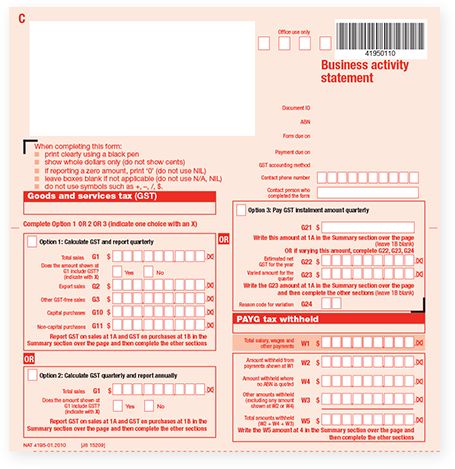

Business Activity Statement Quarters

Your Business Activity Statement is usually issued by the Australian Taxation Office either on a monthly or quarterly basis. - Quarter 3 January-March is due on 28 April.

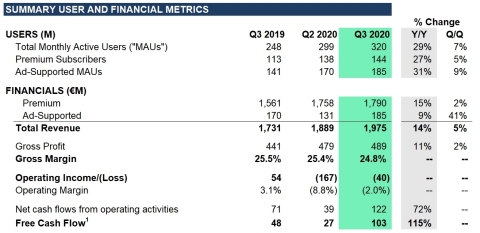

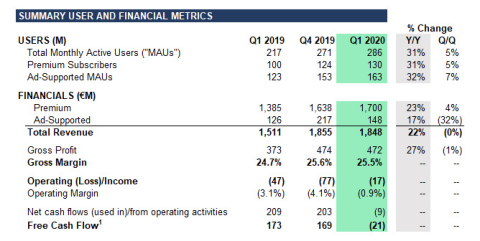

Spotify Spotify Technology S A Announces Financial Results For Third Quarter 2020

Instalment Activity Statement IAS The IAS is the simpler of the two forms and is only issued quarterly.

Business activity statement quarters. This statement is issued monthly or quarterly for reporting on Goods and Services Tax GST Pay As You Go PAYG installments. Goods and services tax GST pay as you go PAYG instalments. - Quarter 2 October-December is due on 28 February.

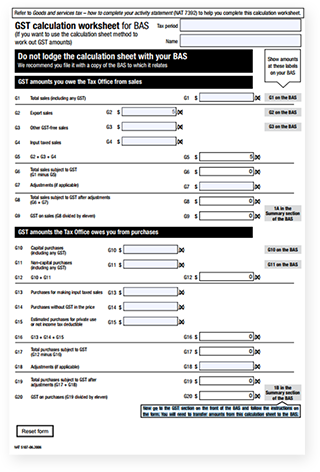

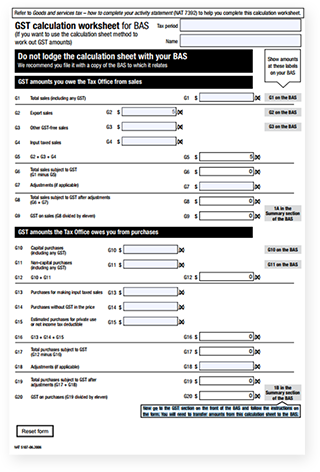

Goods and Services Tax GST amounts that you owe the ATO from sales. You have several options for lodging your business activity statements BAS and reporting your goods and services tax GST pay as you go PAYG instalments PAYG withholding tax and other taxes to us. If you own a business in Australia you must report and pay your business taxes to the Australian Taxation Office ATO using a Business Activity Statement BAS.

On the IAS the ATO tells you what your GST instalment amount is and where applicable what your PAYG instalment amount is. You may also report monthly if your business income tax year does not end on 30 June. How you complete your BAS depends generally on your business registrations and whether you lodge your statement monthly or quarterly.

- Quarter 4 April-June is due on 28 July. Quarter 4 AprilJune - due 28 July. Quarterly You can report every quarter if your business GST turnover is less than 20 million and the ATO has not required monthly reporting.

