Small Business Tax Id Number Texas

After completing the application you will receive your Tax ID EIN Number via e-mail. When we receive the federal employers identification number we will then issue a new permit based on the federal number.

Employer Identification Number Ein

Homemade Soap And Crafts Houston TX 77043.

Small business tax id number texas. Internal Revenue ServiceStarting a Business. Apply for a Texas Tax ID EIN Number To obtain your Tax ID EIN in Texas start by choosing the legal structure of the entity you wish to get a Tax ID EIN for. Once you have submitted your application your EIN will be delivered to you via e-mail.

Search for a business entity Corporation LLC Limited Partnership in Texas by going to the Secretary of States Website. The process to get a state tax ID number is similar to getting a federal tax ID number. Your EIN on the other hand will be assigned by the IRS.

Small Business Administration - Texas. Guide to the Employer Identification Number. Once you finalize your application and are assigned an EIN the number can never be canceled.

However if you find that you dont need the EIN the IRS can close your business. For similar reasons the life of the business is limited to the life of the sole proprietor. Apply for an Employer Identification Number EIN Online.

The tax ID number or employer identification number comes from the IRS. If a sole proprietorship. Step 1 Start.

Internal Revenue Service Phone. Most businesses need an Employer Identification Number EIN. MacRobert Apple Blossom Farm Opening a new business my Fort Bend County Texas Small Business Tax Id own online home business.

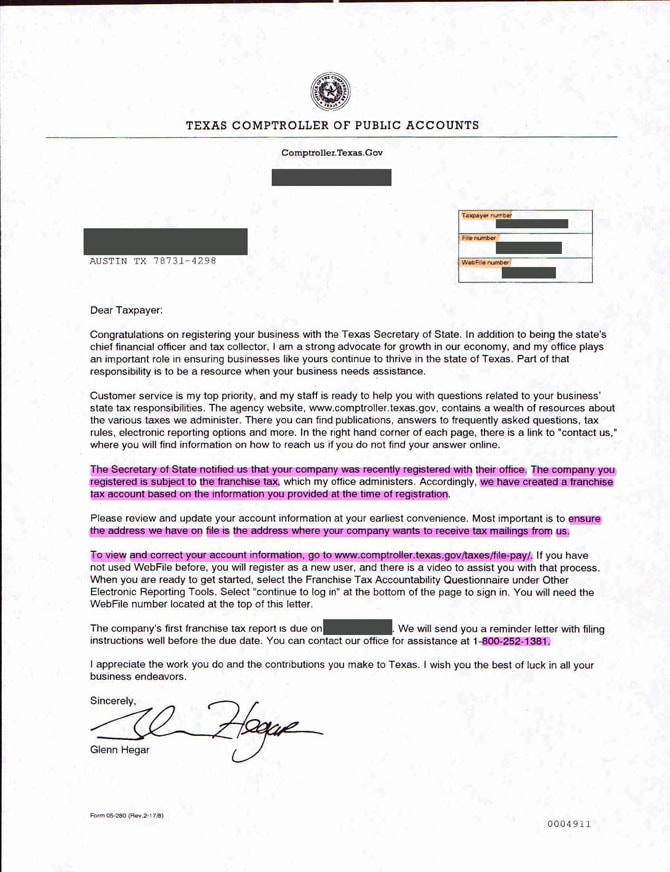

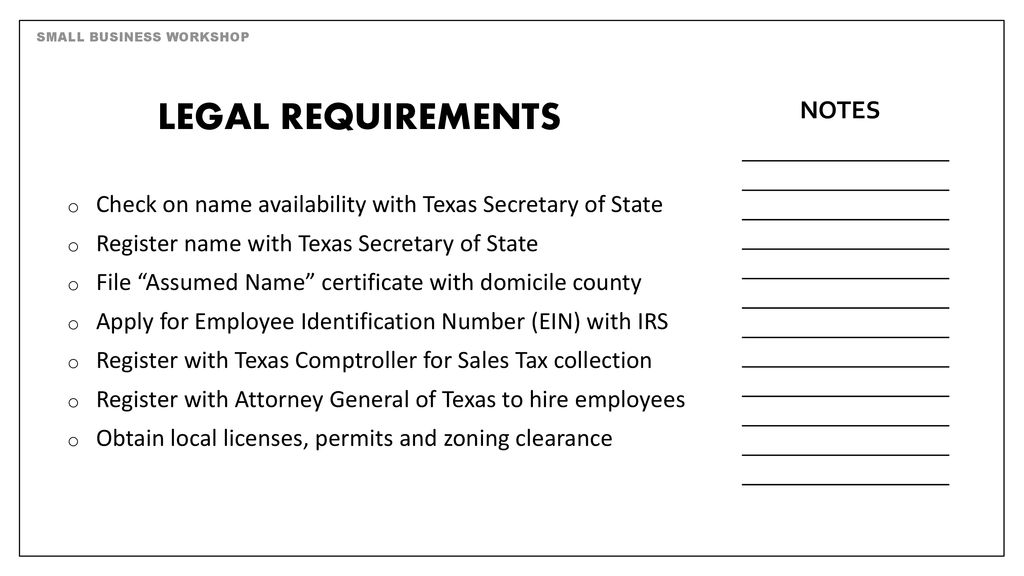

Of course you still need to comply with all the business regulations including finding out how to get a tax ID number in Texas. Those businesses operating within the state of Texas are additionally required to register for more specific identification numbers licenses. When you call the representative will require some identifying information to ensure you are the person authorized to receive the EIN.

