Ohio Business Gateway Amended Return

Filing an Ohio Cigarette Tax Return Out-of-State CIG58 9402XXXX Using the Ohio Business Gateway August 2017 Version. By selecting Continue you will create a brand new account in the Ohio Business Gateway which only should be done if you have never accessed the Gateway in the past.

Https Tax Ohio Gov Portals 0 Forms Employer Withholding Generic Wt Ar Pdf

The TeleFile system will provide you with a confirmation number after we have accepted your filing.

Ohio business gateway amended return. The Ohio Business Gateway allows all sales and use tax returns. There are no restrictions. Based on your feedback last summer this was the most requested feature to be implemented in future upgrades to the Gateway.

The Ohio Business Gateway OBG offers electronic registration and filing tools for the Severance Tax CAT sales tax employer withholding unemployment. By selecting Continue you will create a brand new account in the Ohio Business Gateway which only should be done if you have never accessed the Gateway in the past. To amend the IT 1040 or SD 100 you should file a new return reflecting all the proposed changes.

File an amended return. Register for a vendors license. File Unemployment Compensation Tax.

I have examined the information herein provided electronically in connection with the use of the Ohio Business Gateway to file the taxpayers municipal income tax return. Generally amended returns must be filed within three 3 years from the original filing date. Starting June 30th 2019 you can save edit or delete your ACH or Credit Card information once with your account and it is readily available every time you checkout.

Learn more about the Gateway. Annual taxpayers will be required to file electronically as well beginning January 1 2014. I Table of Contents.

Quarterly taxpayers will be required to file an amended return via the Ohio Business Gateway businessohiogov. The Ohio Business Gateway is a nationally-recognized collaborative initiative of state and local government agencies and an important part of Ohios digital government strategy. Beginning with the severance tax return SV 3 for January 1 2014 - March 31 2014 first quarter of 2014 which is due May 15 2014 severance taxpayers are required to file electronically via the Ohio Business Gateway at wwwbusinessohiogov.

Addresscontact filing frequency corporate structure and cancel account updates. Then select the Upload button. To indicate that its an amended return.

File an amended return. If you have overwithheld for your employees for years prior to the current year each employee should request a refund using Form 10A - Application For Municipal Income Tax Refund. Alternatively annual filers may file an amended return via.

To make changes to Net Profits returns after filing I agree to file an amended report or follow other instructions from the agency or municipality. Obtain a vendors license or use tax account. CAT Returns Semi-Annual Annual Minimum Fee Annual and Quarterly Payment only return already filed CAT Assessment Payments.

Cancel a vendors license. You will need to file an amended return. If you have used the previous Gateway shown below but this is your first time visiting the modernized Gateway click the Cancel button and enter the username and password you have always used to access the Gateway.

Additionally you must indicate that it is an amended return by checking the box at the top of page 1. What should I keep in my records to verify my filing andor payment. If you want to do the math on your own paper return then complete sign OH Form IT-1040 - Print Mail the Form to this address if you are including a tax payment.

Taxpayers need to provide their TIN number which is found on their registration confirmation letter a previously-filed paper return or by calling the departments Taxpayer Services at 888 405-4039. The Ohio Business Gateway is excited to announce our latest feature. Visit the Ohio Business Gateway.

To file your amendment online please visit the Employer Resource Information Center ERIC. On step 2 use the Browse button to select the txt or csv file to be uploaded. If you have used the previous Gateway shown below but this is your first time visiting the modernized Gateway click the Cancel button and enter the username and password you have always used to access the Gateway.

Please enter the confirmation number in the appropriate box on your worksheet. To file by paper use a Request to Amend the Quarterly Tax Return JFS-20129 to correct wage items. Be sure to list your current mailing address on the amended return.

A form 11a must be filed for each period that is being amended. Register for file and pay Commercial Activity Tax. File and pay sales tax and use tax.