Quarterly activity statements are due on the 28th day of the month following the reporting period except for quarter two which is due on 28 February of the following calendar year. 1 Oct 31 Dec. A Business Activity Statement BAS summarises the tax that your business has paid.

Business activity statements BAS If you are a business registered for GST you need to lodge a business activity statement BAS. As a general rule of thumb business owners are expected to lodge their monthly BAS form to the ATO and make payment no later. Quarter 2 OctoberDecember due 28 February.

1 Jul 30 Sep. If your business reports GST and PAYG withholding monthly you will receive a monthly activity statement at the end of each month. 1 Jan 31 Mar.

Monthly PAYGW but quarterly GST the Activity Statement displays PAYG withheld only for the first and second month of the quarter. Lodgment program due dates for lodgment and payment are only available if you or your client have elected to receive and lodge the activity statement online and the activity statement meets the eligibility criteria. There is no need to print any reports from your MYOB software or make any calculations.

You may also report quarterly if your business. The Activity Statement that Xero generates is based on your GST and PAYG withholding reporting frequency. One of the most common things that you will encounter in the business sector is BAS also known as a Business Activity Statement.

If your turnover is less than 10 million you may be able to lodge annually but youre still required to pay a quarterly instalment of the GST you owe. All other Quarter activity statements. Your BAS will help you report and pay your.

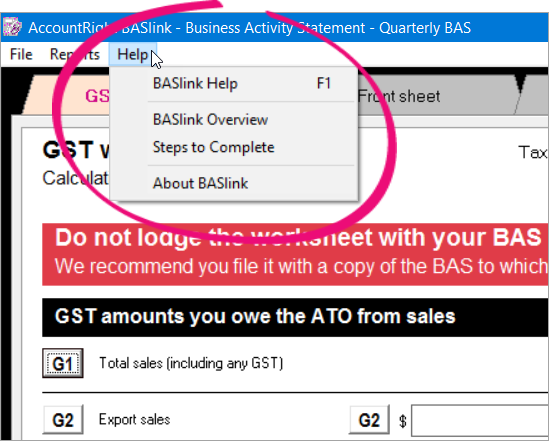

Quarter 3 January-March due 28 April Key lodgment and payment dates for business Activity statements. When you register for an Australian business number ABN and GST we will. The Business activity statement BAS feature is designed to help you fill in your BAS.

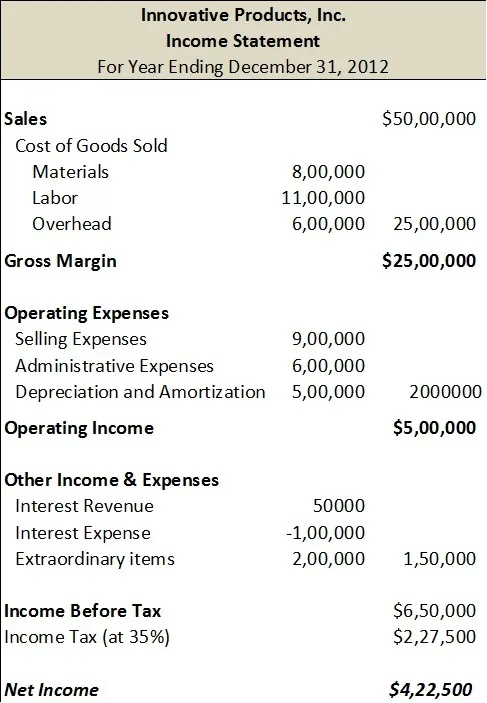

The statement resembles the calculation worksheet that the ATO provides when you receive the BAS form in the mail. While your clients balance sheet is a snapshot view of what its company is like at a certain date a statement of activities summarizes what happened during a month quarter or full year. A companys statement of activities is a record of transactions that happened over a period of time.

Lodge your BAS to the ATO at regularly intervals either monthly quarterly or annually. If your business is operating in Australia youre responsible for submitting Business Activity Statements BAS to the ATO - even if you did no business during the reporting period. Quarter 1 JulySeptember due 28 October.

1 Apr 30 Jun. The BAS includes the following taxation liabilities. Dates for 202021 quarterly activity statement.

These statements are used to report on and pay several different types of taxes including the Goods and Services Tax GST youve collected Pay as You Go PAYG instalments or withholding Fuel Tax. How to lodge your BAS.

