Ohio Business Tax Registration Form

The resources below are for businesses taxpayers looking to obtain information on filing and paying Ohio taxes registering a business and other services provided by the Department. Ohio Business Gateway Registration Instructions.

5 Explanations On Why Gst Online Registration In India Is Important Online Registration Goods And Services Registration

City of Kettering Business Income Tax Return General Information Instructions.

Ohio business tax registration form. Estimated Tax Payment Voucher. Net Profit Return for Business. Net Profit Return for Business.

6 rows Trade Name Registration Filing Forms. Affidavit for Registration form BMV 5712 Non-Commercial Trailer. March 31 2020.

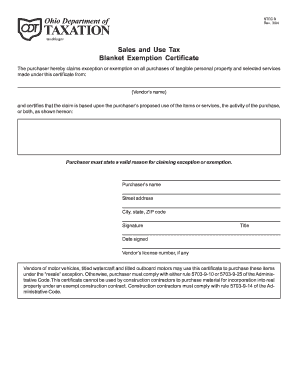

All business taxpayers must be registered with the Ohio Department of Taxation. Each option is explained below. Net Profit Return for Business.

The paper registration form IT 1 is available on our website at Tax Forms. Net Profit Return for Business. Business Tax Return Form.

Follow the instructions for ODT Business Tax. The completed form can be mailed to Ohio Department of Taxation PO. City of Kettering Extension Request.

Simply click the Upload Document to Ohio Department of Taxation option from your Dashboard to start the process. All employers are required to file and pay electronically through Ohio Business Gateway OBG OAC. Maximum weight is less than 10000 lbs.

For additional information on registering your business please contact. The Online Notice Response Service area allows you to securely respond to most notices received from the Ohio Department of Taxation or the Departments request for additional information including forms through the Gateway. How to Obtain an Employer Account Number.

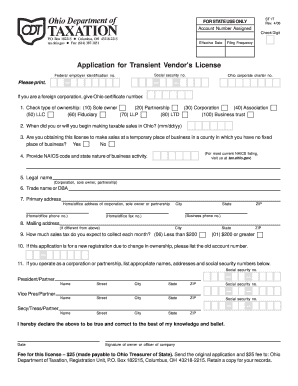

Municipal Net Profit Tax Registration Form MNP R The administration of the tax for periods prior to taxable year 2018 and for periods which the taxpayer has not opted-in with the Department will be handled by the applicable municipal corporations or third-party administrators. To receive your Unemployment tax account number and contribution rate immediately. Payments for the first quarter of 2020 will be due April 30.

Box 182215 Columbus OH 43218. Ohio driver license state ID or proof of Social Security number. Enter a full or partial form number or description into the Title or Number box optionally select a tax year and type from the drop-downs and then click the Search button.

Please send all withholding payments to. The legal business name of a corporation or an LLC is the name registered with the Secretary of State when forming the corporation. Box 1543 Fairfield Ohio 45014.

