Can I Get A Ppp Loan If I Just Started My Business

When you call the number i will inbox please select the my card is lost or stolen option which is the number 1 on the keypad. Depending on when your business was established you may still qualify for a PPP loan.

Nov 13 Ppp Loan Forgiveness Underway Not As Chaotic As Application Period Covid 19 Fwbusiness Com

If youre a small business with employees and qualify for larger loans over 150000 you can definitely get your PPP loans back to back but it will be more complicated and possibly more difficult to use your first PPP loan appropriately before your second PPP funding comes through which is.

Can i get a ppp loan if i just started my business. Freelancers can get PPP loans. Businesses can now get a second PPP loan. I thought the money was gone.

Why is the Congress expanding the program. Please know the debit card can take up to 10 business days to get to you with 2 days added to create the card. For businesses that went out of business prior to that time period you arent eligible for this program.

Small business owners now have until August 8th to apply for PPP loans. However due to the nature of your new business you can calculate your loan amount based. As long as the business was in operation on February 15 2020 and meets other eligibility requirements the business is eligible for a PPP loan.

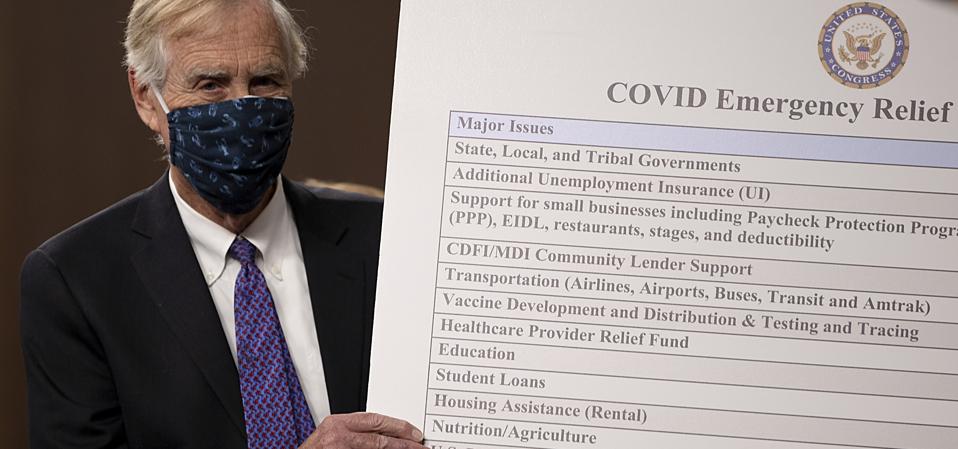

Here are six reasons the program changed in the last round. Theres a line in the sand on whats considered a small business for the purposes of the Paycheck Protection Program. You Can Still Get a PPP Loan.

