Llc Tax Filing Deadline 2021 California

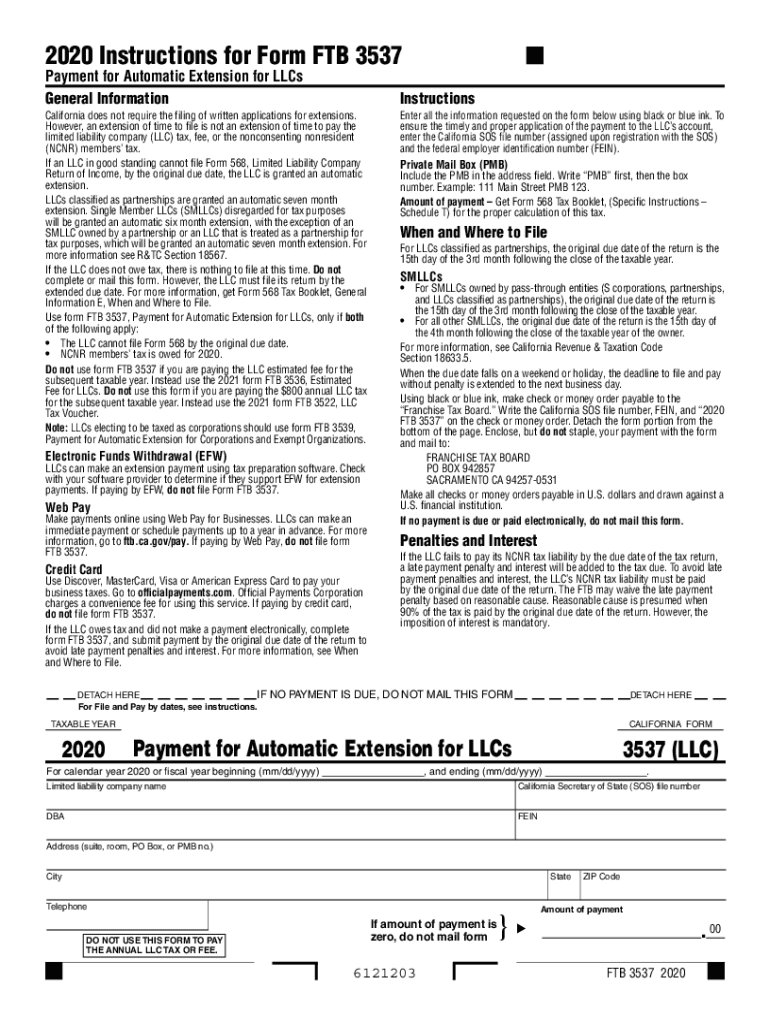

For those affected by Hurricane Delta with valid extensions to file by October 15 may file their returns by February 16 2021. Use LLC Tax Voucher 3522 when making your payment and to figure out your due date.

California Llcs Won T Have To Pay Annual 800 Tax Their First Year Starting Next Year Limited Liability Company Budgeting New Law

Partnerships and S Corporations must apply by March 15 2021 which extends their tax-filing deadline to September 15 2021.

Llc tax filing deadline 2021 california. Different types of business entities file tax returns in different ways. Online videos and Live Webinars are available in lieu of in-person classes. Public Affairs Office.

Your annual LLC tax will be due on September 15 2020 15th day of the 4th month. Intuit reserves the right to modify or terminate this TurboTax Live Basic Offer at any time for. When the due date falls on a weekend or holiday the deadline to file and pay.

15th day of the 4th month after the beginning of your tax year. If your California LLC goes into existence on or after January 1st 2021 but before December 31st 2023 there is no 800 payment due the 1st year. Beginning 2021 California LLCs dont have to pay 800 franchise tax for the 1st year.

Extended filing due date. Each state may use different regulations you should check with your state if you are interested in starting a Limited Liability Company. 15th day of the 10th month after the close of your tax year.

Sales and Use Tax. People and corporations affected by the California wildfires who had a valid extension to file their 2019 tax returns by October 15 2020 now have until January 15 2021 to file their returns. This extension does not affect estimated quarterly taxes which are still due April 15 2021 for non-employee income.

The IRS announced an extension to May 17 2021 of the deadline for filing individual income tax returns including those who pay self-employment taxes. California LLC franchise tax due dates after Assembly Bill 85. Includes states and one 1 federal tax filing.

