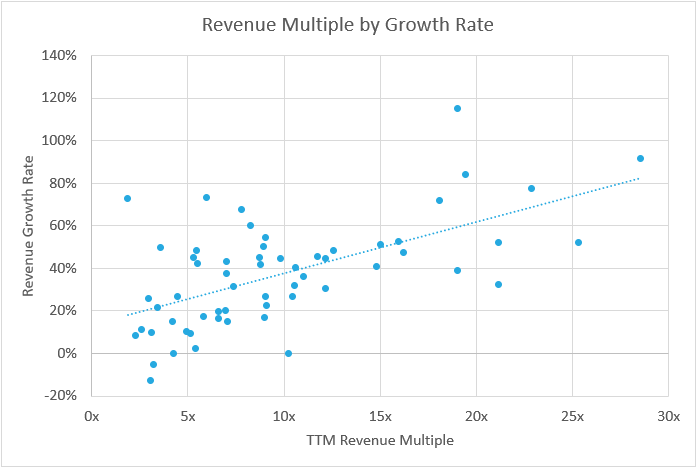

What are the key takeaways of revenue multipleTLDR visitors Revenue multiple is a popular valuation shortcut to quickly evaluate and value technology companies. The two numbers give you an approximate range of potential values for your business. The following diagrams should give you a good feel of where a business could be valued.

But over the 25 years that our firm has been selling businesses weve learned that there are very few hard and fast. In some high growth technology companies people talk about a multiple such as 2x or 3x Revenue Company value. There are some national standards depending on industry type and business size.

Apply a multiplication factor based on industry sales or comparable companies in the sector. 198 rows Valuation Multiples by Industry. There are a several ways to determine the value of a business.

With recurring revenue generated by subscriptions your business gains predictability risk reduction and increased valuation. For larger more established organizations the multiplier can be 4 or higher. The table below summarises eVals current month-end.

The question becomes how do you know what multiplier to use. Here we will focus on the multiples approach which follows two steps. Often when you just start researching the subject of business valuations by industry youll hear talk of selling multiples on revenue net income or EBIDTA and then talk of how to value physical assets vs.

In profit multiplier the value of the business is calculated by multiplying its profit. For businesses valued under 2 million you can expect a 40x to 60x multiple. Two commonly used methods of quickly approximating value are.

Ev To Revenue Multiple Learn How To Calculate Ev Revenue Ratio

Ebitda Multiple Formula Calculator And Use In Valuation

Private Saas Company Valuations 2019 Saas Capital

Enterprise Value Ev To Revenue Multiple

Ebitda Multiple Formula Calculator And Use In Valuation

Explaining 100x Revenue Multiples For Fintech Companies Using Systems Theory By Lex Sokolin Medium

2q20 Public Saas Ev Revenue Multiples Software Equity Group

How To Value A Business Based On Revenue Nash Advisory

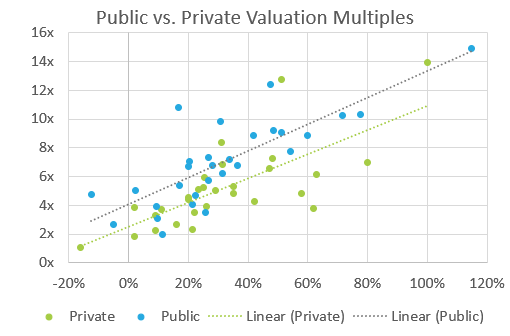

Private Saas Company Valuations 2019 Saas Capital

Ebitda Multiple Formula Calculator And Use In Valuation

Saas Valuations How To Value Your Software Company In 2021

Business Valuation Multiples By Industry Nash Advisory

Trading Multiples Definition Analysis Examples Of Trading Multiples

Private Saas Company Valuations 2019 Saas Capital

Multiples Analysis Definition And Explanation Of Valuation

What S Your Business Worth Business Valuation Calculator

Ev Revenues Multiple Financial Edge

The Price Of Growth A Regression On Growth Rates And Saas Valuations Veecee

How To Value A Business Based On Revenue Nash Advisory

Post a Comment for "Business Valuation Revenue Multiplier"