What Is Form 941 And How Do I File It Ask Gusto

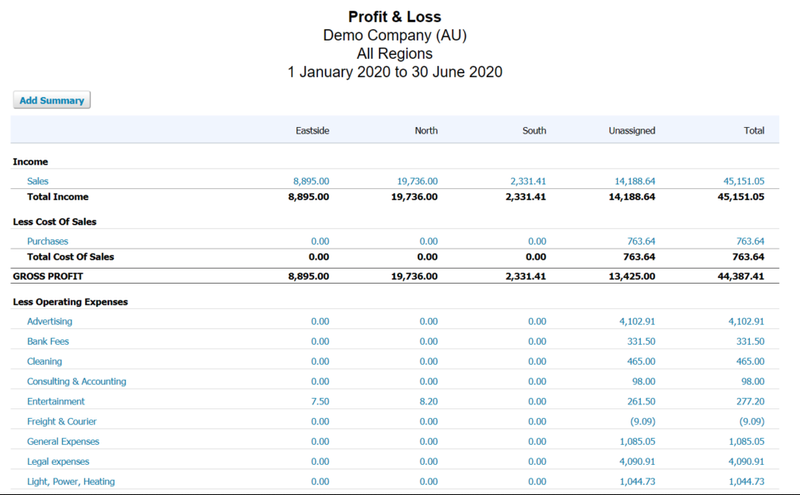

What Is An Income Statement Financial Reports For Small Businesses

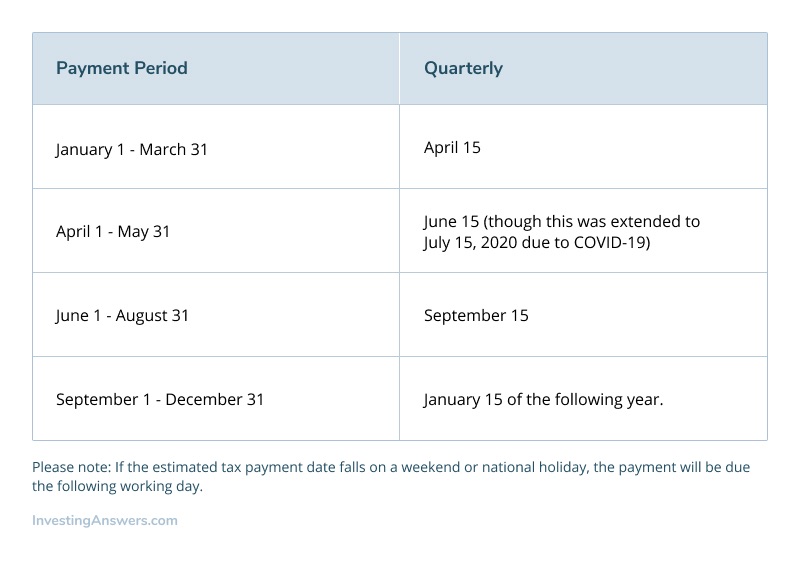

Fiscal Quarters Q1 Q2 Q3 Q4 Investinganswers

Quarterly Business Review Powerpoint Presentation Slides Quarterly Business Review Presentation Qbr Ppt Quarterly Business Report Ppt Presentation

