How To Value Stock For Estate Tax Purposes

Instead to calculate the value of the stock on the date of death take the average of the highest selling price. When used to calculate capital gains on assets you own cost basis represents the original value of an asset for tax purposes with a few adjustments.

How To Deduct Stock Losses From Your Taxes Bankrate

For valuation of the estate for tax purposes which must take place on a specific date a declared dividend may not need to be included.

How to value stock for estate tax purposes. Fn 2 In order to assess what assets and liabilities make up the gross estate the estates executor will conduct an accounting that is inventory which is. To value a house you can make an estimate by searching for the price of similar properties online or getting estate agents to value it. 2704 a 1 the shares are valued for estate tax purposes as if the lapse had never existed.

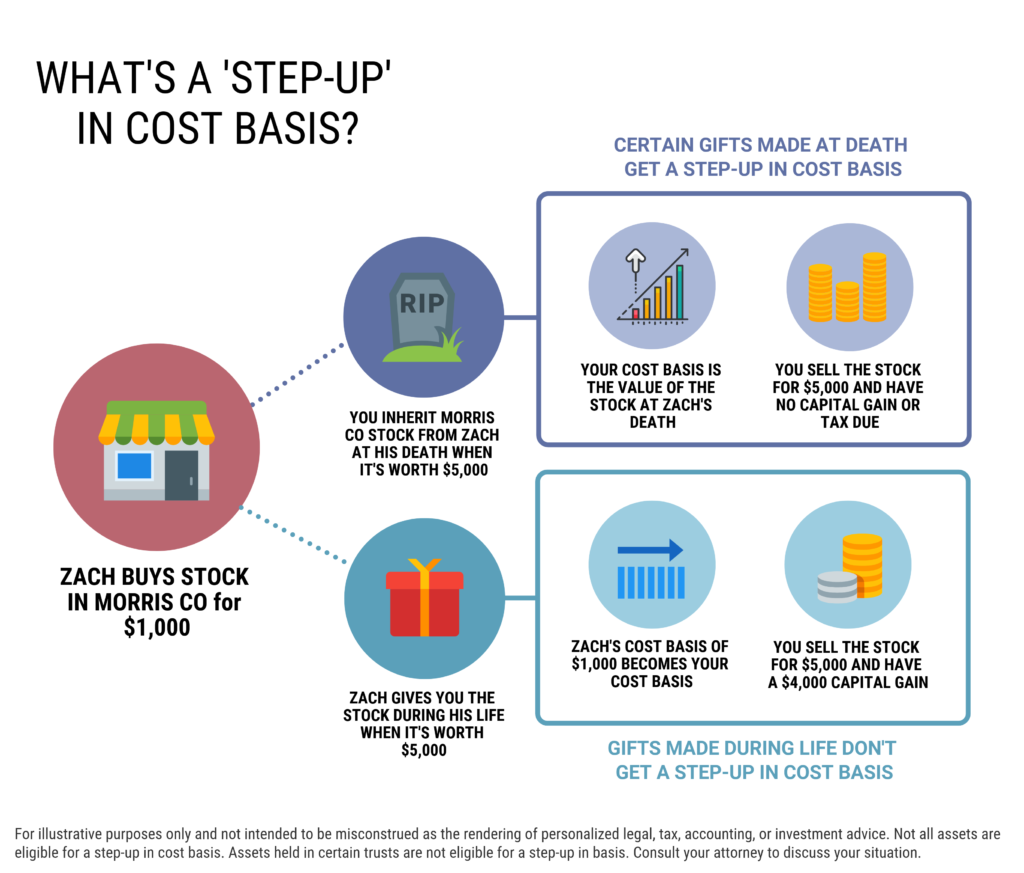

The date or dates on which the property. The value of stocks and bonds is the FMV of a share or bond on the valuation date. 4 With assets you inherit the cost basis is.

If there were no sales on the valuation date but there were sales on dates within a reasonable period both before and after the valuation date the fair market value is determined by taking a weighted average of the quoted closing selling prices on the nearest date before and the nearest date after the valuation. If the stock pays a dividend after your death the dividend is considered part of the estate when its paid. But the date of death valuation isnt just the closing price of the stock that day.