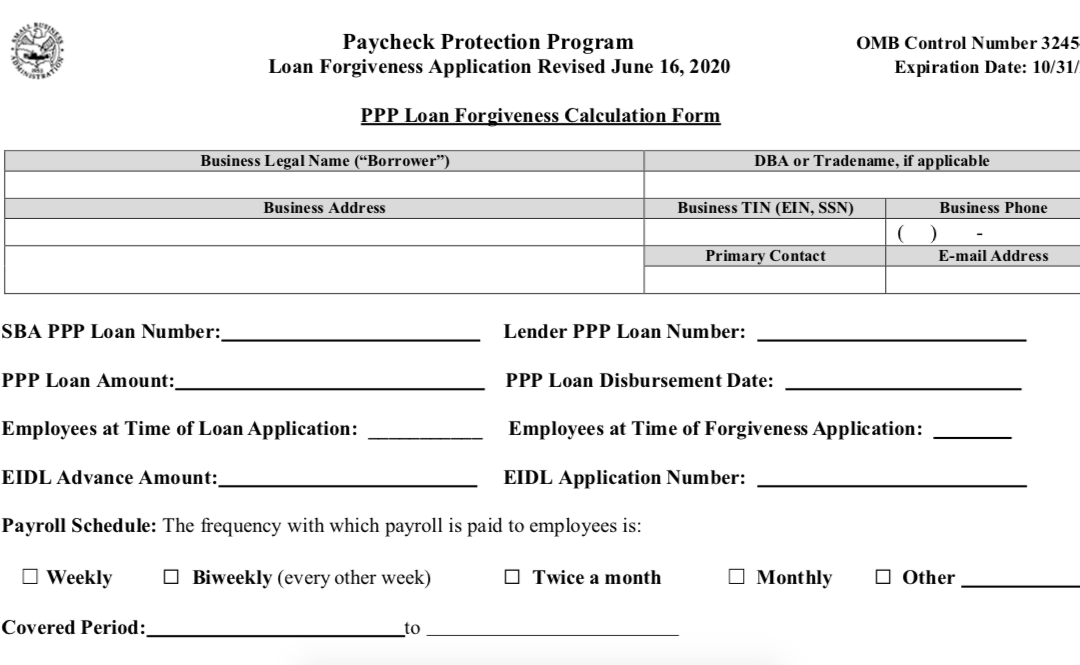

Hospitality and food services business with NAICS codes starting from 72 who have less than 300 employees per physical location. To receive full forgiveness for your PPP loan you must spend at least 60 of your loan funding on payroll costs. This can include hiring new employees hiring back oldprevious employees or simply maintaining your current staffing levels.

Businesses that received a PPP loan when the program first went into effect can now apply for a second draw if they are not a public company do not employ more than 300 people have used or will fully utilize their first PPP loan for permitted uses and may show at least a 25 decrease. If you had to close your business between February 15 2020 and April 26 2020 but have reopened you may still qualify for PPP loans. Your business must have been in operation as of February 15 2020 in order to apply for a PPP loan.

Even if you are the only employee you can use your. The Small Business Administration will start accepting loan applications starting Monday an SBA official said. You can apply for the new PPP loan if you are a sole proprietor Independent Contractor or self-employed.

Look for a dash card mail only will your ppp will be through dash. Yes freelancers and other self-employed individuals can apply for PPP loans. At that point the individual is no longer involved in the bankruptcy and the business may apply for the PPP loan.

Depending on how your business locations are set up under one tax ID or with multiple tax IDs you may need to submit more than one application. Then after receipt of PPP loan proceeds the chapter 7. For most businesses PPP loan amounts are calculated based on average payroll costs over the past year.

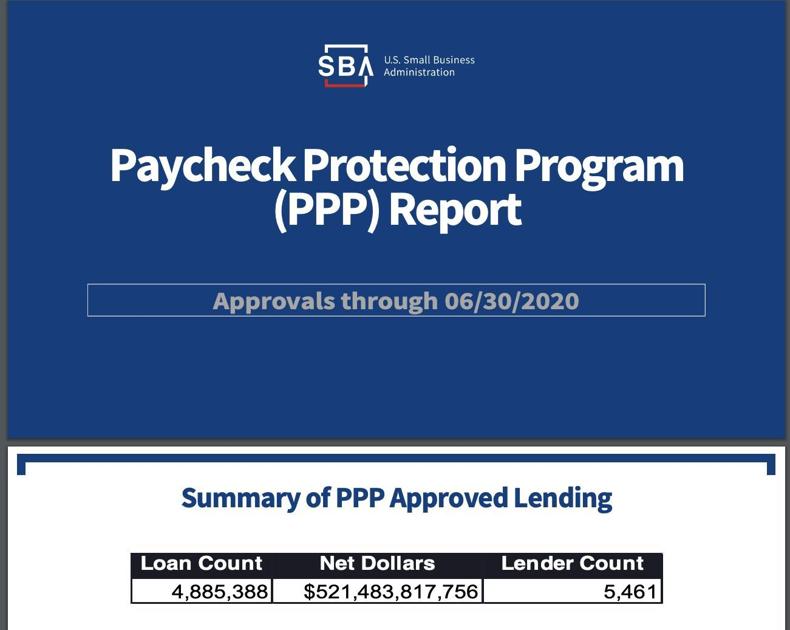

To that end the Small Business Administration SBA has limited who can get a PPP loan to companies with 500 or fewer employeesor 300 employees for companies looking to secure a second draw. Access to business. Desperately trying to obtain a PPP loan before the money runs out.

Lets start by getting a few facts out on the table before proceeding. If your business has permanently closed youre not eligible for the PPP loan program unfortunately. The original date of the program was June 30th.

If your business has multiple locations and meets all of the requirements for eligibility you can apply for a PPP loan. First-round PPP loan beneficiaries who lie under the following category can apply for the second programs.

