Do I Have To Report K1 Loss

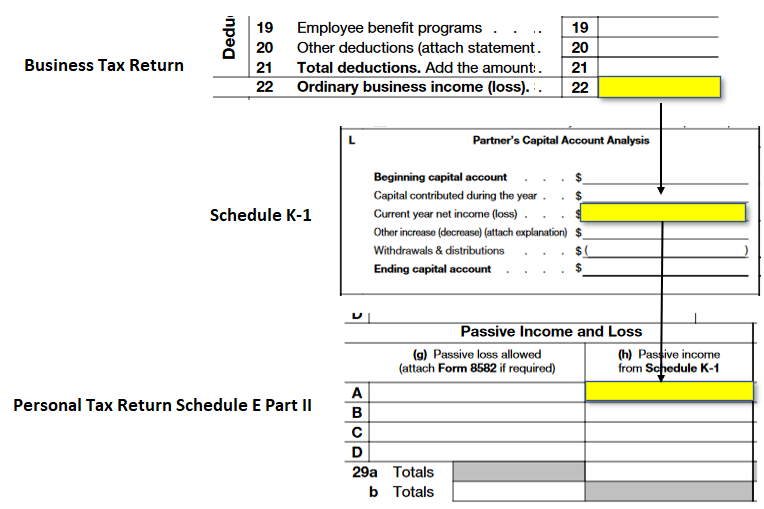

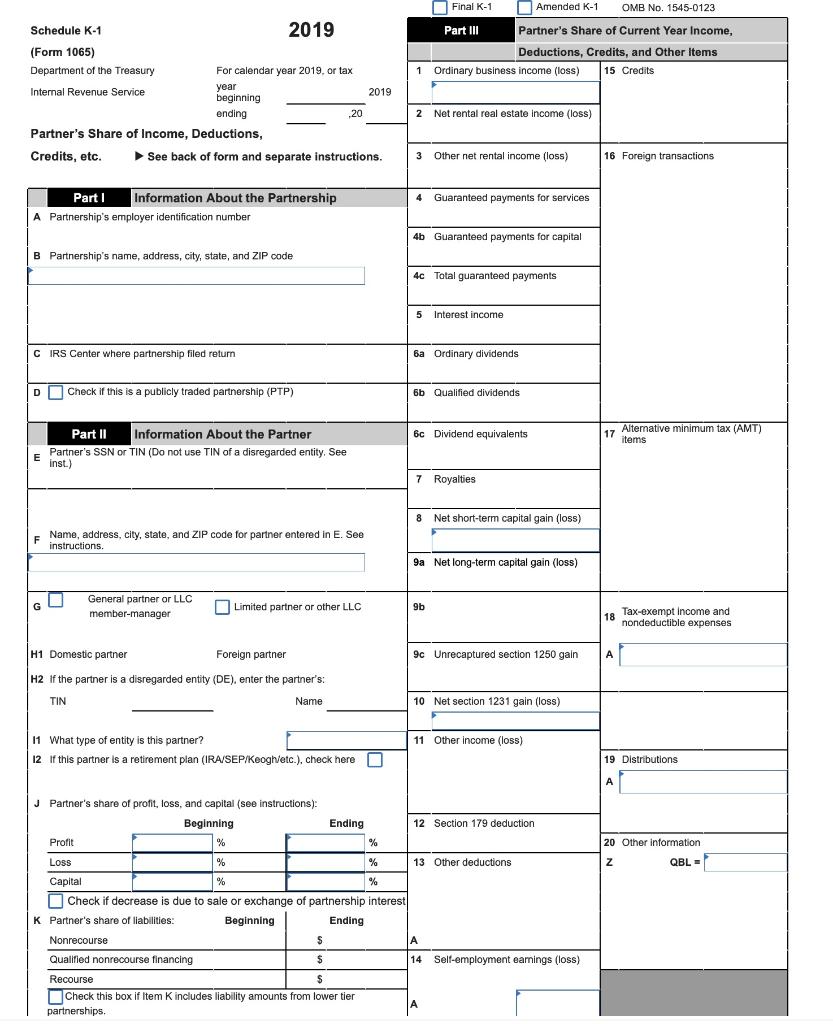

Youll fill out Schedule K-1 as part of your Partnership Tax Return Form. Schedule K -1 Box 1 Ordinary business income loss Income.

Understanding Your Schedule K 1 And Real Estate Taxes Crowdstreet

The sale of a PTP can be a rather complicated tax event.

