Business Taxes Representative Exam

In most cases the taxpayer must have designated the person as the taxpayers representative on a properly completed Ohio Form TBOR 1 Declaration of Tax Representation or its equivalent. Business Taxes Representative Exam Code.

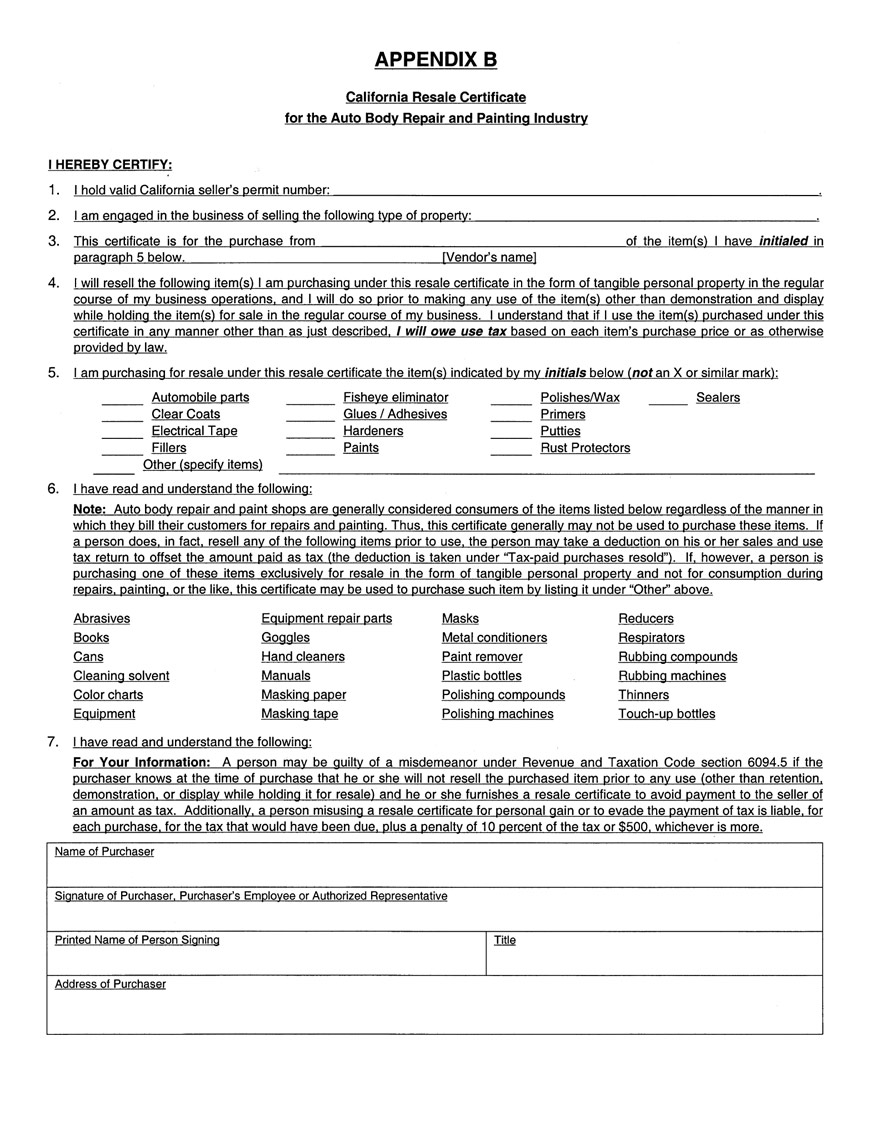

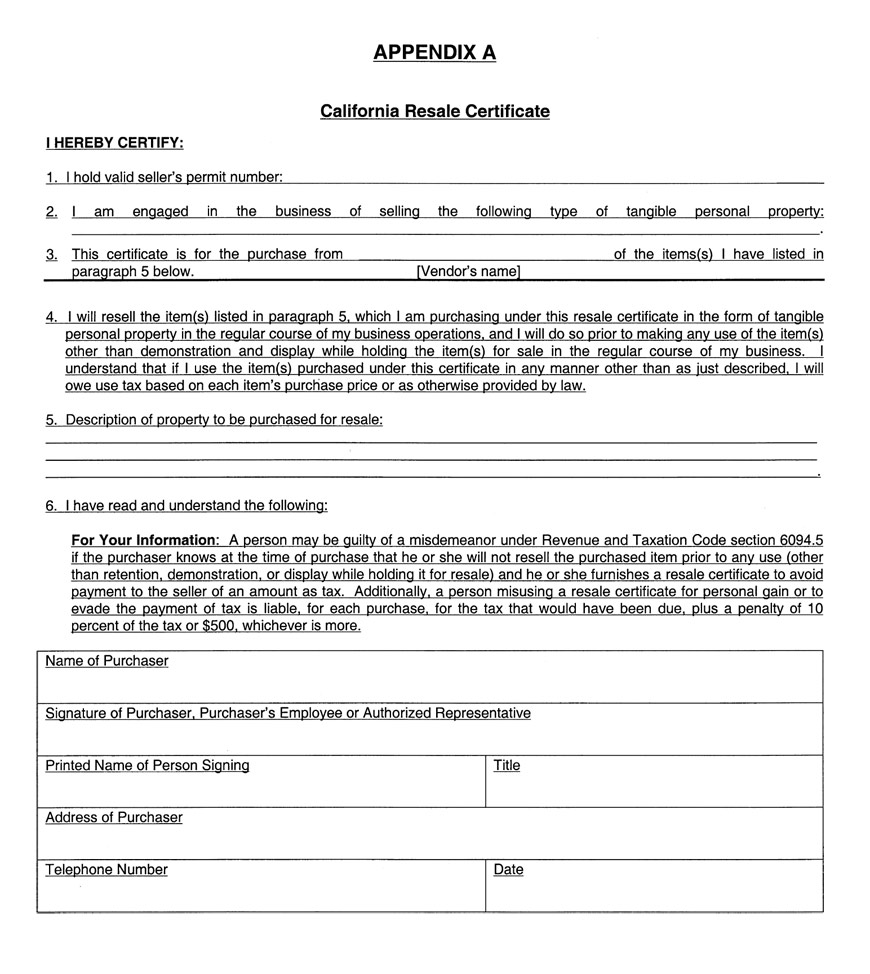

Sales And Use Tax Regulations Article 16

Your talents skills and experience could be a good fit for a future as an Internal Revenue Agent Series 0512 Grade 579.

