Business Loans Queensland Government

This grant reopened on 1 July 2020 for round 2 of applications. The Queensland government has announced today a new 500 million loan facility interest free for the first 12 months to support businesses and keep Queenslanders in work.

Queensland Government Small Business Loans Australiastartups

Have equity of 50 in relation to the purchase or 50 of set up costs for leasing and share farming.

Business loans queensland government. 27 rows A government-backed business loan is a loan that the government provides a. If youre eligible to apply for a grant or program. Hospitality businesses must use the app from 1 May 2021.

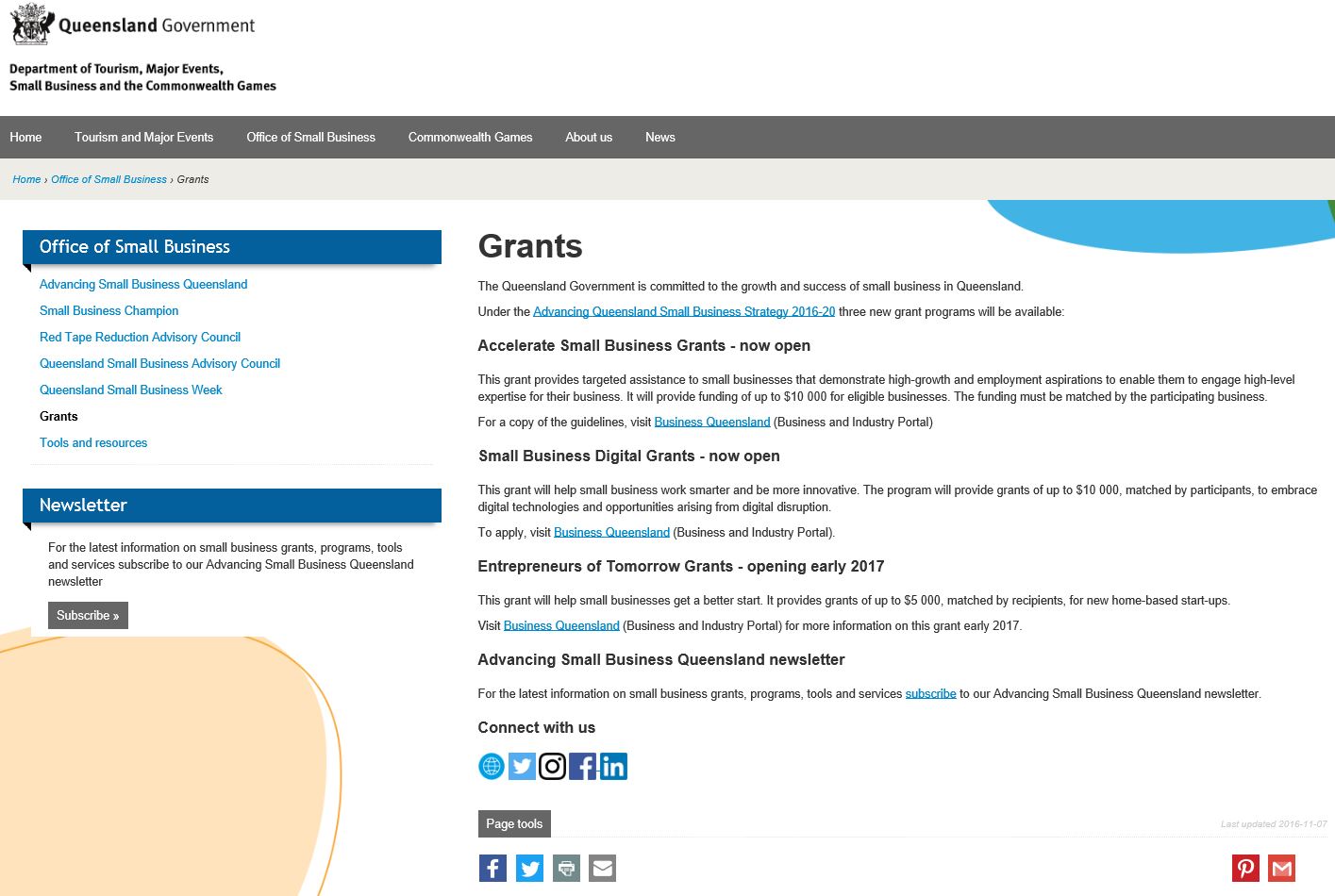

Track the progress of your application via QRIDA by emailing contact_usqridaqldgovau or phoning 1800 623 946. Under the Advancing Queensland Small Business Strategy 2016-20 three new grant programs will be available. If your small business supplies goods and services to Queensland Government find out how you can benefit from the On-time Payment Policy.

The Government guarantee will be 80 of the loan amount. Your stage of business development ie. Round 2 for South East Queensland has now closed.

Now closed for applications the scheme has assisted 7000 Queensland businesses and supported 86000 local jobs. The Queensland Government is committed to the growth and success of small business in Queensland. The objective of this program is to support small businesses subject to closure or highly impacted by the coronavirus COVID-19 shutdown restrictions announced by the Queensland Government to adapt and sustain their operations.

Bank loans equity finance - investing your own or other stakeholders funds into your business in exchange for partial ownership. Lenders are allowed to offer borrowers a repayment holiday of up to 24 months. We are still accepting applications for regional Queensland.

What are the eligibility criteria. Debt finance - borrowing funds that you pay back with interest within agreed time frames eg. The COVID-19 Loan is to be repaid in full within the 10-year term.

To be eligible you must. Have resided in Queensland for 6 months. There are 2 basic financing strategies.

The loans are only issued to the business owner. Loans can be used for a broad range of business purposes including to support investment. Small businesses can apply for up to 10000 to help adapt and sustain business operations sustain employment and build resilience.

Premier Annastacia Palaszczuk said the rapidly evolving impacts of the coronavirus demanded a rapidly evolving response from Government. Premier Annastacia Palaszczuk unveiled the new measures. Find out what your business needs to do to meet current.

