Company Valuation Ebitda Multiple Method

Discounted cash flow analysis uses the inflation-adjusted future cash flows to project. Generally the multiple used is about four to six times EBITDA.

An Alternative Approach Of Testing A Business Valuation

So when youre considering what a company is worth this is how it works mathematically.

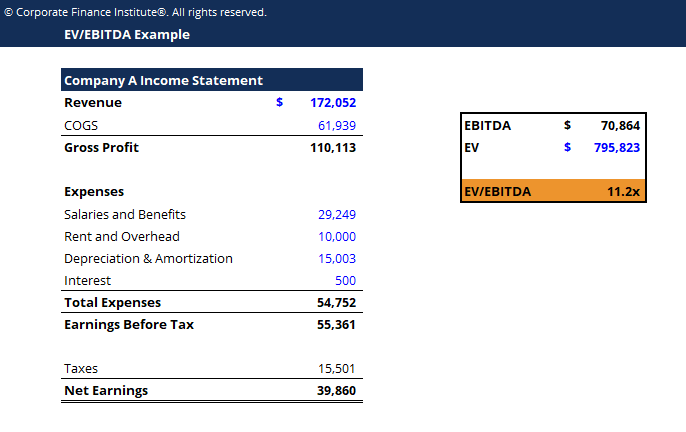

Company valuation ebitda multiple method. Capitalization of Earnings Method. EBITDA Multiple Enterprise Value EBITDA. Discounted Cash Flow.

EBITDA Exit Method Discounted Cash Flow DCF analysis is a generic method for of valuing a project company or asset. It differs from the method typically used by small businesses also referred to as Main Street Businesses in that it is not based on the Sellers Discretionary Earnings SDE. Enterprise Value market capitalization value of debt minority interest preferred shares cash and cash equivalents EBITDA Earnings Before Tax Interest Depreciation Amortization.

The capitalization of earnings method is a neat back-of-the-envelope method for. The asset valuation method ignores goodwill. 221 rows Multiples reflect the average price of a company when compared to a.

All that stuff eats into your profits but for this article thats just what EBITDA is. To Determine the Enterprise Value and EBITDA. With the earnings multiple method the multiple for an established business with sustainable profits might be 6.

In profit multiplier the value of the business is calculated by multiplying its profit. Discounted Cash Flow Analysis. Its EBITDA profits times the multiple estimated.

EBITDA Valuation is an industry multiple or ratio method that is used commonly to determine the Enterprise Value of a company operating in the lower-middle or middle market. What is the Formula for the EBITDA Multiple. Lets say you pay yourself a 300000 salary for.

With the earnings multiple method the multiple for a service-based business might be 05. Its typically through this addition process that you arrive at your companys value as a multiple of EBITDA. A DCF forecasts cash flows and discounts them using a cost of capital to estimate their value today present value.

221 rows In order to achieve this youll need to know your exit multiple. However prospective buyers and investors will push for a lower valuation for instance by using an average of the companys EBITDA over the past few years as a base number. Business Valuation Methods 1.

For example if your companys adjusted net profit is 100000 per year and you use a multiple like 4 then the value of the business will be calculated as 4 x 100000 400000.