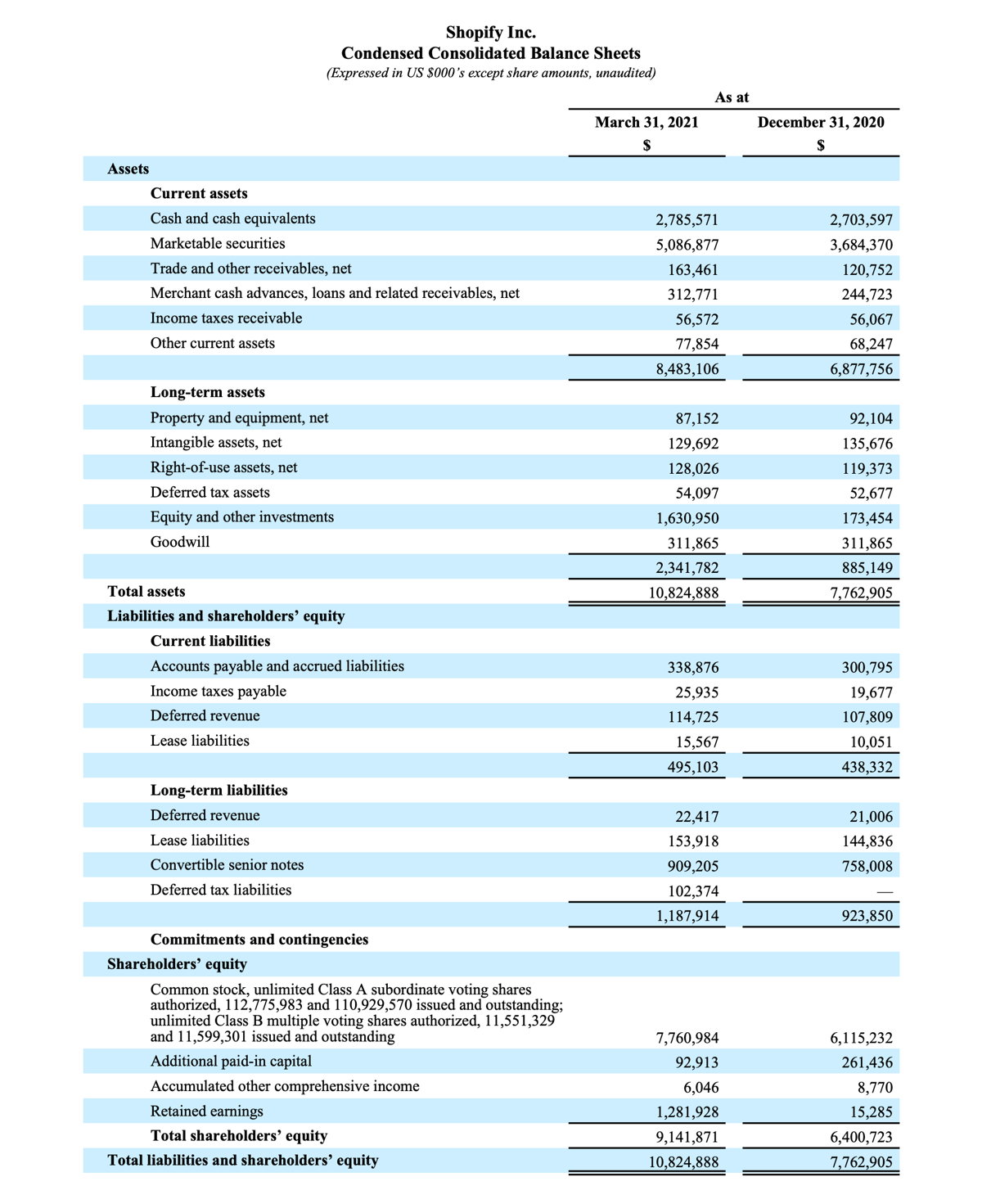

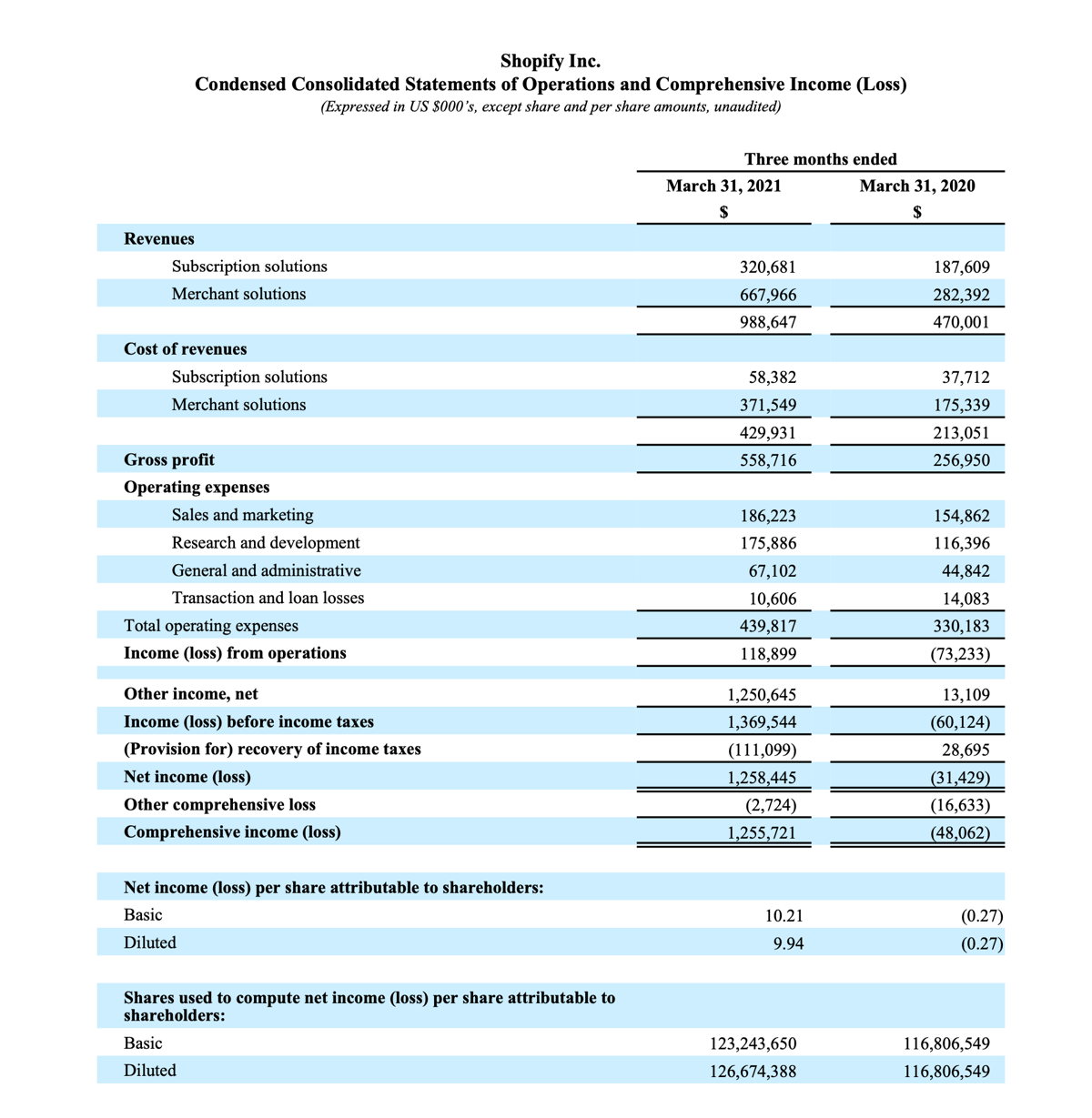

Shopify Announces First Quarter 2021 Financial Results

Prepare Your Activity Statement Manually Myob Accountright Myob Help Centre

Shopify Announces First Quarter 2021 Financial Results