Our Advance Queensland programs and funds are listed below to help you find the support your need. Small Business Disaster Recovery Grants Grants of up to 10000 are still available to businesses across North Queensland to. How the tool can help you If youre doing business in Australia this guided search can help you find out.

A lot of government assistance takes the form of cheap loans. Learn about restrictions for entering Queensland and how to apply for a border declaration pass. Find out if your small business is eligible for grant funding to recover from the 2019 North and Far North Queensland monsoonal trough.

Have sound prospects for the long term viability of your enterprise. These grants are not offered by the TSRA however through our solution broker role we can assist you to contact the Queensland Government. The government also offers various free and low-cost business advisory services financial and tax advice loans and other support.

Have capacity to service the loan. Loans may be used to refinance any pre-existing debt of an eligible borrower including those from the SME Guarantee Scheme. Individuals that are looking to apply for funding for their wives business for example can only be done through the wife making her own application as the business owner.

The Queensland government small business loans are in place for a small business owner to make application for funding for their small business. The Queensland Government will offer businesses interest-free loans to help keep them afloat amid the coronavirus crisis. As part of the Queensland Governments response to COVID-19 a 1 billion loan scheme was delivered by QRIDA between March and September 2020.

You can also view Queensland Government and Australian Government support options. Find grants funding and support programs from across government to help your business grow and succeed. Small Business Disaster Recovery Grants.

Small Business Artisan Producer Grants Program. Check In Qld app. Demonstrate a clear need for the loan.

Read about grants provided to artisan producers to help grow their businesses access opportunities and enhance expertise. We are providing opportunities for small businesses to collaborate and build on their innovation and ideas to help them grow and improve products and services and compete in a global market. A start-up or an established business.

Download the free Check In Qld app to collect customer information and meet your COVID Safe requirements.

