Llc Tax Filing Deadline 2021 Extension

The IRS has announced that it is extending the April 15 2021 tax filing and payment deadlines for victims of February 2021 winter storms in Texas Oklahoma and Louisiana beginning February 11 2021 to June 15 2021. Individual Income Tax Return.

How To File An Extension For Taxes Form 4868 H R Block

Include with your Ohio income tax return.

Llc tax filing deadline 2021 extension. For individuals that means you can still file for a tax extension right on April 15. Table 1 lists the original and extended deadlines for each respective tax. An LLC tax return extension due date may give you six additional months to file or make your business tax payment if you submit Form 7004.

Deadline Extension FAQ. Its also important to note that the income tax refund schedule remains unchanged. Filing an extension with the IRS does not count as filing an extension for Massachusetts.

Form 7004 is used to request an automatic extension to file the certain returns. Such a move would be a well-intended. 2021 IR-21J Declaration of Estimated Tax.

For additional information and updates taxpayers can consult DRSs website. Deadlines for business returns employer withholding and first quarter payments of estimated tax did not change. Individual and Business Tax Deadline Extensions As of April 21 2020 DRS has extended various filing and payment deadlines for individual and business taxpayers.

If you cannot file your tax return by the deadline you need to file for a tax extension by May 17 2021. Federal policymakers are now considering extending the federal tax deadline until September or even as late as 2021. Filing Form 7004 for Business Tax Return Extensions.

You must file for a federal extension to be granted an Ohio extension. When you file Form 8868 your organization can receive an automatic extension of up to six months. The filing due date for 2020 individual returns has been extended to May 17 2021.

The Ohio Department of Taxation grants an automatic six-month extension of time to file until October 15 2021 if you are filing for a federal extension. You have right up until tax day to file for an extension. Filing an Extension in Ohio.

Learn more about filing an extension. 2018 BR-42 Application for Extension of Time. So if your return due date was March 15 2021 an extension will give you until September 15 2021.

If your business is not covered by the IRS tax filing extension related to the February 2021 winter storm you can still get a six-month extension of time to file your return. For submitting the corporate tax returns for income gained in 2020 the deadline is until April month 15 2021. Ohio does not have a separate Ohio extension form.

This serves as an incentive for people to still file sooner rather than later. Either form 1120 or form 7004 must be filed for requesting an extension of about six months. The deadline is also applicable for the first quarterly tax fee of the year.

If you file Form 8868 for your June 15 2021 deadline your new due date will be December 15 2021. We cant process extension requests filed electronically after May 17 2021. In order for an extension to be valid at least 80 of the tax liability must be on account on May 17 2021 through payments withholding and credits.

2021 IT-15J Employers Semi-Monthly. This extension applies to the entire state of Texas and other states that include declared winter storm disaster areas. The extra time for filing and paying taxes was a prudent step that kept money in taxpayers pockets and helped tax-collecting agencies process tax returns more safely during the quarantine.

When are 2021 tax extensions due. 2018 BR-25 Annual City Tax Return for Businesses. Information about Form 7004 Application for Automatic Extension of Time To File Certain Business Income Tax Information and Other Returns including recent updates related forms and instructions on how to file.

The extension also applies to. However business owners must pay any estimated taxes by the original deadline to avoid interest and penalties on overdue tax payments. To request an extension to file your federal taxes after May 17 2021 print and mail Form 4868 Application for Automatic Extension of Time To File US.

Its important to remember that nonprofits can only file one extension per year. 2021 IT-11J Employers Quarterly Return of Tax Withheld. The same goes for businesses.

The deadline for individual and business returns filing on extension has not changed and remains October 15 2021. Nonprofits can request an extension by filing Form 8868. S corps and partnerships can still get an extension on March 15 and the last day for C corps to file for an extension is April 15.

Irs And Many States Announce Tax Filing Extension For 2020 Returns

Irs Extends Filing And Payment Deadlines For Tax Year 2020 Tax Pro Center Intuit

Extension Filers Deadline Approaches Taxes Humor Tax Return Filer

Irs Extends Tax Return Due Date From April 15 To May 17

October Tax Deadline Nears For Extension Filers H R Block Newsroom

Tax Day 2021 Tax Filing Deadline H R Block

Irs Announced Federal Tax Filing And Payment Deadline Extension The Turbotax Blog

2021 Tax Deadlines And Extensions For Americans Abroad

Irs And Many States Announce Tax Filing Extension For 2020 Returns

Tick Tock Goes The Clock 19 More Days Until The Irs Tax Extension Deadline Is Here Call Providence For Help Not Much Ti Irs Taxes Tax Extension Tax Services