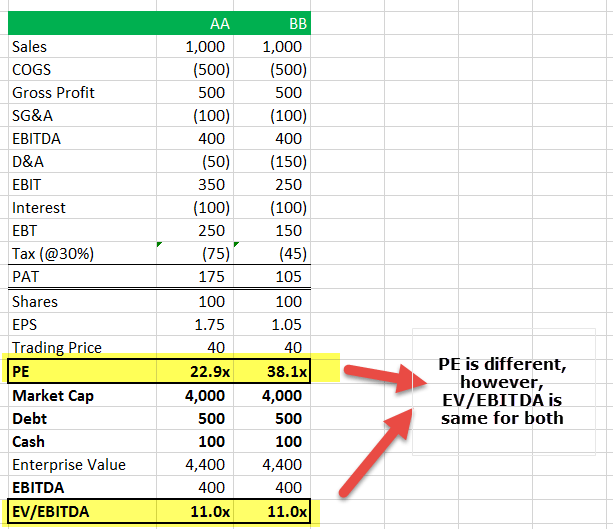

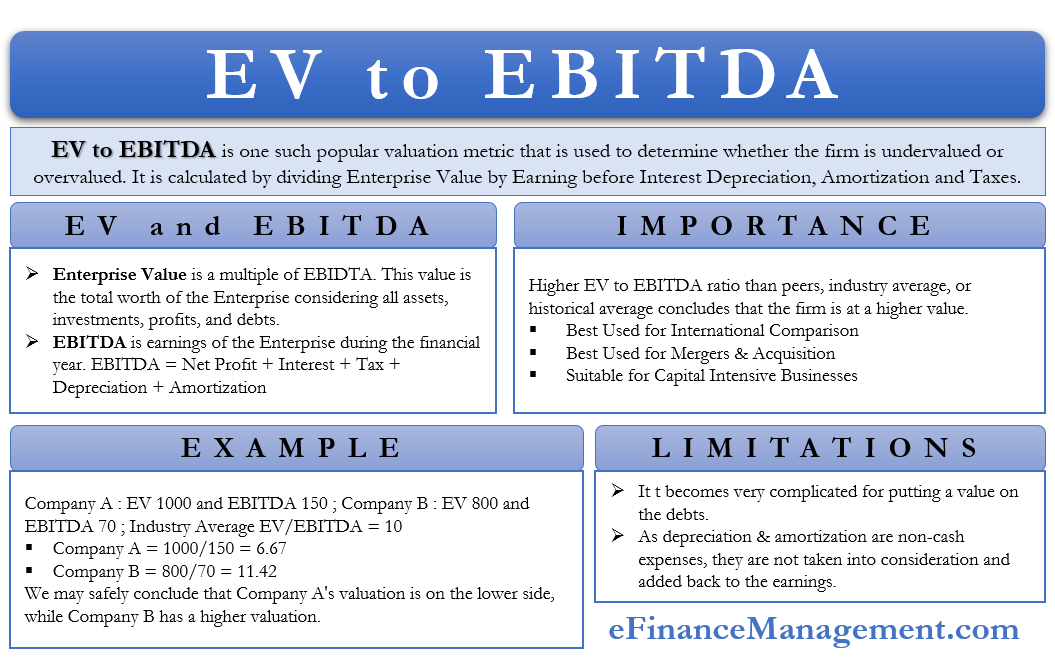

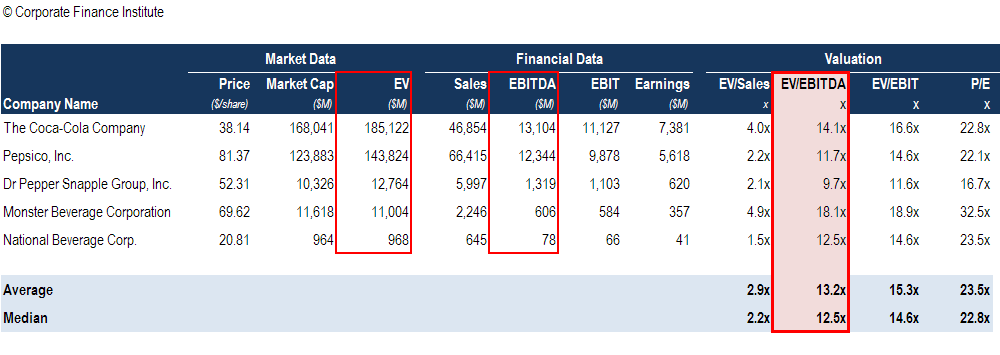

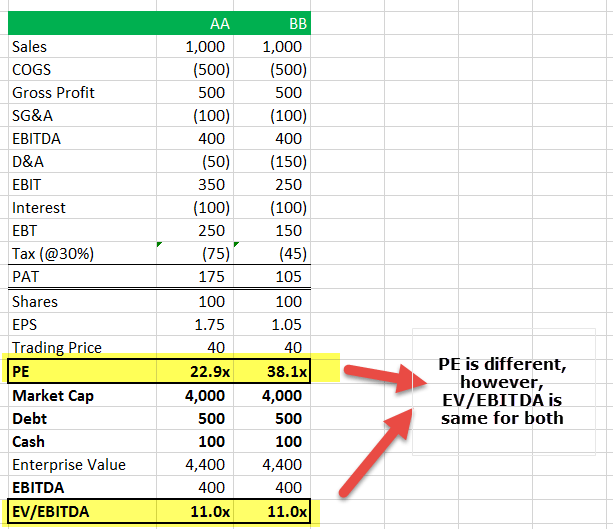

Ev To Ebitda Definition Formula Interpretation Better Than Pe Example

What S The Value Of My Business The Ins And Outs Of Ebitda Multiples Cronkhite Capital