Do i have to report k1 loss. My final K-1 shows ending capital account as zero but over the life of the partnership I have experienced significantly more loss than is reported on each years K-1 line 1 Ordinary business income loss. 199A deduction will make the already difficult job of reporting for an interest in a PTP moredifficult. Step 1 Report active income from box 1 on line 28 column J of Schedule E.

As long as the tax returns are done correctly and truthful they have nothing to adjust. When I report this under the TT dialog Describe Partnership Disposal and then report. When the shareholder or partner reports the gain they have to adjust any 179 expenses still being carried over because of the taxable income limitation.

You cannot use the loss in the future if you do not report it this year. Tax rules require tax-advantaged accounts like IRAs to pay income tax on what is called unrelated business income An IRA holds investments and partnership income may not be investment income resulting in UBI from your. The addition of the Sec.

3 As to the IRS you dont have to worry. The information about the disposition is instead reported separately on each K-1 so the partners and shareholders can report the gain on their return. Even if you dont take the flow through loss this loss reduces your basis in the company the same.

With more than 1000 in UBI you need to contact your IRA custodian. Report any loss of active income in column H. Introduction to the Partnership K -1 Purpose - to report the flow through of the partners share of income deductions credits etc.

If the K-1s you received total to less than 1000 in UBI there is nothing you need to do. The first answer is accurate as the K-1 does not go with the return. Yes you should enter the K-1 on your tax return even if it shows a loss.

If however you meant the K-1s were not completed and the members want to file timely returns and there are only losses to report they have 2 options. There are many people with loss all the times. If your K-1 shows a net loss you report it on the appropriate tax schedule for example Schedule E for a partnership.

Use these instructions to help you report the items shown on Schedule K-1 on your tax return. They are suspended to be used when you have a passive profit or when you sell the units. Keep the K-1 amount for calculation of your shareholders basis.

Then you write in the loss on your Form 1040 and deduct it from. With this tax form the business can also track the participation of each partner in the business performance depending on how much capital was invested. The amount of loss and deduction you may claim on your tax return may be less than the amount reported on Schedule K-1.

Include your share on your tax return if a return is required. PTPs will be required to report the information necessary to calculate the deduction to investors on Schedule K-1. Active income also referred to as non-passive income by the IRS includes payments you received by actually participating in a business.

Yes the Schedule K-1 should be amended and yes you must enter in the K-1 and report the 1099-B using the basis and the loss info from the K-1. Dealing with the Partnership K -1 on the 1040 What you really need to know. Schedule K-1 is the tax form used by partners and shareholders to report to the Internal Revenue Service their income losses dividends or capital gains during the fiscal year.

It is a passive loss. One is to file an auto extension and complete their returns when K-1s. The instructions mean that you are not allowed to deduct this loss from your other income.

Schedule K-1 is a schedule of IRS Form 1065 that members of a business partnership use to report their share of a partnerships profits losses deductions and credits to the IRS. While the information on a schedule K-1 is fairly straightforward its important to make sure you are reporting it accurately to avoid costly mistakes.

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

3 Ways To Fill Out And File A Schedule K 1 Wikihow

3 0 101 Schedule K 1 Processing Internal Revenue Service

To Win At The Tax Game Know The Rules Published 2015 Irs Tax Forms Tax Forms Irs Taxes

What Is A Schedule K 1 Form Zipbooks

3 Ways To Fill Out And File A Schedule K 1 Wikihow

Solved Schedule K1 Francesca Schedule K1 Lance Chegg Com

A Small Business Guide To The Schedule K 1 Tax Form The Blueprint

3 0 101 Schedule K 1 Processing Internal Revenue Service

1065 Schedule K 1 Share Of Partnership Profits Or Losses Pdffiller Blog

Schedule K 1 Instructions How To Fill Out A K 1 And File It Ask Gusto

Irs 1065 Schedule K 1 2020 2021 Fill Out Tax Template Online Us Legal Forms

3 0 101 Schedule K 1 Processing Internal Revenue Service

3 Ways To Fill Out And File A Schedule K 1 Wikihow

How To Fill Out Schedule K 1 Irs Form 1065 Youtube

Schedule K 1 Tax Form Here S What You Need To Know Lendingtree

Schedule K 1 Tax Form What Is It And Who Needs To Know Tax Forms Income Tax Filing Taxes

Don T Miss The Deadline For Reporting Your Shareholding Income With Form 1120s Schedule K 1

Post a Comment for "Do I Have To Report K1 Loss"