A sole proprietorship is often operated under the name of the owner. Application for Employer Identification Number Form SS-4 PDF. You should get one right after you register your new business.

The Texas taxpayer number or TIN has 11 digits while the EIN has nine digits. As an entrepreneur you need both state tax ID and federal tax ID numbers to run your business file tax returns pay wages get a tax-deferred. If you are opening a business or other entity that will have employees will operate as a Corporation or Partnership is.

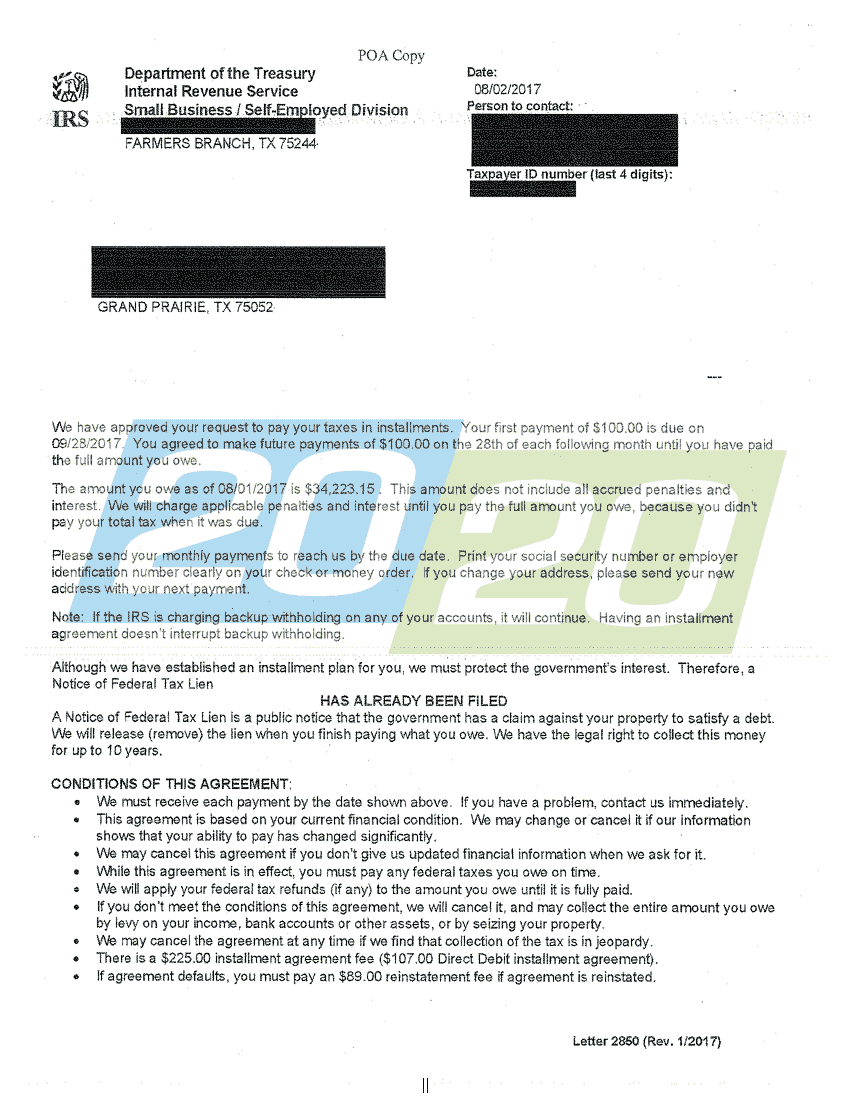

Find out from the IRS if you need an EIN how to get one what to do if youve lost or misplaced yours and more. To know whether you need a state tax ID research and understand your states laws regarding income taxes and employment taxes the two most common forms of state taxes for small businesses. Obtaining a Tax ID Number EIN When starting a business in Texas serving as the administrator or executor of an estate creator of a Trust or operating a Non Profit Organization obtaining a Tax ID EIN is a key responsibility.