What Is A Bas Statement Small Business Resources Reckon Au

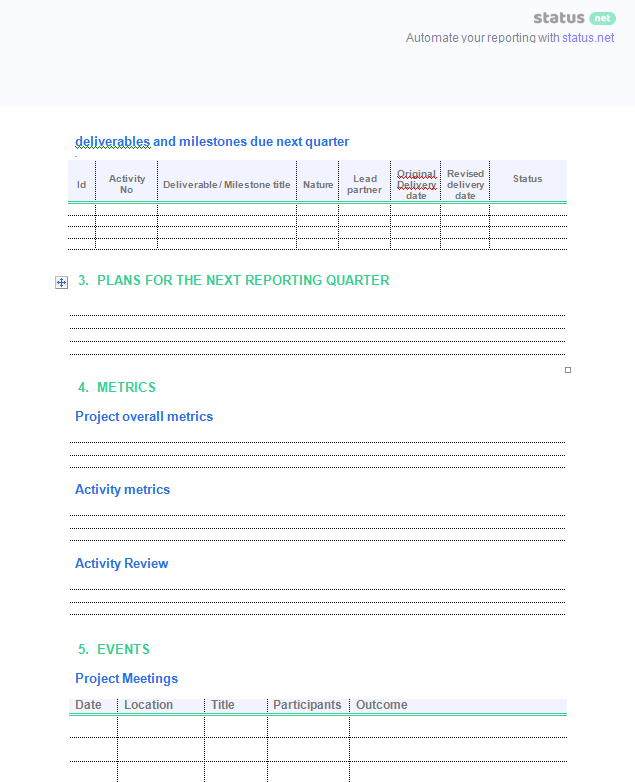

2 Easy Quarterly Progress Report Templates Free Download

What Is A Bas Statement Small Business Resources Reckon Au