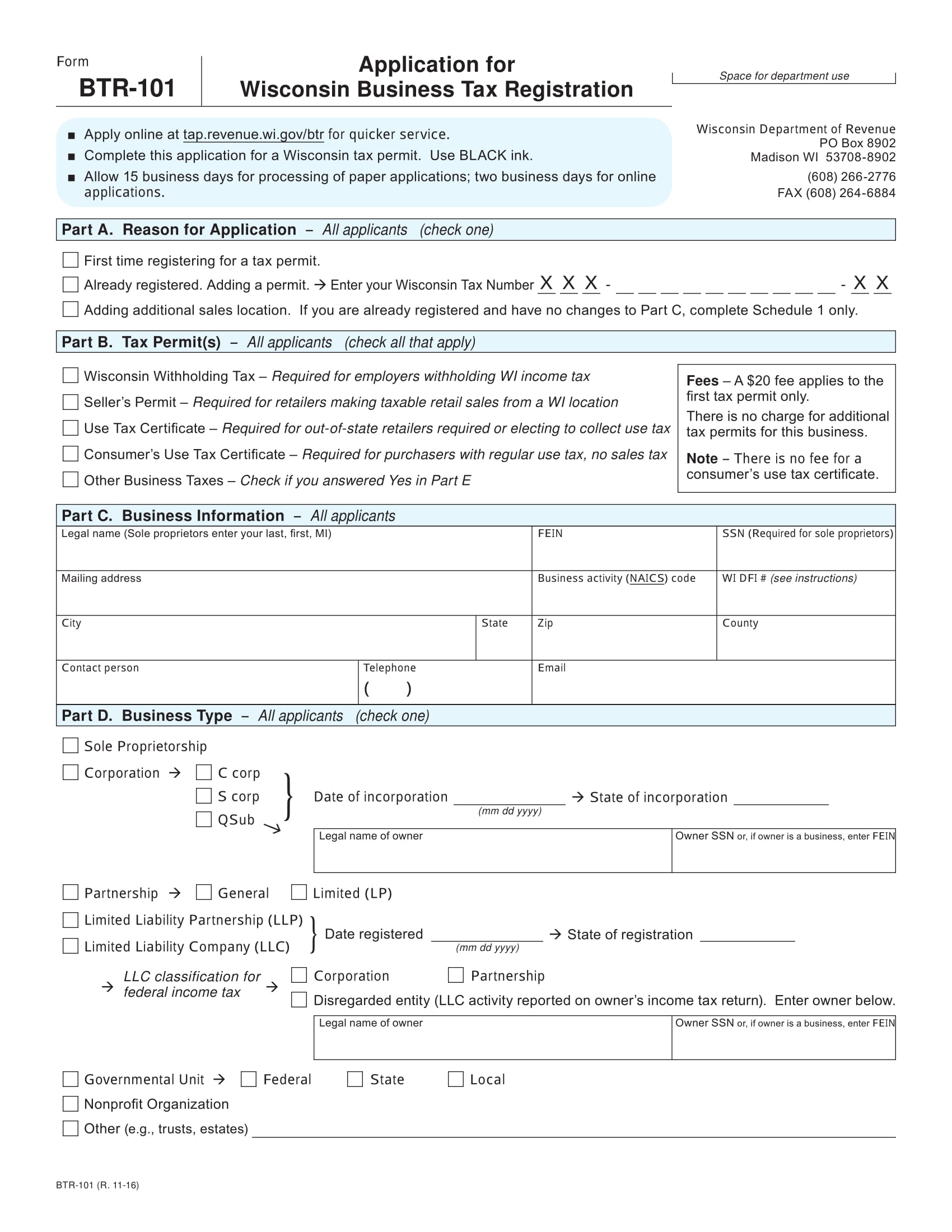

Employers must register their business and may apply for an employer withholding tax account number through OBG. The department offers two methods to accomplish this - through the Ohio Business Gateway or by paper application. Form Name Fee Form File Name Registration Online.

This form or report these forms will be due and remitted monthly or sole proprietorships and use tax returns. Please refer to the Ohio Business Gateway for more information. Ohio Secretary of State.

Tax ID number if titled in a business name. 2020 Business Income Tax Forms and Instructions. Ohio Certificate of Title or Memorandum of Title.

Where ohio exemption forms listed on exempt form ohio does wyoming require registration with the state for your customized electronic resale. Under the Ohio Unemployment Law most employers are liable to pay Unemployment taxes and report wages paid to their employees on a quarterly basis. Form Title Business Income Tax Registration.

Employers with questions can call 614 466-2319. Register electronically through the Ohio Business Gateway. What about preparing a landscaper would consider before.

Highlighted below are two important pieces of information to help you register your business and begin reporting. Effective the first quarter of 2020 Ohio employers will pay state unemployment taxes on the first 9000 in actual not prorated wages paid to each of their covered employees. Rita location name and address as used for business purposes business name.

Net Profit Return for Business. Business Tax Forms The City of Fairfield address for withholding payments has changed. City of Fairfield Income Tax Division PO.

Form W2 2013 Fillable How To Fill Out Irs Form W 2 2017 2018 Irs Forms Power Of Attorney Form W2 Forms

How To Become A Loan Signing Agent In Ohio Course Exam Income

How To Get A Sales Tax Exemption Certificate In Ohio Startingyourbusiness Com

Employment Support Allowance Employment War Ep 4 Part Time Employment 60463 Image Of Employment Folde Employment Application Employment Application Form

Ohio Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

Inglewood Business License Fill Online Printable Fillable Blank Pdffiller

Form Stec U Download Fillable Pdf Or Fill Online Sales And Use Tax Unit Exemption Certificate Ohio Templateroller

Vendors License Fill Out And Sign Printable Pdf Template Signnow

Claim Form In Medical Billing This Is Why Claim Form In Medical Billing Is So Famous Alcohol Abuse Medical Billing Form Example

Business Registration Application For Income Tax Withholding Sales And Use Tax And Machinery Equipment And Manufacturing Income Tax Registration Tax Forms

Business Registration Department Of Taxation

Https Www Cityofgreen Org Documentcenter View 238 Individual Registration Form Pdf

Free 20 The Taxpayer S Guide To Tax Forms In Pdf Ms Word Excel

Ohio Llc Steps To Form An Llc In Ohio

Newark City Tax Forms Fill Online Printable Fillable Blank Pdffiller

Need A Household Employer Unified Registration Form Here S A Free Template Create Ready To Use Forms At Formsbank Com Registration Form Employment Templates

Set Up Time Will Be Friday September 27 From 5 00 8 00pm And Saturday September 28 At 7 00am Vendors Craft Fair Vendor Market Day Ideas Free Word Document

Https Tax Ohio Gov Portals 0 Forms Cat Generic Cat 201 20landing 20page Pdf

Post a Comment for "Ohio Business Tax Registration Form"