Business Support And Government Grants Intelligent Business Solutions

Jobkeeper Payment Information For Employers Unlegislated 4front

Business Support And Government Grants Intelligent Business Solutions

Newsport Daily Qld Government Offering Up To 250 000 Loans To Save Businesses

Queensland Government Loans Dreamworld Operator Ardent Leisure 70 Million To Reopen After Coronavirus Theme Park Shutdown Abc News

Should I Use A Broker For A Business Loan Loan Brokers Analyzed

Queensland Government Announces Further Covid 19 Assistance For Manufacturers Australian Manufacturing

![]()

Covid 19 Recovery Hub Ondeck Australia

Qld Government Examples By 1300 Resume Issuu

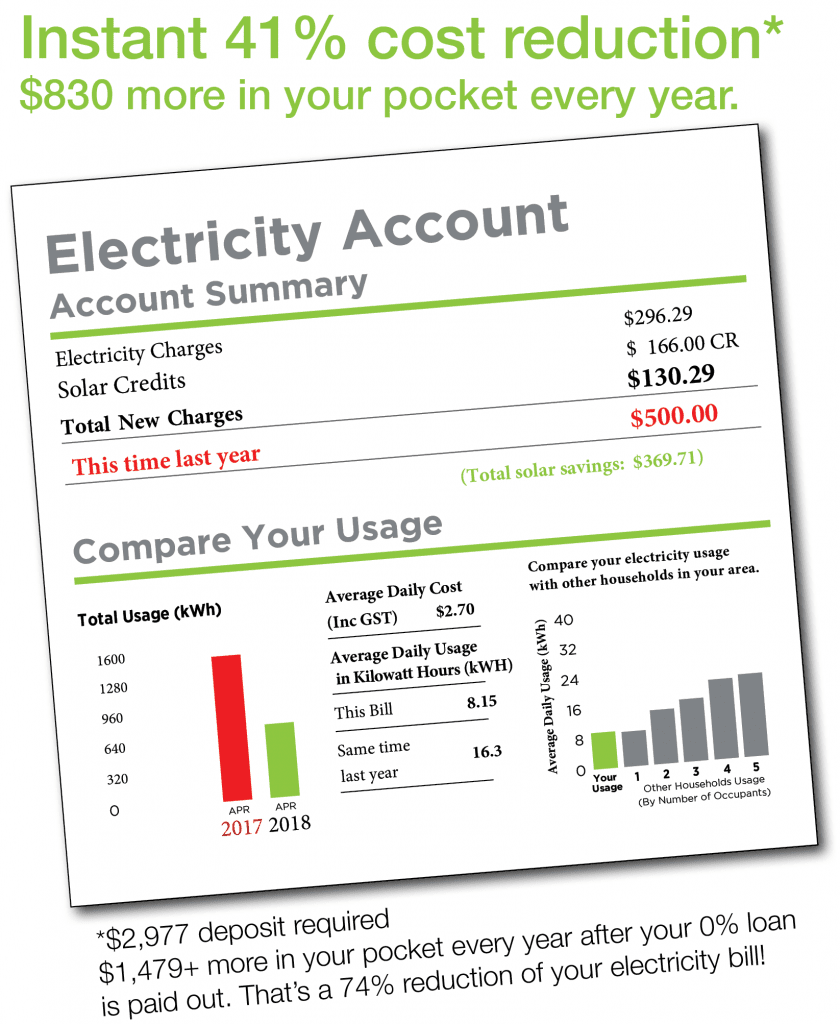

Qld Government Interest Free Solar Loan Offers Instant Bill Relief

250k Loans Qld Government Tjn Accountants

Business Support And Government Grants Intelligent Business Solutions

Stimulus Packages Coronavirus Covid 19 Australia

Business Queensland Businessqldgov Twitter

Queensland Government Grants And Loans Tsra

Queensland Government Grants And Loans Tsra

How To Obtain A Small Business Grant In Australia 74 Best Sme Grants

250k Loans Qld Government Tjn Accountants

Business Queensland Businessqldgov Twitter

Post a Comment for "Business Loans Queensland Government"