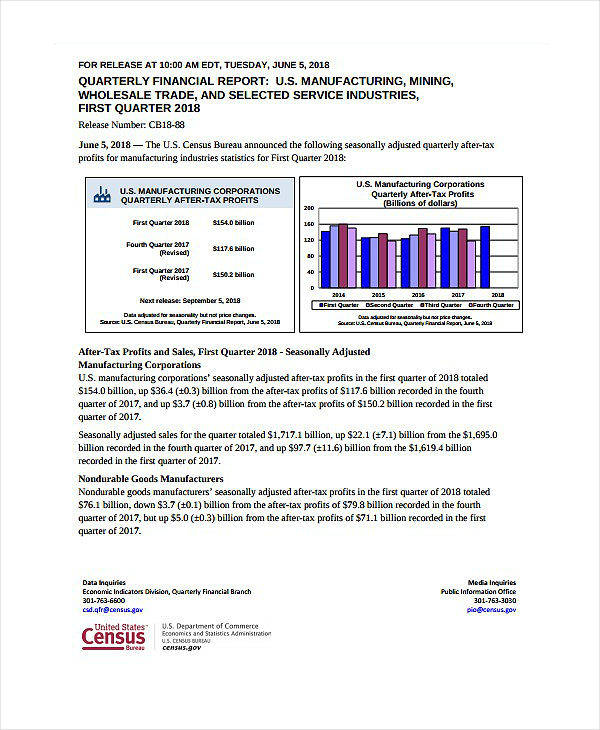

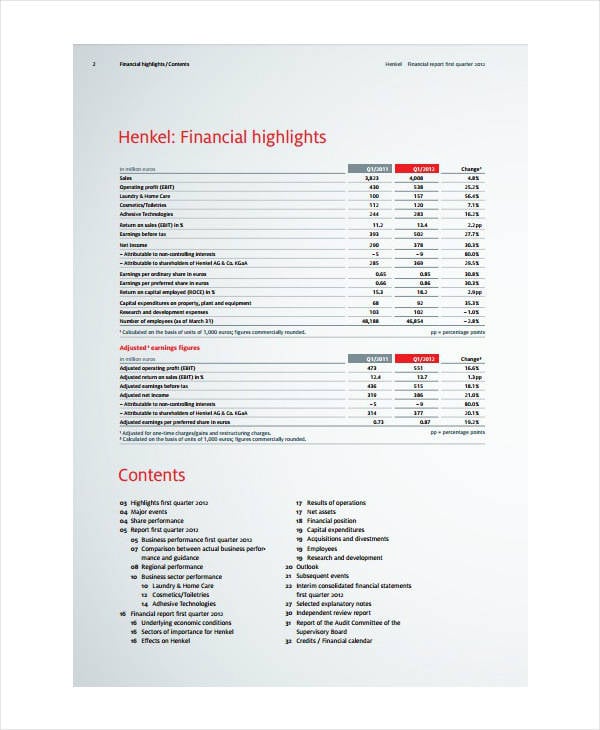

7 Quarterly Financial Report Templates Pdf Docs Word Free Premium Templates

How To Create A Profit And Loss Statement Step By Step The Blueprint

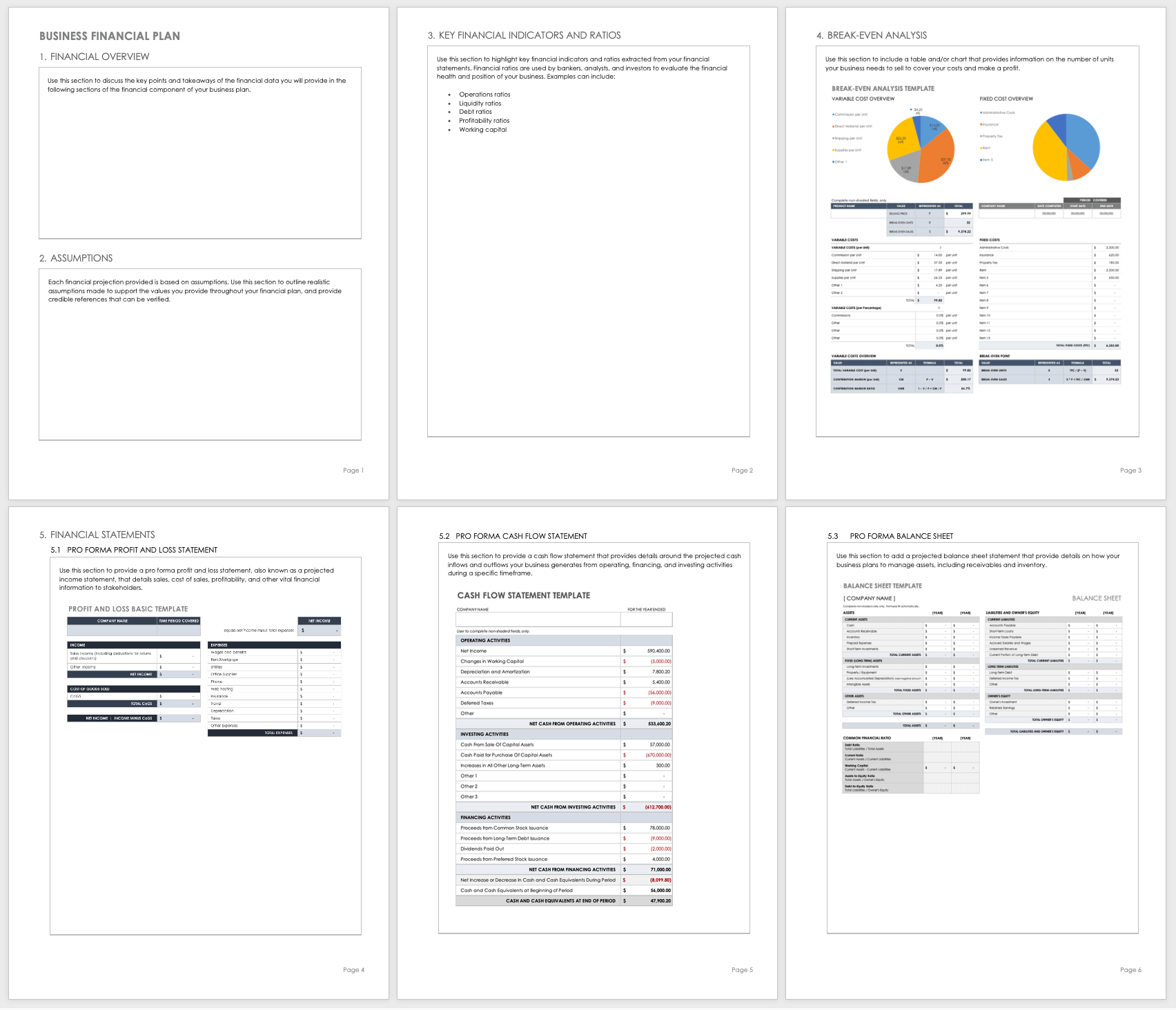