Business taxes representative exam. To take California State employment exams online candidates will need to have created a CalCareer account and be logged in. Learn More Business Pay. The Business Taxes Compliance Supervisors II and III are used in a supervisory capacity to direct one or more.

An independent and proactive decision-maker you will conduct field examinations of individual taxpayers and small businesses to determine liability. The Tax Compliance Representative Exam assesses a variety of different cognitive abilities needed to succeed in the position. California State Board of Equalization Business Taxes Representative salaries - 20 salaries reported.

The questions in these practice tests follow the same style as the questions on the actual exam to provide you with optimum preparation. Michelle is a small business owner who has outdated customer information in her computer files. Departmental Open Final Filing Date.

The resources below are for businesses taxpayers looking to obtain information on filing and paying Ohio taxes registering a business and other services provided by the Department. A relationship existing between two or more persons who join to carry on a trade or business. Exams are available to take 24 hours a day and test-takers will get their scores instantly when they finish the exam.

Business Taxes Compliance Specialists perform the most complex compliance and collection functions. From the CalCareers homepage click ExamAssessment Search. File Your Business Taxes Online.

Tax Representative Salary Information. To use the forms provided by the City of Columbus Income Tax Division we recommend you download the forms and open them using the newest version of Acrobat Reader. Small BusinessSelf-Employed Division SBSE Approximately 57 million taxpayers 41 million self-employed persons 9 million small businesses with assets of less than 10 million and 7 million filers of employment excise estate and gift returns fall under the SBSE category.

You will use the latest in computers telecommunications and. In order to apply for a Tax Compliance Representative position with the State of California you must apply take and be successful in the current Tax Compliance Representative Exam. 8PB13 8PB14 8PB15 Departments.

California Department of Tax and Fee Administration Exam Type. Bureau of Labor Statistics BLS reported a median salary of 55640 for tax examiners and collectors and revenue agents as of May 2020. The following State of California exams are available to take online.

Practice with our preparation package to be as prepared as possible for the test. The taxpayer must sign and date the declaration and may restrict the persons representation to certain matters if the taxpayer so specifies. Business Taxes Representatives provide assistance to taxpayers to ensure compliance with tax laws collect delinquent taxes and perform a variety of compliance and collection functions.

She has wasted a lot of time and money sending mail to customers who have moved or have received multiple copies of her mailings. California Department of Tax Fee Administration Business Taxes Representative salaries - 12 salaries reported. California Department of Tax and Fee Administration Employment Development Department Franchise Tax Board - Exam Type.

Business Taxes Representative 6 Tax Technician 3 Intern 3 Co-Gründer Strategiedirektor 2 Internship 1 Student Assistant - Business Taxes Representative 1 Tax Tech I 1 Appraiser Associate 1 Consultant Sales and Use Tax 1 Tax Tech 1 Tax Compliance Officer 1 Business Tax Representative 1 Staff Programmer Analyst 1. Continuous CLASSIFICATION DETAILS Business Taxes Representative 381700 - 591200 per month View the classification specification for the Business Taxes Representative classification. Results are uploaded and saved in your CalCareer account within a few days of taking the exam.

Step One Establish Eligibility Visit httpwwweddcagovcareers and click on the Open Examinations link. Corporations that elect to pass corporate income losses deductions and credits through to their shareholders for federal tax purposes. Business Taxes Representative BOE Tax Compliance Representative EDD Compliance Representative FTB Exam Code.

As an IRS representative serving this group youll educate and. A legal entity that is separate and distinct from its owners. Fill-in Forms and Instructions Filter by year 2021 2020 2019 2018 2017 2016 2015 2014 2013 Submit.

/dotdash_Final_Securities_Industry_Essentials_SIE_Exam_Apr_2020-01-c3f95f3ac10840b295210c17ba28d83e.jpg)

Securities Industry Essentials Sie Exam Overview

Important Ea Exam Updates 2020 2021

Series 7 Exam Prep Training And Study Materials By Examfx

Https Jobs Ca Gov Jobsgen 8pb13 Pdf

4 19 10 Examination General Overview Internal Revenue Service

Sales And Use Tax Regulations Article 16

What Is Irs Form 1041 Income Tax Income Tax Return Small Business Tax

4 10 3 Examination Techniques Internal Revenue Service

Series 6 Exam Prep Materials Series 6 Top Off Exam

Integrated Sie And Series 7 Exam Prep Training By Examfx

Free Series 7 Practice Exams Resources 2021 100s Of Questions

Oakland Tax Attorney And Cpa David Klasing

4 10 3 Examination Techniques Internal Revenue Service

The Best Tax Software Of 2021 For The Self Employed Forbes Advisor

4 10 3 Examination Techniques Internal Revenue Service

Https Jobs Ca Gov Jobsgen 8pb13 Pdf

4 19 10 Examination General Overview Internal Revenue Service

Irs Audit Letter 2205 A Sample 1

4 10 3 Examination Techniques Internal Revenue Service

Post a Comment for "Business Taxes Representative Exam"