Ev To Revenue Multiple Learn How To Calculate Ev Revenue Ratio

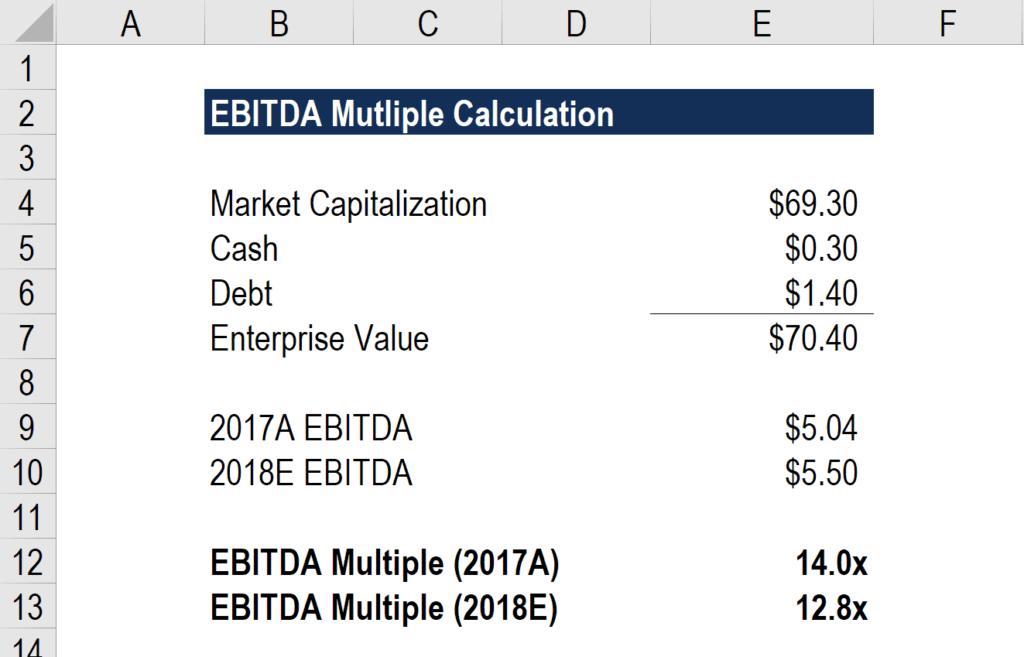

Ebitda Multiple Formula Calculator And Use In Valuation

What S The Value Of My Business The Ins And Outs Of Ebitda Multiples Cronkhite Capital

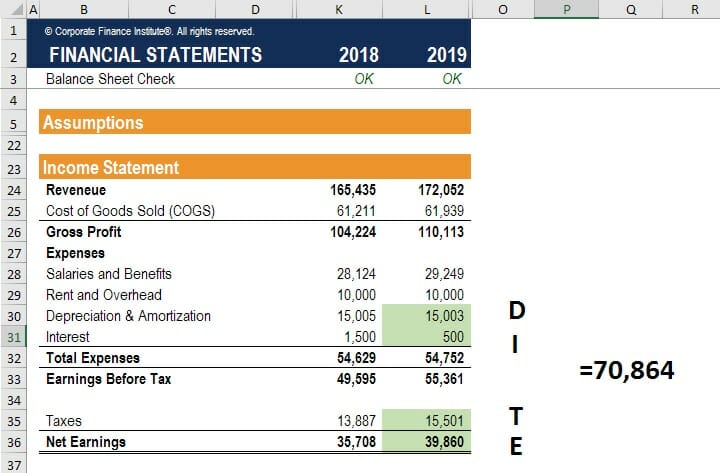

Ev Ebitda Guide Examples Of How To Calculate Ev Ebitda

Ev To Ebitda How To Calculate Ev Ebitda Valuation Multiple

Ev To Ebitda How To Calculate Ev Ebitda Valuation Multiple

Multiples The Market Approach To Valuation Chinook Capital

Ebitda Multiple Formula Calculator And Use In Valuation

Ev Ebitda Guide Examples Of How To Calculate Ev Ebitda

Introduction To Enterprise Value Ev Of The Business Magnimetrics

Ebitda Multiple For Business Valuation Magnimetrics

How To Calculate Terminal Value In A Dcf Analysis

Ebitda Multiple Formula Calculator And Use In Valuation

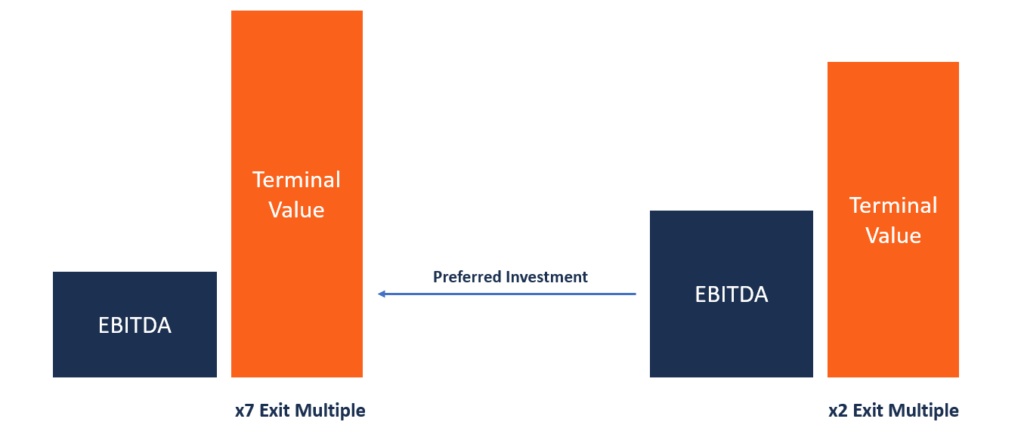

Exit Multiple Overview Terminal Value Perpetual Growth Method

An Alternative Approach Of Testing A Business Valuation

How To Calculate Terminal Value In A Dcf Analysis

Using The Ev Ebitda Multiple Smartly

Post a Comment for "Company Valuation Ebitda Multiple Method"