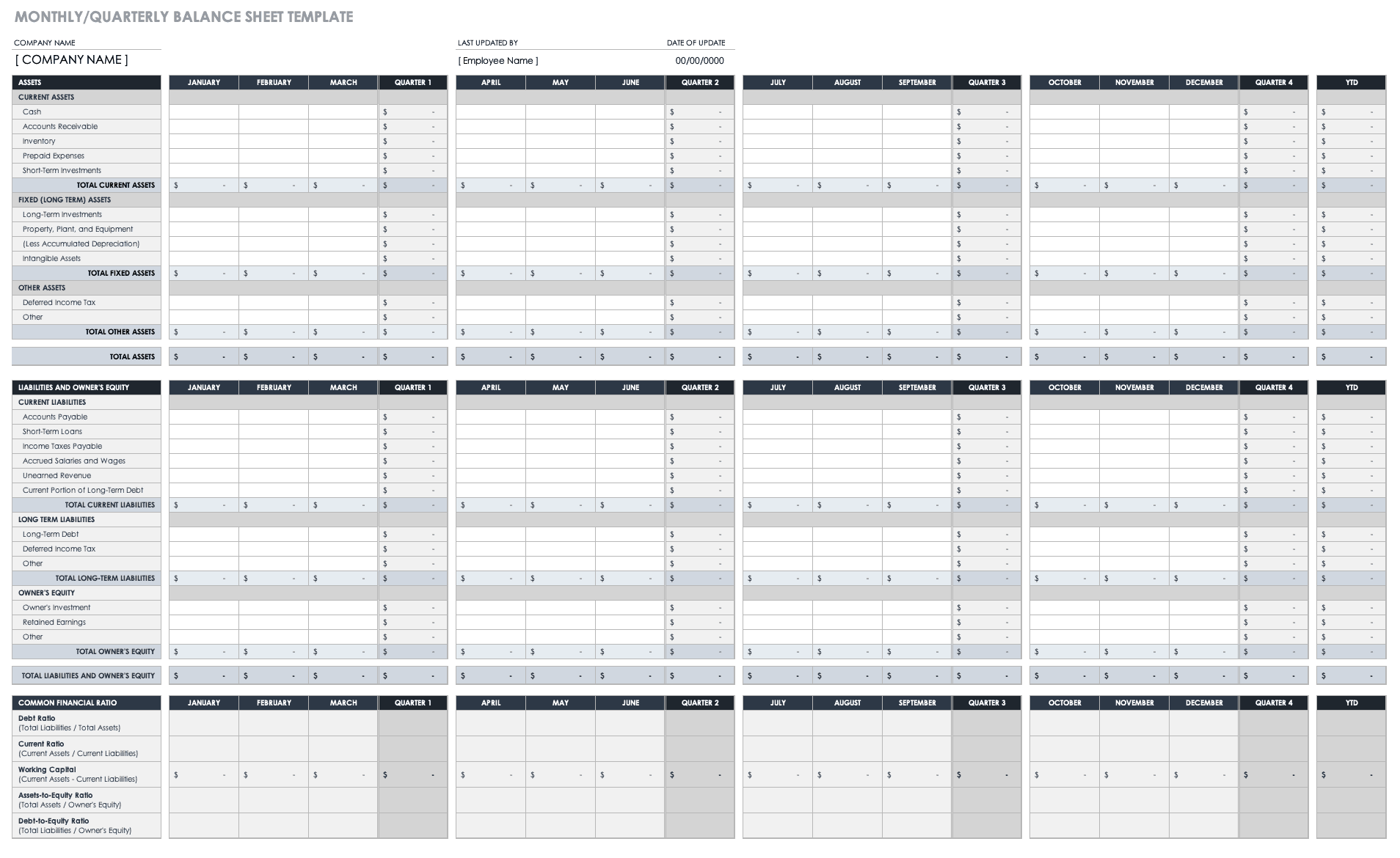

Business Plan Financial Templates Smartsheet

Spotify Spotify Technology S A Announces Financial Results For First Quarter 2020

7 Quarterly Financial Report Templates Pdf Docs Word Free Premium Templates

Business Plan Financial Templates Smartsheet

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

:max_bytes(150000):strip_icc()/GettyImages-172202514-d0ed8243906e47208b08a376e0bcbdc7.jpg)

Post a Comment for "Business Activity Statement Quarters"