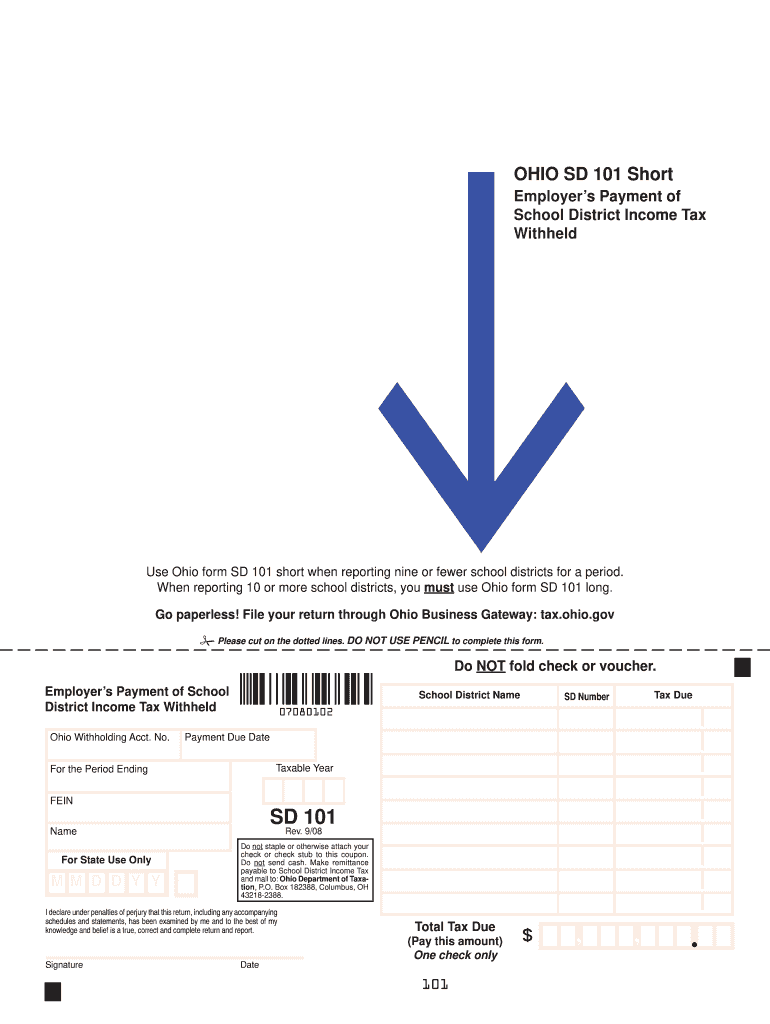

Cancel a vendors license. Gateway services offer Ohios businesses a time- and money-saving online filing and payment system that helps simplify business relationship with government agencies. After signing into OBG select the SD 101 transaction from your dashboard and proceed through step 1.

You must file an amended return through Ohio CAT TeleFile or the Ohio Business Gateway. Annual filers may file an amended return via the Ohio Business Gateway businessohiogov. Sign the amended return and mail it to one of the addresses listed below.

The SD 101 return should populate with the data from your file and any errors will be indicated. A separate Request to Amend the Quarterly Tax Return JFS. Ohio businesses can use the Ohio Business Gateway to access various services and submit transactions and payments with many state agencies such as.