You can use the fair market value of the policy if you are calculating the value of. The estate tax is an excise tax paid by the decedents estate on the fair market value of the net assets in-cluded in the decedents estate on the date of death. Dollar amount from sale of stock or bond.

The value for such purposes is the date-of-death fair market value FMV or if an election is made under IRC section 2032 the FMV on the alternative valuation date six. Average of the high and low price of stock or bond on date of transfer. PAs who work with estates know that if a decedent owned stock of a closely held business at his or her death the value of the stock generally must be determined if an estate tax return will be filed.

1531 Chapala St 1 Santa Barbara CA 93101 818 313-6300 FAX. Ordinarily the date of. For estate tax purposes a resident is someone who had a domicile in the United States at the time of death.

Estate Valuations Pricing Systems has been the leading provider of high-quality security evaluations for estate- and gift-tax purposes for over 35 years. For gift and estate tax purposes the fair market value of property transferred to another party is measured on the date of the transfer as the price at which the property would change hands between a hypothetical willing buyer and a willing seller neither being under any compulsion to buy or to sell and both having reasonable knowledge of relevant facts the willing-buyer willing-seller test Treas. Generally the value of stock in an estate is set at its fair market value as of the date of the decedents death.

Taking Stock in Estates If you pass away any stock you own becomes part of the estate. Stock in a corporation carrying on a trade or business if 20 or more in value of the voting stock of the corporation is included in the gross estate of the decedent or the corporation had no more than 45 shareholders. But if the estates value is close to or over the inheritance tax threshold you may be better off getting a professional valuation from.

Thus if the lapse occurs during the life of the owner of an entity it is treated as a gift and if it occurs at the owners death it is treated as a transfer includible in the gross estate. IRS publication 561 says. Evaluate millions of stocks and bonds for estate- and gift-tax purposes with EVP Office EstateVal and.

In order to calculate the value of a policy for estate tax purposes use Internal Revenue Service Form 712 located on the IRSs website at httpwwwirsgovpubirs-pdff712pdf. Fair Market Value is the price the property would sell for on the open market. A property description the amount and terms of mortgages property surveys the assessed value the tax rate and the assessors appraised FMV.

A statement that the appraisal was prepared for income tax purposes. Fair market value is what a person would be able to sell the stock for if the seller did not have to sell and the buyer did not have to buy.

What Is A Step Up In Basis Cost Basis Of Inherited Assets

8 Tips If You Re Being Compensated With Incentive Stock Options Isos Myra Personal Finance For Immigrants

Simple Tips To Navigate During Stressful Times In The Stock Market Http Bonniegortler Com 5515 Simple T Stock Options Trading Stock Market Stock Market Crash

These 21 Sketches Make Complicated Financial Concepts Simple Enough To Fit On A Napkin Budgeting Finances Personal Finance Budget Personal Finance

Carrots Versus Sticks Payroll Taxes Federal Income Tax Estate Tax

Enterprise Value Forward Sales Enterprise Value Value Stocks Growth Company

Grat Gratification How One Business Owner Achieves Substantial Estate Tax Savings With A Grantor Retained Annuity Trust Estate Tax Achievement Business Owner

Popular Investment Strategies David Gene Neugart Investing Investing Strategy Property And Casualty

These 21 Sketches Make Complicated Financial Concepts Simple Enough To Fit On A Napkin Personal Finance Budget Finance Investing Finance

Cpa Exam Reg Estate Tax Cpa Exam Cpa Exam Reg Cpa

Taxes On Stocks How Do They Work Forbes Advisor

Tax Incentives Estate Tax Commercial Real Estate Tax Credits

Relationship Between The Stock Price And Its Determinants Stock Prices Corporate Tax Rate Investing

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

Obama Estate Tax Plan Die Once Get Taxed Twice Estate Tax Death Tax Capital Gains Tax

Non Qualified Stock Options Turbotax Tax Tips Videos Stock Options Turbotax Tips

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Post a Comment for "How To Value Stock For Estate Tax Purposes"