Pin On Jerrybanfield Com Blog Posts

Paycheck Protection Program How It Works Funding Circle

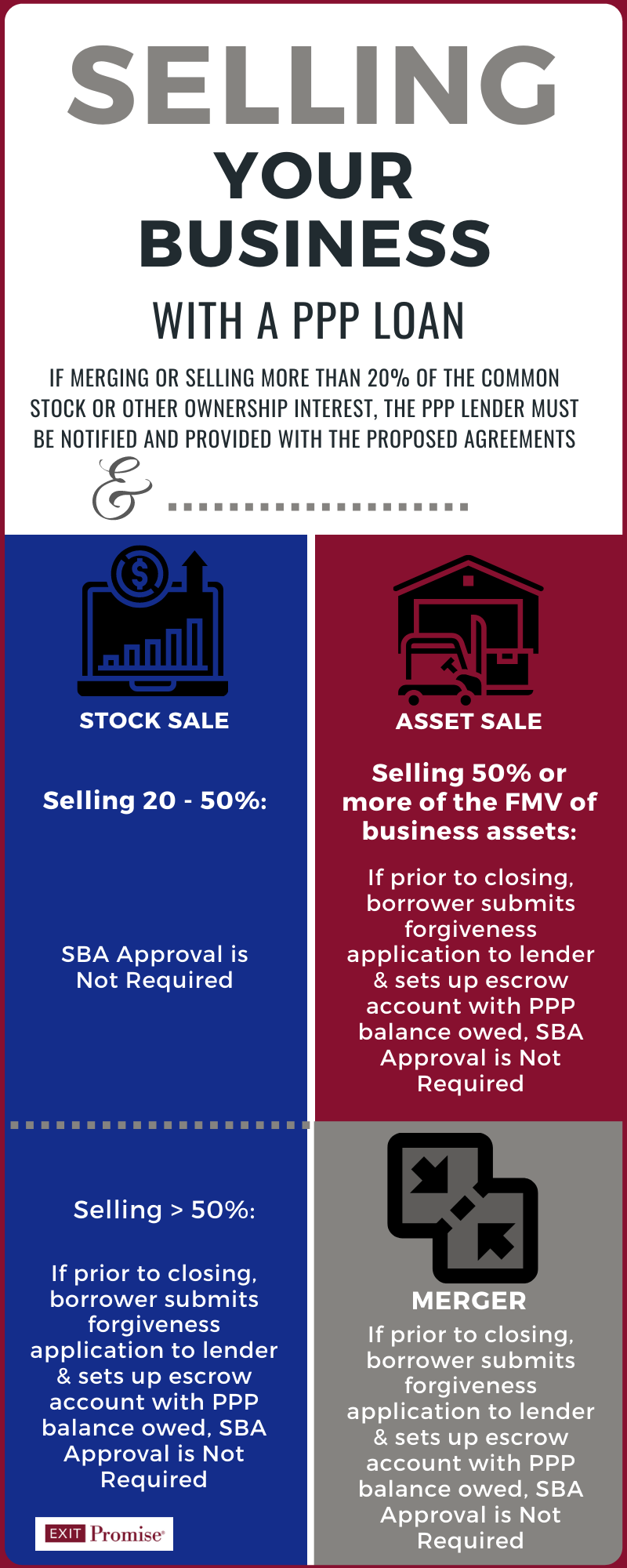

Buying Or Selling A Business With A Ppp Loan Consider This

How To Make Sense Of The Ppp Loan Program For Vc Backed Startups By Mark Suster Both Sides Of The Table

How To Apply For A Ppp Loan When Self Employed Divvy

New Paycheck Protection Program Ppp Loans How To Qualify And Apply Nav

Ppp Loan Forgiveness Everything You Need To Know Bnc Tax

Everything You Need To Know About Ppp Loans In 2021 Funding Circle

What Small Business Owners Need To Know About The New Round Of Ppp Loans

Paycheck Protection Program How It Works Funding Circle

Ppp Loan When Selling A Business Exit Promise

How To Calculate Your Paycheck Protection Program Loan Amount Bench Accounting

Ppp Loan Program Extended Loan Data Released What Small Businesses Need To Know

How To Apply For A Ppp Loan When Self Employed Divvy

7 Alternative Options If You Can T Get A Ppp Loan In 2021 Funding Circle

What To Do If Your Ppp Loan Isn T Forgiven Nation S Restaurant News

What Happens To Your Ppp Loan If Your Business Closes The Motley Fool

Post a Comment for "Can I Get A Ppp Loan If I Just Started My Business"