How To File Sales Tax Department Of Taxation

How To File Sales Tax Department Of Taxation

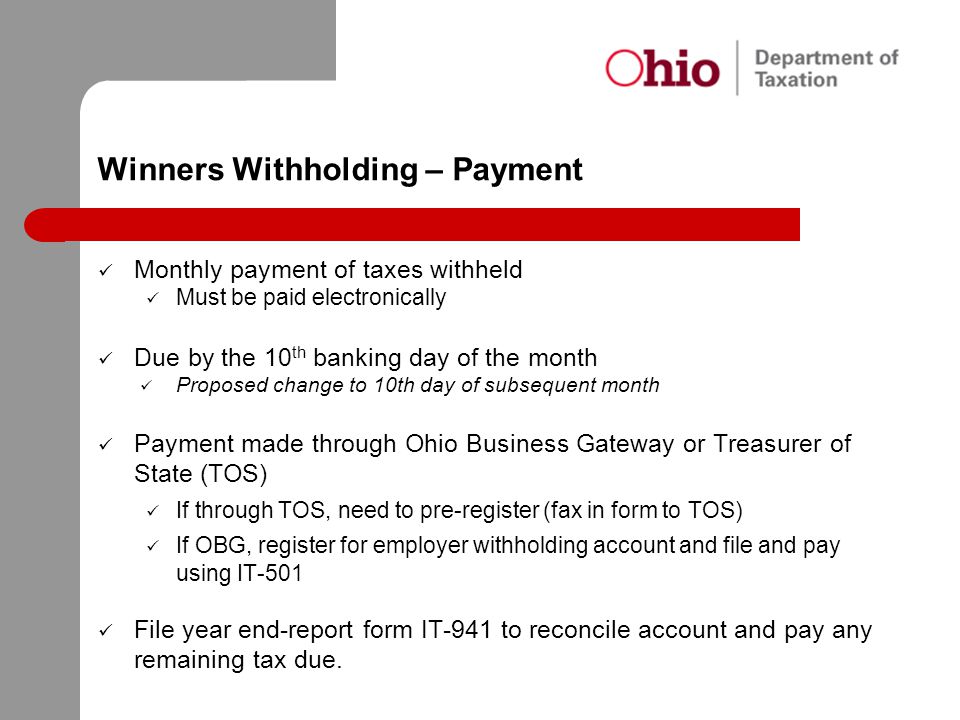

Ohio Department Of Taxation S Casino Training Ppt Download

News Opportunities Sbdc Small Business Development Center Akron Ohio Sbdc Small Business Development Center Akron Ohio

Ohio Department Of Taxation Posts Facebook

Https Tax Ohio Gov Static Excise Kwh Helpfiles Kwh 20sap 20filing 20instructions 202 1 16 Pdf

Https Cdn Ritaohio Com Media 700338 Lyndhurst Hb5 Tax Ord Pdf

Ohio Department Of Taxation S Casino Training Ppt Download

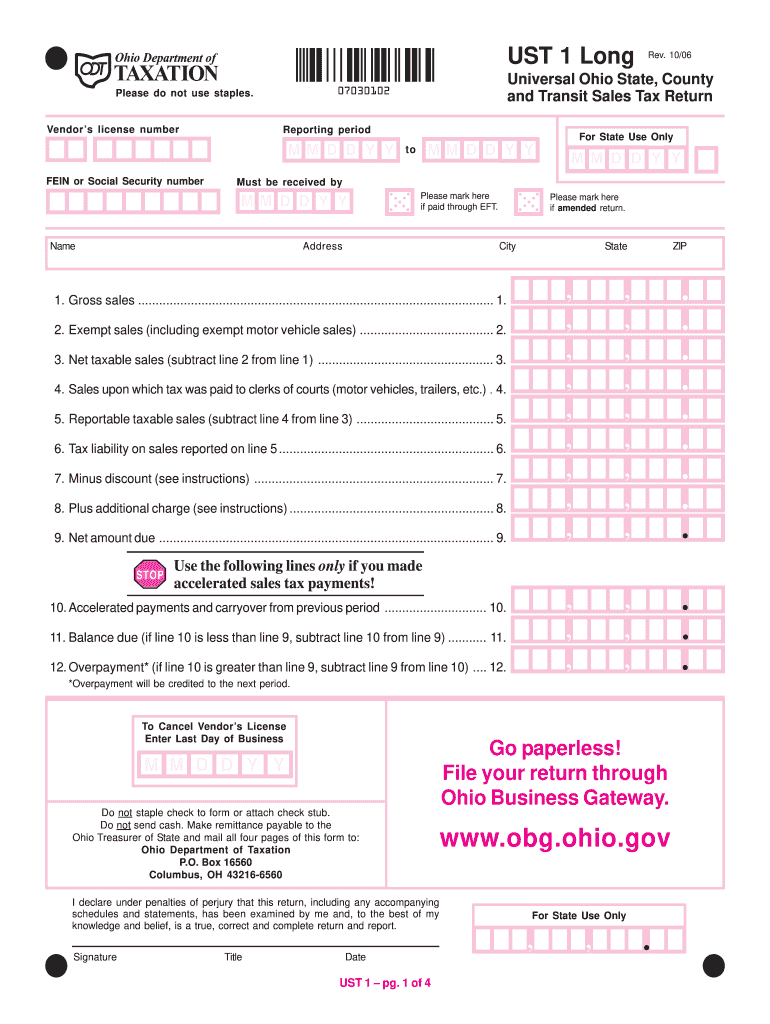

2006 2021 Form Oh Odt Ust 1 Long Fill Online Printable Fillable Blank Pdffiller

Incorporate In Ohio Do Business The Right Way

Ohio Department Of Taxation S Casino Training Ppt Download

Oh Sd 101 Short 2008 Fill Out Tax Template Online Us Legal Forms

Income Amended Returns Department Of Taxation

2012 Form Oh Ohif 1 Fill Online Printable Fillable Blank Pdffiller

Oh Sd 141 Long 2016 2021 Fill Out Tax Template Online Us Legal Forms

Ohio Department Of Taxation S Casino Training Ppt Download

Https Www Ci Miamisburg Oh Us Index Php Option Com Docman Task Doc Download Gid 539 Itemid 119

Post a Comment for "Ohio Business Gateway Amended Return"