Irs And Indiana Dor Extend Tax Filing Deadline To May 17 2021 Whitinger Company

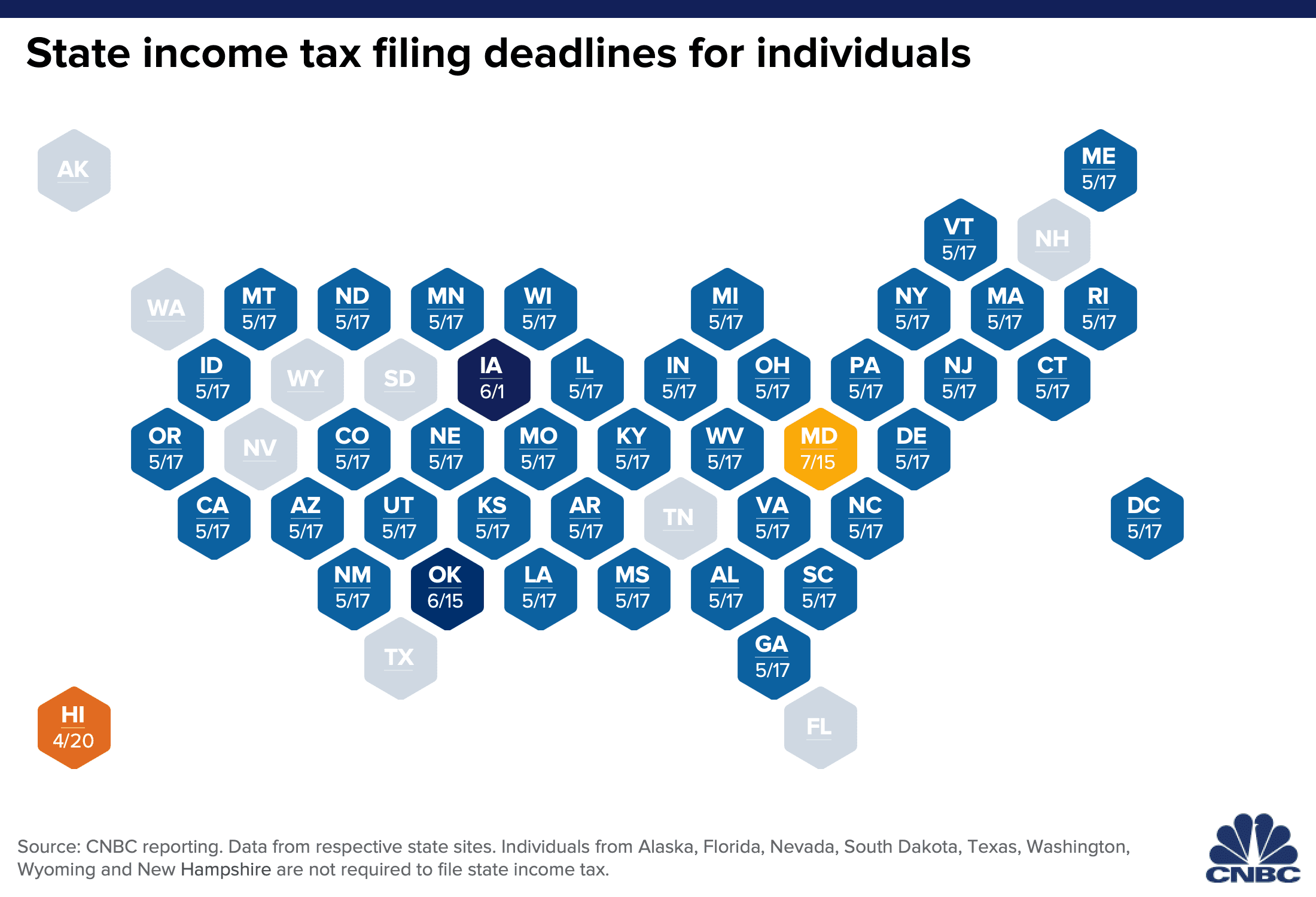

Irs Extended The Federal Tax Deadline When State Tax Returns Are Due

This Is Your Reminder Only 34 Days Until The Irs Tax Extension Deadline Is Here No Time To Procrastinate Call Us If You Tax Extension Irs Taxes Tax Services

Federal Tax Day For Individuals Shifts To May 15 Taxops

Irs Extends More 2021 Tax Deadlines But Estimated Payments Still Due April 15 2021 Cpa Practice Advisor

What Are The 2021 Tax Deadlines And Extensions For American Expats Tax Deadline Filing Taxes Expat

Irs Makes It Official Tax Deadline Delayed To May 17 2021 Cpa Practice Advisor

Will Ohio S Tax Filing Deadline Be Postponed To May 17 To Match The New Irs Deadline Cleveland Com

The 2021 Tax Filing Deadline Is Extended For Texas Oklahoma And Louisiana Residents Taxact Blog

Post a Comment for "Llc Tax Filing Deadline 2021 Extension"