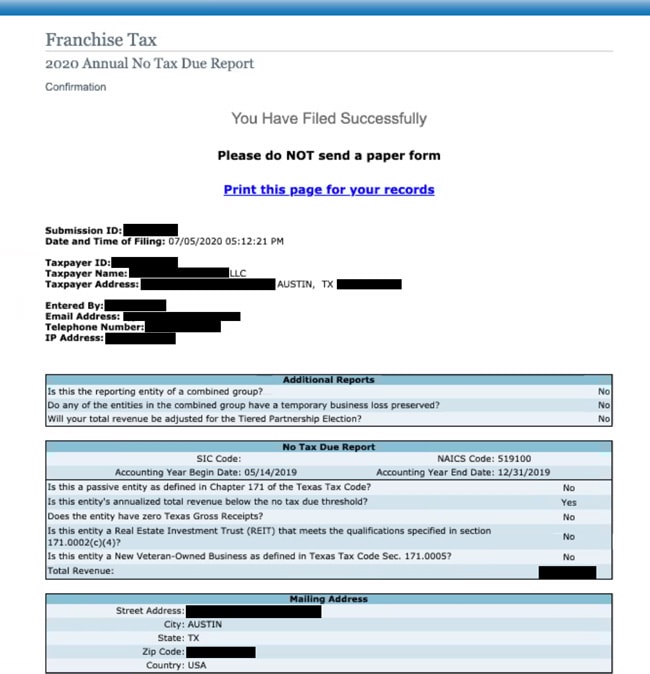

Your EIN is your federal tax ID number. Small Business and Self-Employed. If a business applies for a sales tax permit before obtaining a federal employers identification number the Comptrollers office will issue a permit under a temporary number.

Apply for a Texas Tax ID EIN Number Online. Employer Identification Number EIN 9 digits Section 1 Social Security number SSN 9 digits Individual Taxpayer Identification Number ITIN 9 digits Comptrollers assigned number FOR STATE AGENCY USE ONLY 11 digits Current Texas Identification Number FOR STATE AGENCY USE ONLY 11 digits 3. Texas Small Business Tax Id 77043.

When preforming your lookup by name be sure to include as many keywords as you can in order to to have the best results. An EIN is a nine-digit number for example 12-3456789 assigned to sole proprietors corporations limited liability companies LLC partnerships estates trusts and other entities for tax filing banking and business purposes. To begin your application select the type of organization or entity you are attempting to obtain a Tax ID EIN Number in Texas for.

Most businesses must file and pay federal taxes on any. It lets you legally hire employees pay taxes and open a business. Unemployment Tax Collected by the Texas Workforce Commission.

If you ever lose your EIN you can always call the IRS Business Specialty Tax Line at 800-829-4933. Basic federal tax information for new businesses including information about EINs business taxes and general small business resources. The former is assigned by the states comptroller and serves the same purpose as the federal tax ID number.

Sole Proprietor Individual. Employer Identification Numbers are issued for the purpose of tax administration and are not intended for participation in any other activities eg tax lien auction or sales lotteries etc. Nontransferable in that an individual cannot transfer his tax identification number to another person or entity- a new tax identification number will be required.

TxSmartBuy - State and Local Bid Opportunities. Your first tax period would end. SBAgovs Business Licenses and Permits Search Tool allows you to get a listing of federal state and local permits licenses and registrations youll need to run a business.

Preform a lookup by Name Tax ID Number or File Number. A Tax ID also known as an Employer ID Number EIN is a unique nine digit number that identifies your business or entity with the IRS for tax purposes essentially like a Social Security. How to Apply for an EIN.

How To Get A Resale Certificate In Texas Startingyourbusiness Com

We Can Help You Pay Your Taxes On Time Accounting Firms Bookkeeping Services Online Bookkeeping

Texas Llc No Tax Due Public Information Report Llc University

How To Get A Tax Id Number For A Business In Texas Financeviewer

How To Get A Tax Id Number For A Business In Texas Financeviewer

How Much Does A Small Business Pay In Taxes

Llc In Texas How To Start An Llc In Texas Truic Guides Limited Liability Company Best Templates Registered Agent

Certificate Of Liability Insurance Coi How To Request Throughout Certificate Of Liability Insurance Te Liability Insurance Certificate Templates Insurance

Why Texas Is Good For Business Texas Is Creating Jobs And Thriving While Many States Like California Infographic Business Infographic Small Business Resources

Texas Llc Certificate Of Formation Pdf Download Startingyourbusiness Com

Texas Sales And Use Tax Exemption Certification Blank Form Ideal Throughout Resale Certificate Request Letter Template Letter Templates Lettering Blank Form

Comptroller Texas Gov Taxinfo Taxpubs Tx94 105 Pdf Tax Forms Financial Tips Property Tax

Temporary Texas Drivers License Template Templates Drivers License Card Templates

How To Start A Business In Texas A Truic Small Business Guide

Best States To Move An Llc To Infographic Infographic Infographic Marketing Business Infographic

Texas Llc No Tax Due Public Information Report Llc University

Tax Lien Help Greensboro Ga 30642 M M Financial Blog Debt Relief Programs Irs Taxes Credit Card Debt Relief

How To Get A Tax Id Number For A Business In Texas Financeviewer

Application Small Business Certification Www Texassba Us Business Certifications Small Business Start Up Small Business

Post a Comment for "Small Business Tax Id Number Texas"