A Limited Liability Company LLC is a business structure allowed by state statute. Owners of an LLC are called members. You have until the 15th day of the 4th month from the date you file with the SOS to pay your first-year annual tax.

As an example if your California LLC was approved in November on any day of 2020 November is counted as month 1. 15th day of the 3rd month after the close of your tax year. The annual LLC tax is due and payable by the 15th day of the 4th month after the beginning of the LLCs taxable year fiscal year or April 15 2021 calendar year.

Depending on elections made by the LLC and the number of members the IRS will treat an LLC either as a corporation partnership or as part of the owners tax return a disregarded entity. So the 4th month after that is February of 2021 not March which is what most people think. Sacramento The Franchise Tax Board FTB today announced that consistent with the Internal Revenue Service it has postponed the state tax filing and payment deadline for individual taxpayers to May 17 2021.

Your annual tax amount is 800. A domestic LLC with at least two members is classified as a partnership for federal income tax purposes unless it files Form 8832. A Limited Liability Company LLC is an entity created by state statute.

January 1 2021 is the first day of its first tax year. Sole proprietorships and single-owner LLCs must apply for an extension by May 17 2021 which extends their tax-filing deadline to October 15 2021. For questions about filing extensions tax relief and more call.

CDTFA public counters are now open for scheduling of in-person video or phone appointments. You must apply for a tax extension no later than your typical tax deadline. Meets the requirements of Californias 15-day rule and will not need to file a California tax return for 2020.

Annual Franchise Tax 800 LLC University. Most states do not restrict ownership so members may include individuals corporations other LLCs and foreign entities. Last updated December 26 2020.

Lets look at a few examples below. Businesses impacted by the pandemic please visit our COVID-19 page Versión en. November 2020 prepayment due.

Assembly Bill 85 provides a first-year exemption from the 80000 annual tax to limited partnerships limited liability partnerships and limited liability companies that organize or register with the California Secretary of State on or after January 1 2021 and before January 1 2024. Please contact the local office nearest you. You form a new LLC and register with SOS on June 18 2020.

Must file by May 3 2021 to be eligible for the offer. The first 800 payment is due in the LLCs 2nd year. And the 15th day would make your first 800 payment due by February 15th 2021.

How To Deduct Stock Losses From Your Taxes Bankrate

When Should You Amend Your Tax Return The Turbotax Blog

Individual Tax Filing Deadline Extended To May 17th 2021 Tax Plus

Aicpa Urges Irs To Extend 2021 Tax Deadline Cpa Practice Advisor

When Are The 2021 State Filing Deadlines Taxslayer Pro S Blog For Professional Tax Preparers

Https Www2 Deloitte Com Content Dam Deloitte Us Documents Tax Us Tax Multistate Covid 19 State And Local Tax Due Date Relief Developments Updated 52120 Pdf

Https Www2 Deloitte Com Content Dam Deloitte Us Documents Tax Us Tax Multistate Covid 19 State And Local Tax Due Date Relief Developments Updated 52120 Pdf

What If You Can T File Your Income Taxes By April 15 The Irs Gives Extensions To Anyone Cpa Practice Advisor

Individual Tax Filing Deadline Extended To May 17th 2021 Tax Plus

Https Www2 Deloitte Com Content Dam Deloitte Us Documents Tax Us Tax Multistate Covid 19 State And Local Tax Due Date Relief Developments Updated 52120 Pdf

How To File Robinhood 1099 Taxes

Tax Day April 15 Key Date For Some Despite Extension

Ca Ftb 3537 2020 2021 Fill Out Tax Template Online Us Legal Forms

Https Www2 Deloitte Com Content Dam Deloitte Us Documents Tax Us Tax Multistate Covid 19 State And Local Tax Due Date Relief Developments Updated 52120 Pdf

State Conformity To Irs Income Tax Deadline Extension Wipfli

Https Www2 Deloitte Com Content Dam Deloitte Us Documents Tax Us Tax Multistate Covid 19 State And Local Tax Due Date Relief Developments Updated 52120 Pdf

What To Do If You Miss The Tax Filing Deadline The Official Blog Of Taxslayer

California Llc Franchise Tax Waived In First Year

Https Www2 Deloitte Com Content Dam Deloitte Us Documents Tax Us Tax Multistate Covid 19 State And Local Tax Due Date Relief Developments Updated 52120 Pdf

Post a Comment for "Llc Tax Filing Deadline 2021 California"